Former Governor, Central Bank of Ireland. @PIIE.com; @TCDeconomics; @CEPR.org

Patrick Honohan is an Irish economist and public servant who served as the Governor of the Central Bank of Ireland from 2009 to 2015. He has been a nonresident senior fellow at the Peterson Institute for International Economics since 2016. .. more

Reposted by Edgar Morgenroth

Reposted by Patrick Honohan

#Comet #Space #astronomy #astrophotography 🧪🔭☄

Reposted by Patrick Honohan

Fresh one in Dublin.

Lovely to wake up to this...@martinwolf_ of @FT @data.ft.com

has picked Money as one of his Best Economics Books of 2024.

Chuffed!

Cheers!

www.ft.com/content/d5fa...

go.bsky.app/UweG3ib

Reposted by Patrick Honohan

Info & register: www.piie.com/events/2024/...

Reposted by Patrick Honohan

Today, we dive into Ireland’s journey from crisis to confidence.

@rebeccawire.bsky.social speaks with Eamon Gilmore, former Foreign Minister, and @phonohan.bsky.social on Ireland’s recovery, housing crisis, and global role.

#EconSky

Reposted by Patrick Honohan

@piie.com paper provides the calculation for twenty countries. There are some surprises.

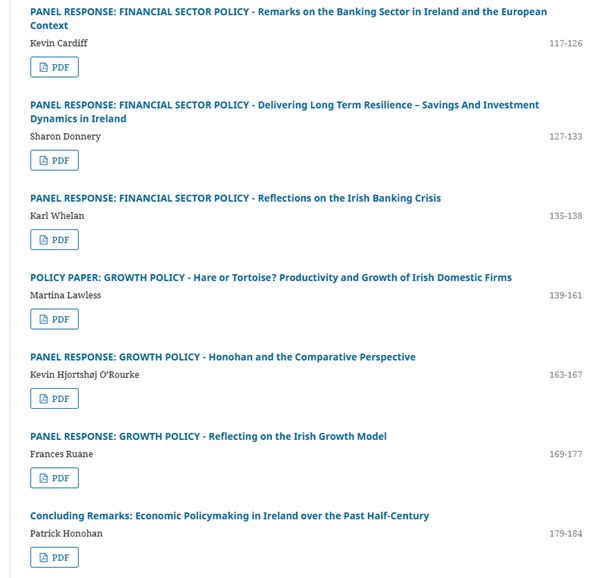

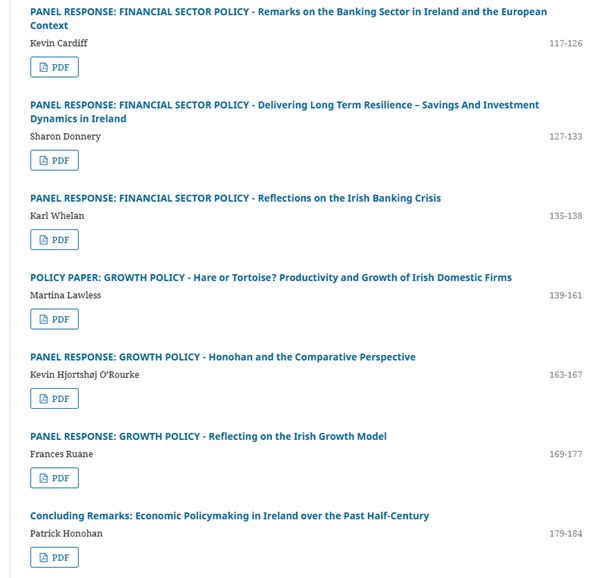

www.esr.ie/index.php/es...

Reposted by Patrick Honohan

www.esr.ie/index.php/es...

Today, we dive into Ireland’s journey from crisis to confidence.

@rebeccawire.bsky.social speaks with Eamon Gilmore, former Foreign Minister, and @phonohan.bsky.social on Ireland’s recovery, housing crisis, and global role.

#EconSky

It works like this:

Rounding is voluntary and applies only to cash payments;

Your bill is rounded up or down to the nearest 5c;

1c and 2c coins are still legal tender.

Everyone is happy.

Reposted by Patrick Honohan

Reposted by Mark A. Wynne

www.federalreserve.gov/newsevents/p...

Reposted by Patrick Honohan

www.federalreserve.gov/newsevents/p...

Info & register: www.piie.com/events/2024/...