positivemoney.org/update/new-r...

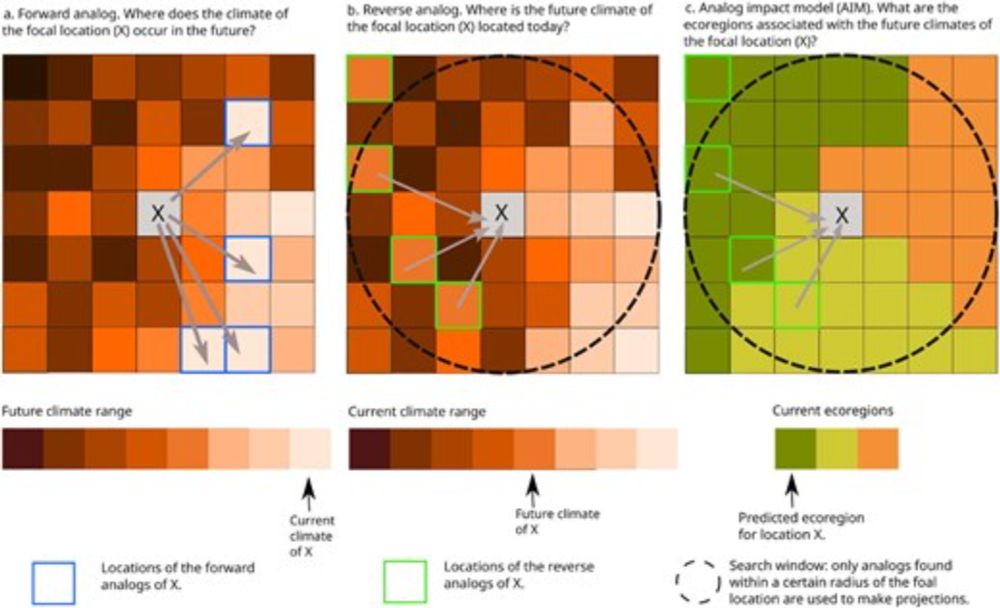

We describe how spatial climate analogs can be used in climate change research, impact assessment, decision-making, and communication.

#MacroEcology

#ClimateChange

#GlobalChange

1/4

We describe how spatial climate analogs can be used in climate change research, impact assessment, decision-making, and communication.

#MacroEcology

#ClimateChange

#GlobalChange

1/4

www.nature.com/articles/s41...

www.nature.com/articles/s41...

@positivemoneyeu.bsky.social wrote a paper on this @jordischroeder.bsky.social

www.datocms-assets.com/132494/17212...

@positivemoneyeu.bsky.social wrote a paper on this @jordischroeder.bsky.social

www.datocms-assets.com/132494/17212...

1.QE can be complement&substitute for IR policy

2.QE macro effect more uncertain than IR, but duration extraction effect significant.

3.Few channels-signaling, liquidity provision..

Good 2have more tools, don't ditch them

Refreshing points by Lucrezia Reichlin #ecbwatchers

1.QE can be complement&substitute for IR policy

2.QE macro effect more uncertain than IR, but duration extraction effect significant.

3.Few channels-signaling, liquidity provision..

Good 2have more tools, don't ditch them

Refreshing points by Lucrezia Reichlin #ecbwatchers

In a new paper, @ph-jaeg.bsky.social and I dig into what this strategy needs to deliver— backed by lots of brand-new *sectoral* data on the distribution of national subsidies.

Here are our main takeaways:

In a new paper, @ph-jaeg.bsky.social and I dig into what this strategy needs to deliver— backed by lots of brand-new *sectoral* data on the distribution of national subsidies.

Here are our main takeaways:

Sounds interesting? Join us for our upcoming #Freitagsseminar w. Gaël Giraud.

📅 28th of February 2025

📍 #OeNB or online via Webex

Registration here: bit.ly/411oDRw

#Event

Sounds interesting? Join us for our upcoming #Freitagsseminar w. Gaël Giraud.

📅 28th of February 2025

📍 #OeNB or online via Webex

Registration here: bit.ly/411oDRw

#Event

#JobAlert #Economics #CivilSociety

positivemoney.org/vacancy/seni...

#JobAlert #Economics #CivilSociety

positivemoney.org/vacancy/seni...

Our article on what politicians think about the ECB is now out in @jcms-eu.bsky.social

We surveyed Members of the European Parliament to uncover their views on the ECB

👉 Available at onlinelibrary.wiley.com/doi/10.1111/...

And a short thread here -->

Our article on what politicians think about the ECB is now out in @jcms-eu.bsky.social

We surveyed Members of the European Parliament to uncover their views on the ECB

👉 Available at onlinelibrary.wiley.com/doi/10.1111/...

And a short thread here -->

1. Non-existent euro value chains locked the EU into disastrous dollar denominated fossil fuel imports

2. Wavering and weak ECB swap line policies (limited, conditional, unattractive)

3. That rare beast “a euro denominated safe asset”

1. Non-existent euro value chains locked the EU into disastrous dollar denominated fossil fuel imports

2. Wavering and weak ECB swap line policies (limited, conditional, unattractive)

3. That rare beast “a euro denominated safe asset”

🎈In a new working paper, @steffenmurau.bsky.social and I set out to theorise failure and develop a new IPE perspective that foregrounds offshore money.

A thread 🧵

🎈In a new working paper, @steffenmurau.bsky.social and I set out to theorise failure and develop a new IPE perspective that foregrounds offshore money.

A thread 🧵

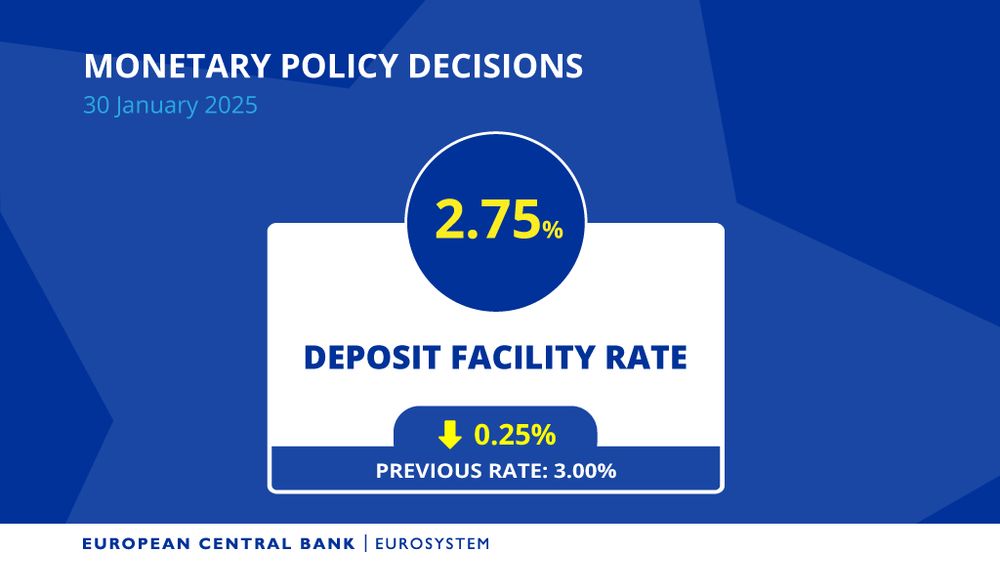

Also, can we take the moment to appreciate that no political figure is threatening the @ecb.europa.eu to cut rates 👐

This independence could be put to good use towards the 🌎 🌱

We are doing this because inflation is developing broadly as we expected and is on track to settle at around our 2% target.

Read today’s monetary policy decisions www.ecb.europa.eu/press/pr/dat...

Also, can we take the moment to appreciate that no political figure is threatening the @ecb.europa.eu to cut rates 👐

This independence could be put to good use towards the 🌎 🌱

Channels of influence in sustainable finance:

A framework for conceptualizing how private actors shape the green transition

www.cambridge.org/core/journal...

A 🧵 on our main arguments:

Channels of influence in sustainable finance:

A framework for conceptualizing how private actors shape the green transition

www.cambridge.org/core/journal...

A 🧵 on our main arguments:

☑️ Introduce green lending facilities,

☑️ Implement climate criteria in its collateral framework,

☑️ Tilt the stock of securities in the remaining asset purchase portfolios.

4/5

☑️ Introduce green lending facilities,

☑️ Implement climate criteria in its collateral framework,

☑️ Tilt the stock of securities in the remaining asset purchase portfolios.

4/5

➡️ With 40 civil society organizations, we urge the ECB Governing Council to deliver an improved Climate Roadmap when concluding this year’s strategy assessment.

3/5

➡️ With 40 civil society organizations, we urge the ECB Governing Council to deliver an improved Climate Roadmap when concluding this year’s strategy assessment.

3/5

Why? ⤵️

1/5

Why? ⤵️

1/5

www.crisesnotes.com/does-restric...

www.crisesnotes.com/does-restric...