https://scholars.huji.ac.il/aloneizenberg

1. regression and classification,

2. language interface to databases,

3. autocomplete on steroids, &

4. Highly verbal electronic-software pets.

But that does not mean that claims of grossly... 1/

1. regression and classification,

2. language interface to databases,

3. autocomplete on steroids, &

4. Highly verbal electronic-software pets.

But that does not mean that claims of grossly... 1/

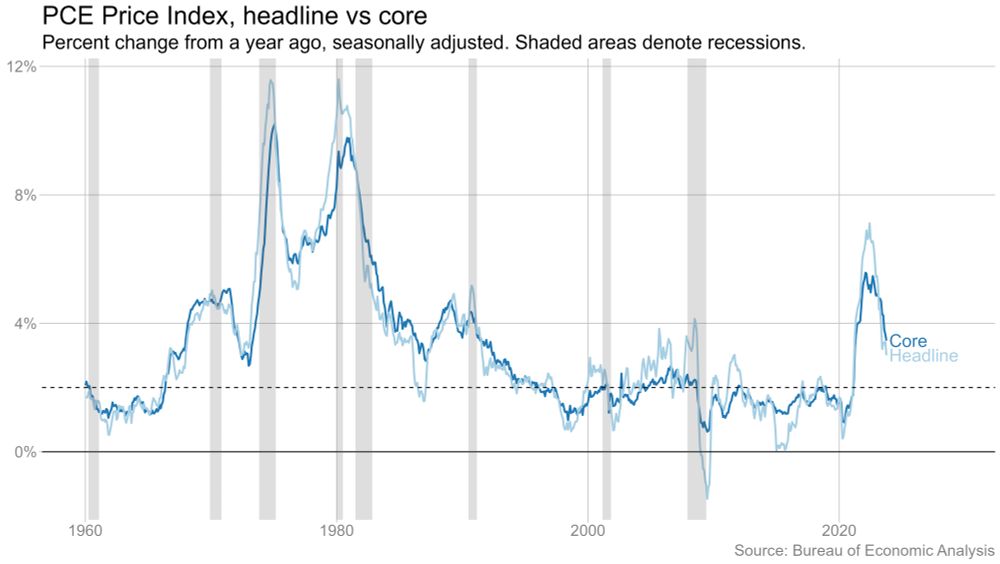

Nonetheless I'd like to use this time to study how market power and tacit collusion interact with an inflationary environment.

THE END - thank you for your patience with my non-knowledge on how to make a thread on this platform

Nonetheless I'd like to use this time to study how market power and tacit collusion interact with an inflationary environment.

THE END - thank you for your patience with my non-knowledge on how to make a thread on this platform

2. Price rigidity has many reasons and manifests itself in manners beyond Rockets & Feathers. -->

2. Price rigidity has many reasons and manifests itself in manners beyond Rockets & Feathers. -->