Posts

Media

Videos

Starter Packs

Reposted

Amy Hanauer

@amyhanauer.bsky.social

· May 15

What Corporations Have to Gain from the Gutting of the IRS

Seven huge corporations recently announced that in 2024 they were allowed to collectively keep $1.4 billion in tax breaks from previous years that they had publicly admitted would likely be found ille...

itep.org

Kris Cox

@krisycox.bsky.social

· May 12

Policymakers Should Expand the Child Tax Credit for the 17 Million Children Currently Left Out of the Full Credit | Center on Budget and Policy Priorities

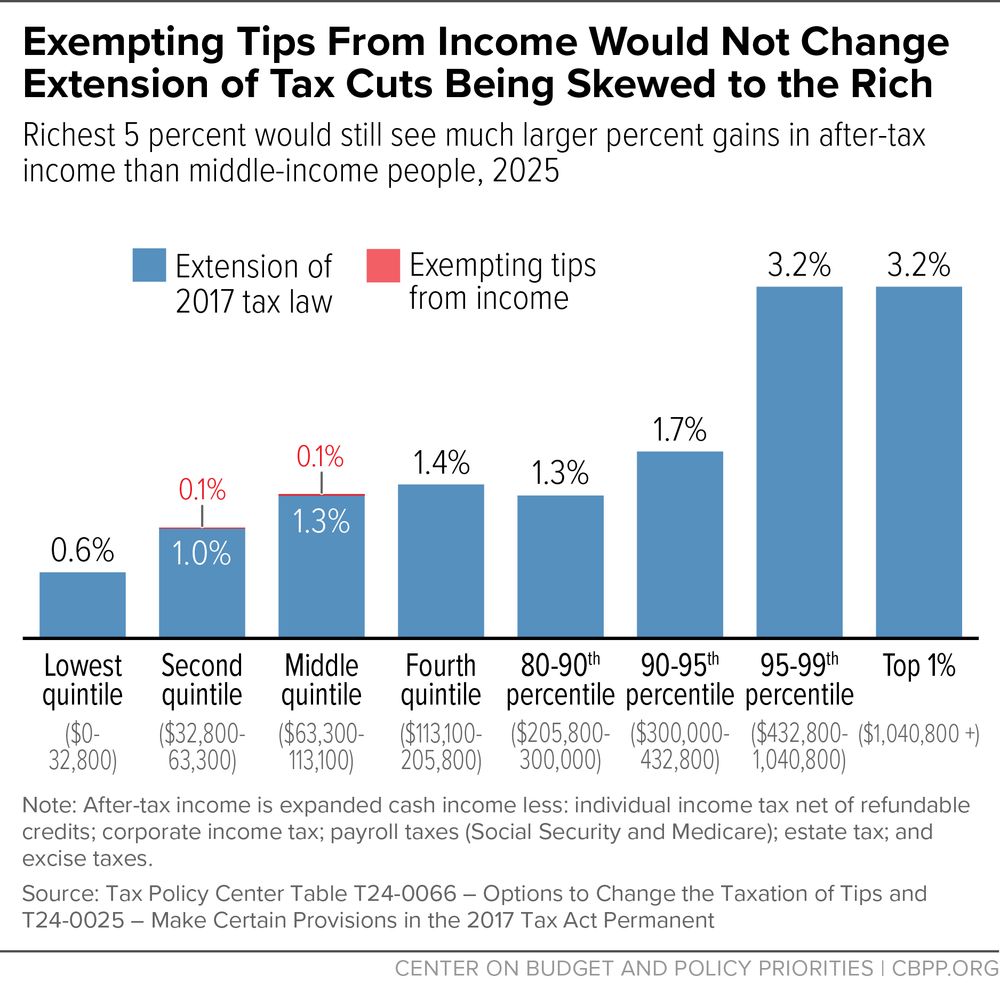

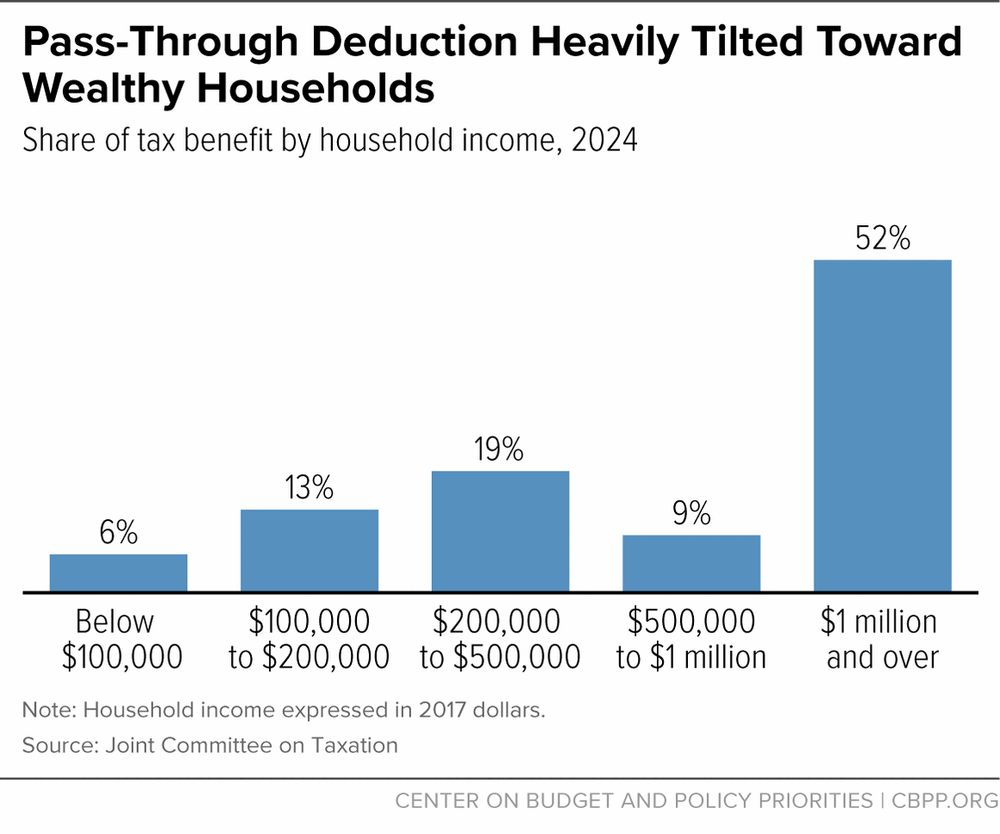

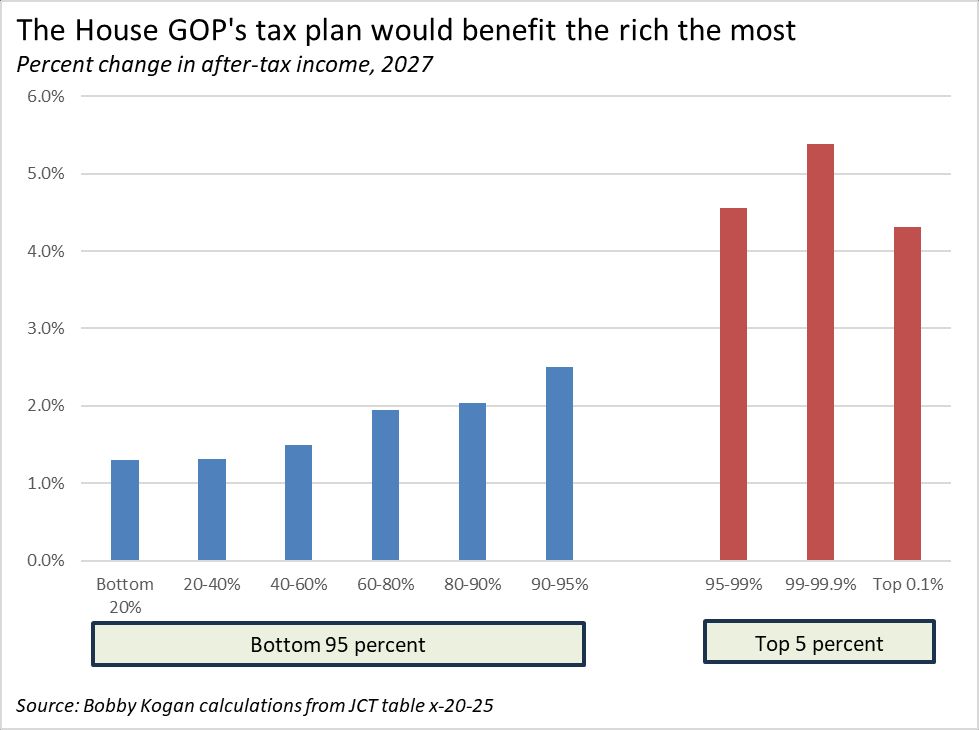

Congressional Republicans may soon release a budget resolution that will set the terms of the tax debate, and which is expected to extend the 2017 tax law, including its changes to the Child Tax...

www.cbpp.org

Kris Cox

@krisycox.bsky.social

· May 12

Policymakers Should Expand the Child Tax Credit for the 17 Million Children Currently Left Out of the Full Credit | Center on Budget and Policy Priorities

Congressional Republicans may soon release a budget resolution that will set the terms of the tax debate, and which is expected to extend the 2017 tax law, including its changes to the Child Tax...

www.cbpp.org

Reposted