This has been a long journey since 2007, with key progress in the past 5 years.

How did Bulgaria make it? Here are three key points about 🇧🇬 economy and society and some myth busting.

We will issue up to €90bn in EU-Bonds in the first half of 2026.

This will ensure Europe can:

🌱 Support NextGenerationEU objectives

🇺🇦 Stand with Ukraine

🛡️ Invest in defence

🔗 More: link.europa.eu/KGfPQ4

As EU leaders huddle in Brussels, Stephen Paduano and I analyse the reparations loan in a new piece.

This is not only a "There Is No Alternative" (TINA) moment—but the financial and legal risks are also manageable.

1/

www.cer.eu/insights/ukr...

As EU leaders huddle in Brussels, Stephen Paduano and I analyse the reparations loan in a new piece.

This is not only a "There Is No Alternative" (TINA) moment—but the financial and legal risks are also manageable.

1/

www.cer.eu/insights/ukr...

Excellent oped identifying the limits of risks & how layered guarantees via EIB & ESM can help.

Financials are clear. Politics need to urgently follow.

@blavatnikschool.bsky.social

www.ft.com/content/7e70...

Excellent oped identifying the limits of risks & how layered guarantees via EIB & ESM can help.

Financials are clear. Politics need to urgently follow.

@blavatnikschool.bsky.social

www.ft.com/content/7e70...

• China’s exports to the US have were down by 29% year on year in November amid tariffs and tensions

• However, Chinese shipments to other regions - notably south-east Asia - keep growing rapidly

www.ft.com/content/b9bf...

• China’s exports to the US have were down by 29% year on year in November amid tariffs and tensions

• However, Chinese shipments to other regions - notably south-east Asia - keep growing rapidly

www.ft.com/content/b9bf...

The issue isn’t the 2035 engine ban - it’s demand falling off a cliff today

With @sandertordoir.bsky.social and @lucasguttenberg.bsky.social, we show why flipping regs won’t help - and what the EU can do instead.

The issue isn’t the 2035 engine ban - it’s demand falling off a cliff today

With @sandertordoir.bsky.social and @lucasguttenberg.bsky.social, we show why flipping regs won’t help - and what the EU can do instead.

“Brussels” is the phantom menace Europe loves to blame

www.economist.com/europe/2025/...

“Brussels” is the phantom menace Europe loves to blame

www.economist.com/europe/2025/...

The drivers have switched.

Europe’s great stockmarket inversion

www.economist.com/finance-and-...

From The Economist

The drivers have switched.

Europe’s great stockmarket inversion

www.economist.com/finance-and-...

From The Economist

Competitiveness and growth challenges in EU as a whole are different that the ones in DE or FR.

Competitiveness and growth challenges in EU as a whole are different that the ones in DE or FR.

This has been a long journey since 2007, with key progress in the past 5 years.

How did Bulgaria make it? Here are three key points about 🇧🇬 economy and society and some myth busting.

This has been a long journey since 2007, with key progress in the past 5 years.

How did Bulgaria make it? Here are three key points about 🇧🇬 economy and society and some myth busting.

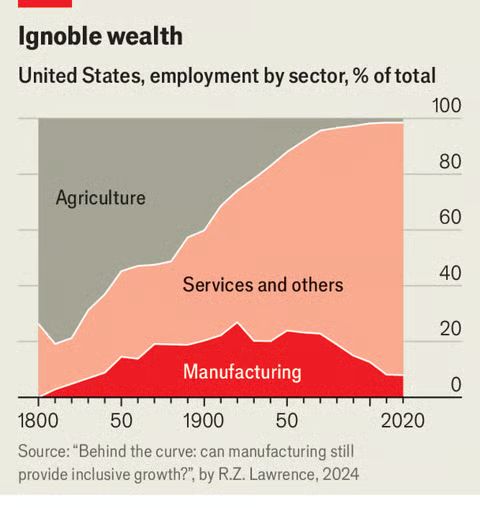

• Drop in share of manufacturing jobs mostly illustrates productivity growth through automation

• In real terms US manufacturing output is more than twice higher than it was in early 1980s

• Drop in share of manufacturing jobs mostly illustrates productivity growth through automation

• In real terms US manufacturing output is more than twice higher than it was in early 1980s

TLDR- no, 🇧🇬 did not game its data.

Effect was 1/12th of what is claimed and does not change fulfilment of criterion.

Let's make sure this does not fuel disinfo.

@izakaminska.bsky.social @atanaspekanov.bsky.social

open.substack.com/pub/europebu...

TLDR- no, 🇧🇬 did not game its data.

Effect was 1/12th of what is claimed and does not change fulfilment of criterion.

Let's make sure this does not fuel disinfo.

@izakaminska.bsky.social @atanaspekanov.bsky.social

open.substack.com/pub/europebu...

1) United States 🇺🇸

2) China 🇨🇳

3) Russia 🇷🇺

4) Germany 🇩🇪

5) India 🇮🇳

6) United Kingdom 🇬🇧

7) Saudi Arabia 🇸🇦

8) Ukraine 🇺🇦

9) France 🇫🇷

10) Japan 🇯🇵

New SIPRI data on #MilitarySpending out now ➡️ bit.ly/3GH5GNe

1) United States 🇺🇸

2) China 🇨🇳

3) Russia 🇷🇺

4) Germany 🇩🇪

5) India 🇮🇳

6) United Kingdom 🇬🇧

7) Saudi Arabia 🇸🇦

8) Ukraine 🇺🇦

9) France 🇫🇷

10) Japan 🇯🇵

New SIPRI data on #MilitarySpending out now ➡️ bit.ly/3GH5GNe

That said, interesting fact - 🇧🇬 has one of the longest fixed pegs in modern monetary history, from 1997 to today. It served the country well & 🇧🇬 is on track to adopt the euro in 2026.

www.economist.com/finance-and-...

That said, interesting fact - 🇧🇬 has one of the longest fixed pegs in modern monetary history, from 1997 to today. It served the country well & 🇧🇬 is on track to adopt the euro in 2026.

www.economist.com/finance-and-...

Avoiding Kindleberger’s Trap - on.ft.com/421m2Zw via @FT

Avoiding Kindleberger’s Trap - on.ft.com/421m2Zw via @FT

open.spotify.com/episode/50as...

open.spotify.com/episode/50as...