Matt Peterson

@mattpeterson.bsky.social

4.4K followers

1.5K following

1.9K posts

Covering policymaking, economics, and financial markets for Barron’s. [email protected]

mattpeterson.me

Posts

Media

Videos

Starter Packs

Reposted by Matt Peterson

Reposted by Matt Peterson

Reposted by Matt Peterson

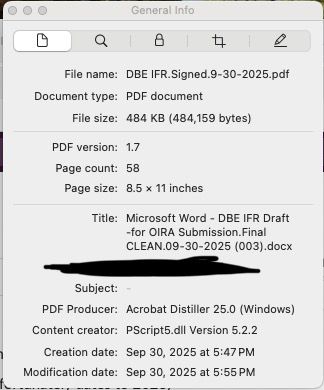

![Financial conditions in the world in which we live, they seem really quite accommodative. Credit spreads are as low as they've been almost in history. Public markets are open for debt and equity issuers. So you would say, I wonder why that is. I'd say part of that is because you're carrying around $7 trillion in the balance sheet the Fed. That's one of your monetary tools. QE works, as Jim [Grant] suggested, first through financial assets, and then will find its way and transmit itself to the real economy. Interest rates are different. We have a lot more experience in interest rates. They hit the real economy first. So I see two economies are out there, each being given a different bit of monetary medicine. Monetary medicine is highly accommodative to the world which so many of us live, but it's not so accommodative on Main Street.](https://cdn.bsky.app/img/feed_thumbnail/plain/did:plc:zf64hzilq4a7yj6lcj34uxvc/bafkreicp6nuep25qxrwjb3ufvexqjl3epz5b3algecu2p5tdyplgeqzzhm@jpeg)