Reposted by: Michael D. Bauer, Iikka Korhonen, Aaron Sojourner

Session 1: 4 Sept 17:00 CEST

@ivanwerning.bsky.social @mit.edu

Topic: Tariffs as Cost-Push Shocks: Implications for Optimal #MonetaryPolicy

Sign up: cepr.org/events/event...

#EconSky #EconConf

SF Fed Center for Monetary Research:

www.frbsf.org/research-and...

www.federalreserve.gov/econres/feds... 1/3

Sign up: cepr-org.zoom.us/webinar/regi...

Reposted by: Michael D. Bauer

Monthly sessions explore central bank frameworks, policy design, and international dimensions.

More: cepr.org/events/event...

#EconSky

Reposted by: Michael D. Bauer

Reposted by: Michael D. Bauer

cepr.org/events/luiss....

Reposted by: Michael D. Bauer

Reposted by: Michael D. Bauer, Nandini Gupta

Reposted by: Michael D. Bauer

www.nytimes.com/2024/11/22/t...

Reposted by: Michael D. Bauer

Together with the Bank of Canada and the Chicago Fed, we're organizing a Conference on #FixedIncome Research and Implications for #MonetaryPolicy on May 22-23, 2025, in San Francisco. Submissions due by January 31. More details: www.frbsf.org/news-and-med...

#EconSky

Reposted by: Michael D. Bauer

They invite high-quality research papers on central #banking, #monetarypolicy, financial stability and related topics.

Hosted by: Boston Fed and the HBS Pricing Lab D^3

Deadline: 20 March

More info: cebra-events.org/call-for-pap...

#EconSky

#MonetaryPolicy #MacroFinance #CentralBanking #EconSky

www.federalreserve.gov/conferences/...

More info is also in our conference call for papers:

www.frbsf.org/news-and-med...

The SF Fed and its Center for Monetary Research are launching the new Janet Yellen Award!

This award will be given annually to an exceptional early-career researcher who has made significant and policy-relevant contributions to macro-finance and/or monetary economics.

www.frbsf.org/news-and-med...

cepr.org/publications...

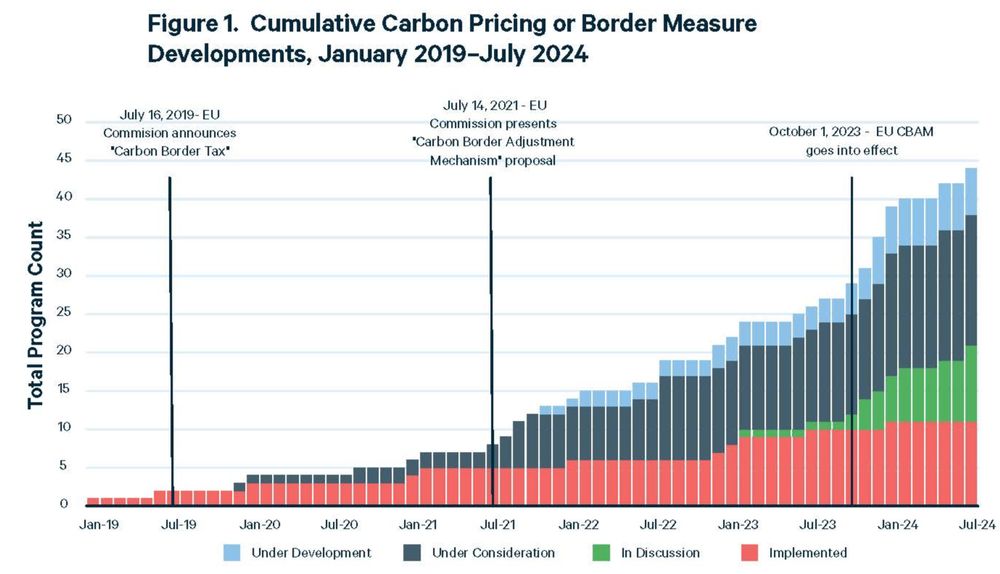

Also worth checking out this @rff.org policy brief: www.rff.org/publications...

Reposted by: Michael D. Bauer

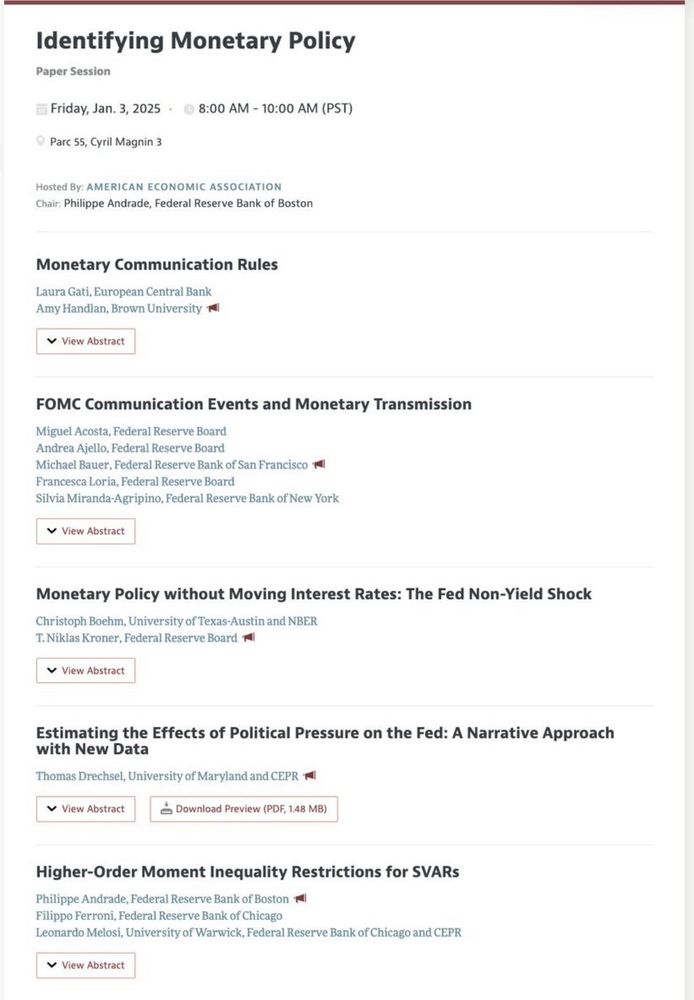

Check out this nice session on Friday morning: "Identifying Monetary Policy"

With presentations by Amy Handlan @michaeldbauer.bsky.social @kronerniklas.bsky.social myself and Philippe Andrade

Thank you Philippe for organizing! #ASSA2025

www.frbsf.org/news-and-med...

All details on the virtual seminar here: www.frbsf.org/news-and-med...

1. The importance of stupidity in scientific research

Open Access

journals.biologists.com/jcs/article/...