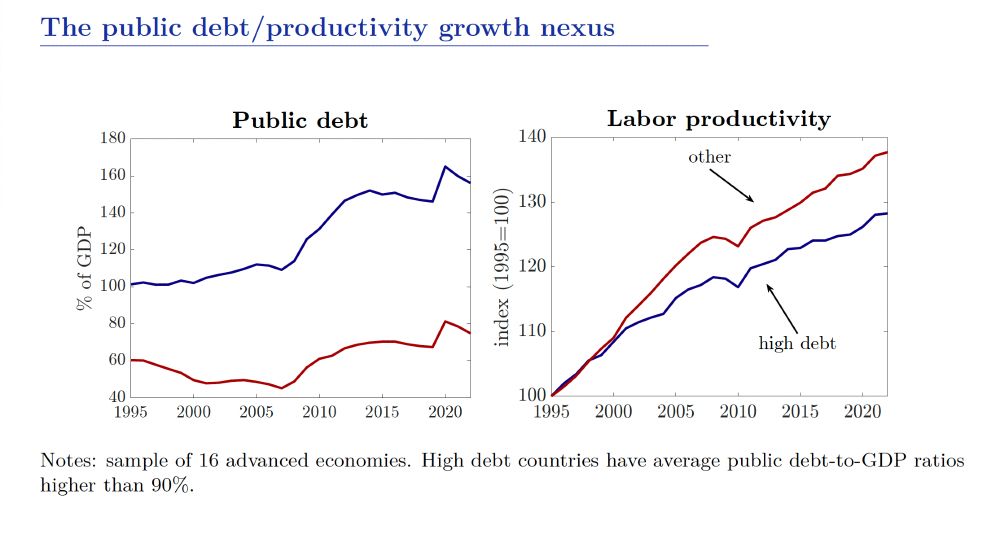

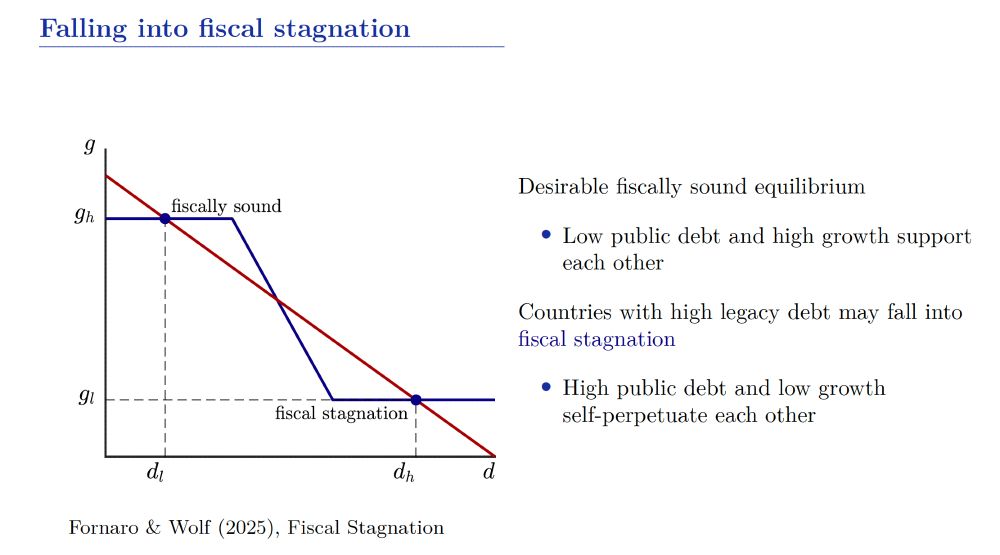

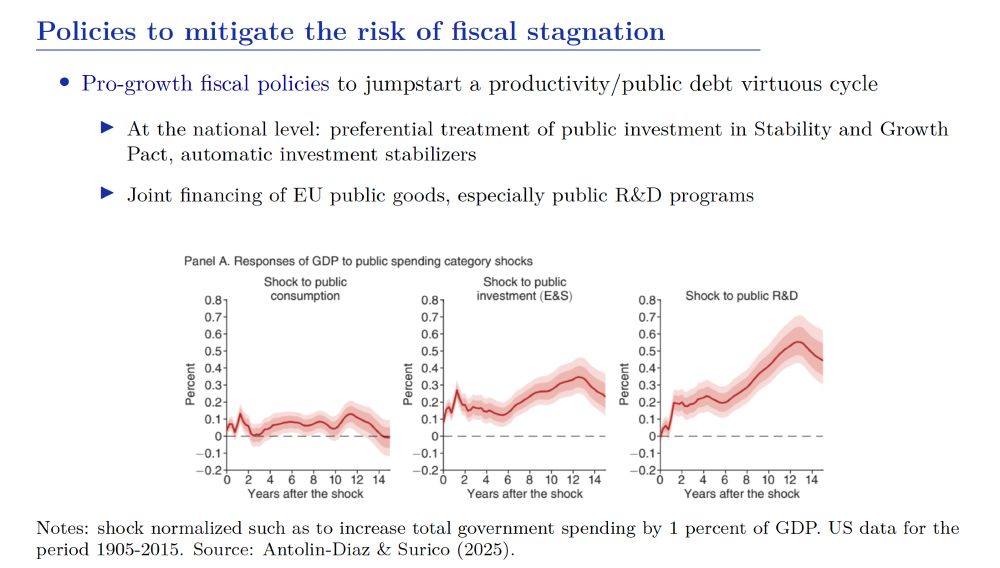

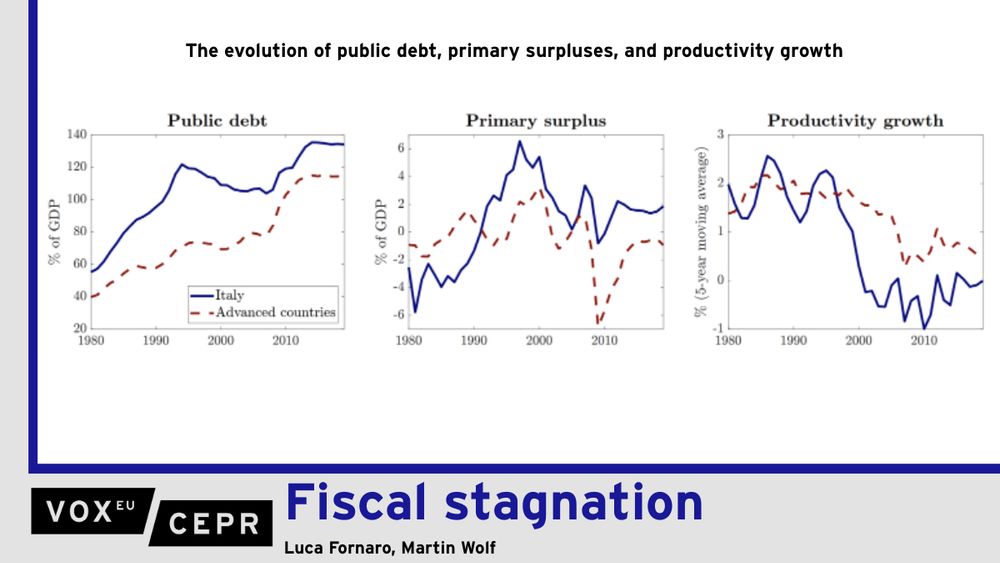

Key insights: 1) High public debt may push the economy into fiscal stagnation, a persistent state of low growth and high fiscal distortions. 2) Pro-growth policies are crucial to exit stagnation, but they require credibility.

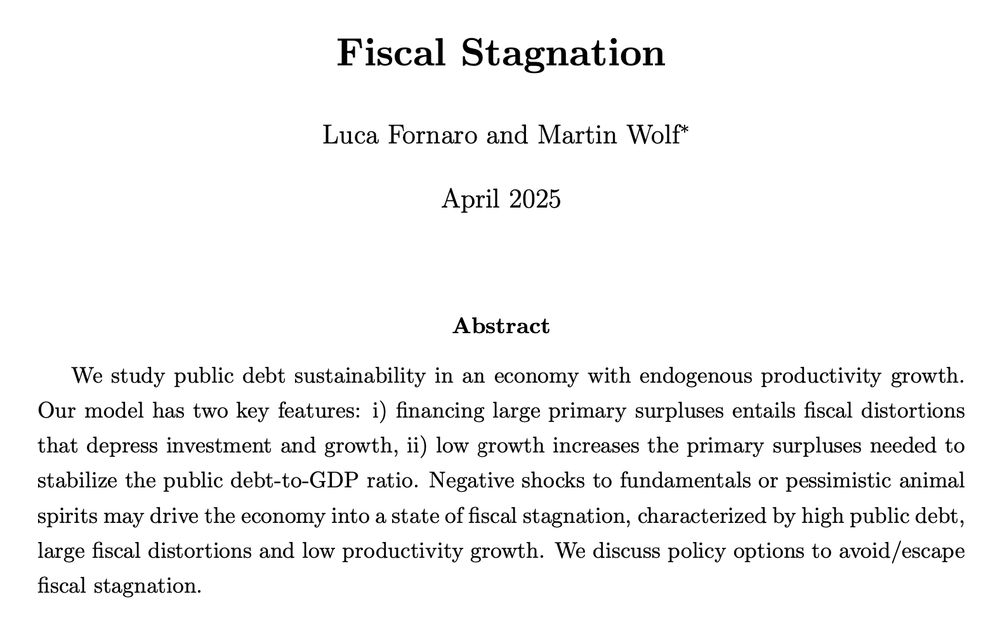

One thing that struck me is that debt sustainability analyses typically abstract from the impact of fiscal policy on productivity growth.

One thing that struck me is that debt sustainability analyses typically abstract from the impact of fiscal policy on productivity growth.

We tackle these issues in a new paper on Tariffs and Technological Hegemony.

We tackle these issues in a new paper on Tariffs and Technological Hegemony.

www.ecb.europa.eu/pub/pdf/sint...

www.ecb.europa.eu/pub/pdf/sint...

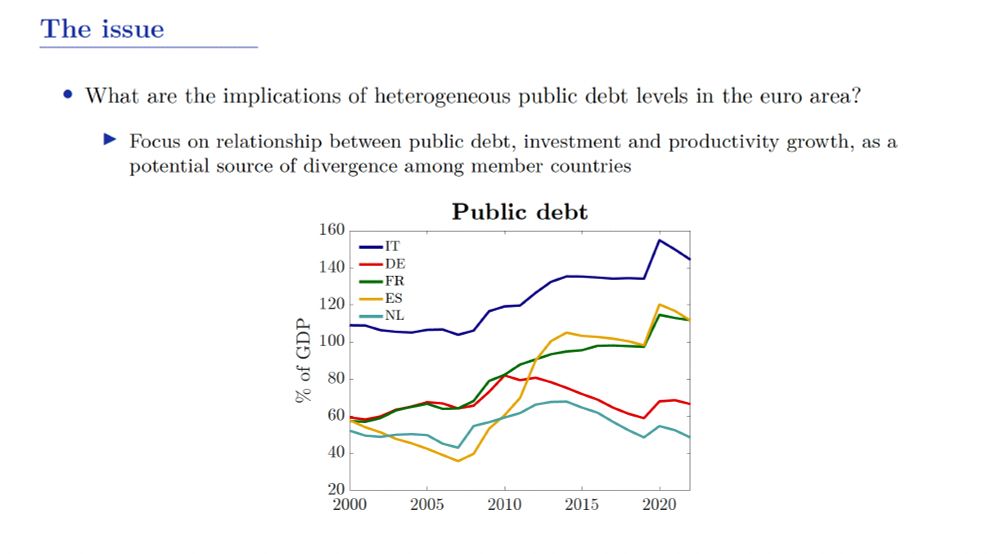

@ecb.europa.eu Forum in Sintra. My remarks focused on the risk that high legacy debt may push part of the euro area into fiscal stagnation, and how a pro-growth approach to fiscal policy can mitigate this risk.

@ecb.europa.eu Forum in Sintra. My remarks focused on the risk that high legacy debt may push part of the euro area into fiscal stagnation, and how a pro-growth approach to fiscal policy can mitigate this risk.

podcasts.apple.com/it/podcast/m...

featuring @lucafornaro.bsky.social provides extremely insightful and clear views on macroeconomic policies to counter hysteresis and stagnation 📈

podcasts.apple.com/it/podcast/m...

featuring @lucafornaro.bsky.social provides extremely insightful and clear views on macroeconomic policies to counter hysteresis and stagnation 📈

youtu.be/B7aRTPgepok?...

youtu.be/B7aRTPgepok?...

cepr.org/voxeu/column...

#EconSky

cepr.org/voxeu/column...

#EconSky

Key insights: 1) High public debt may push the economy into fiscal stagnation, a persistent state of low growth and high fiscal distortions. 2) Pro-growth policies are crucial to exit stagnation, but they require credibility.

Key insights: 1) High public debt may push the economy into fiscal stagnation, a persistent state of low growth and high fiscal distortions. 2) Pro-growth policies are crucial to exit stagnation, but they require credibility.

www.piie.com/blogs/realti...

The views of Maurice Obstfeld (and other American economists) on the relationship between the internal and external accounts of the US are finally starting to evolve.

www.brookings.edu/wp-content/u...

The views of Maurice Obstfeld (and other American economists) on the relationship between the internal and external accounts of the US are finally starting to evolve.

www.brookings.edu/wp-content/u...

bsky.app/profile/pear...

bsky.app/profile/pear...

open.substack.com/pub/matthewc...

open.substack.com/pub/matthewc...

open.substack.com/pub/matthewc...

open.substack.com/pub/matthewc...