Research fellow at Regent's Park College, Oxford

📈 Using data to make the world of work better for all 🌈

https://sites.google.com/site/paweladrjaneconomics/

Sevilla, España

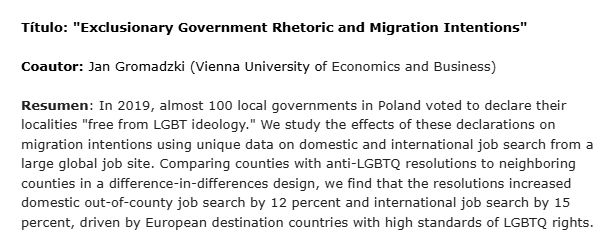

In Poland, anti-LGBTQ resolutions by 100 local governments caused a rise in migration intentions, reflected in job search

Here’s what @jangromadzki.bsky.social and I found: 🧵

In Poland, anti-LGBTQ resolutions by 100 local governments caused a rise in migration intentions, reflected in job search

Here’s what @jangromadzki.bsky.social and I found: 🧵

Link: docs.iza.org/dp18217.pdf

Main findings ⬇️

1/7

Link: docs.iza.org/dp18217.pdf

Main findings ⬇️

1/7

The shutdown offers lots of lessons about what private sector data can and can't do.

New at @piie.com : www.piie.com/blogs/realti...

The shutdown offers lots of lessons about what private sector data can and can't do.

New at @piie.com : www.piie.com/blogs/realti...

UK data:

UK data:

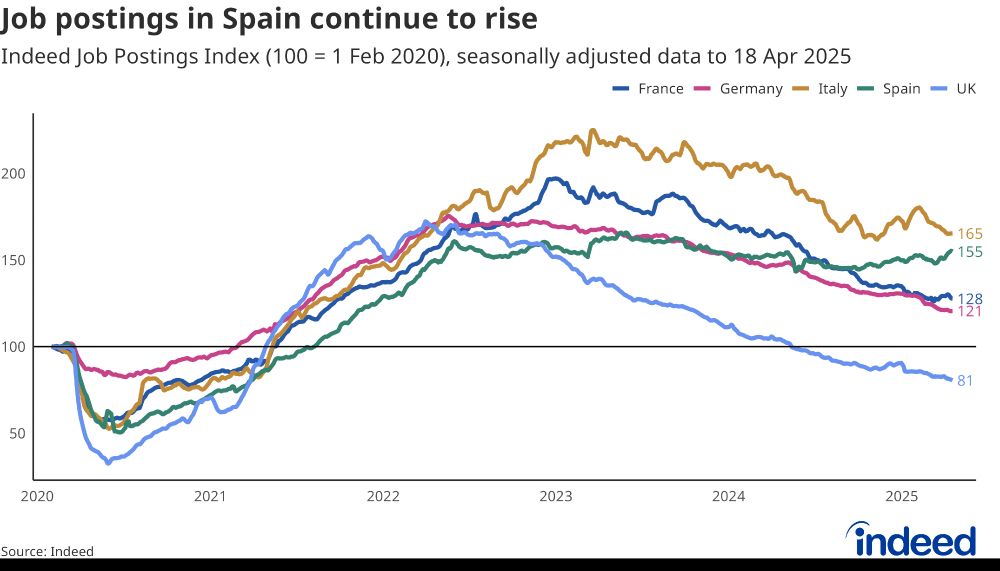

As of late August, job postings in Spain are 46% and Italy 53% above pre-pandemic levels.

Guillermo Gallacher and I wrote a blog post about Eurozone's four largest economies 👇

As of late August, job postings in Spain are 46% and Italy 53% above pre-pandemic levels.

Guillermo Gallacher and I wrote a blog post about Eurozone's four largest economies 👇

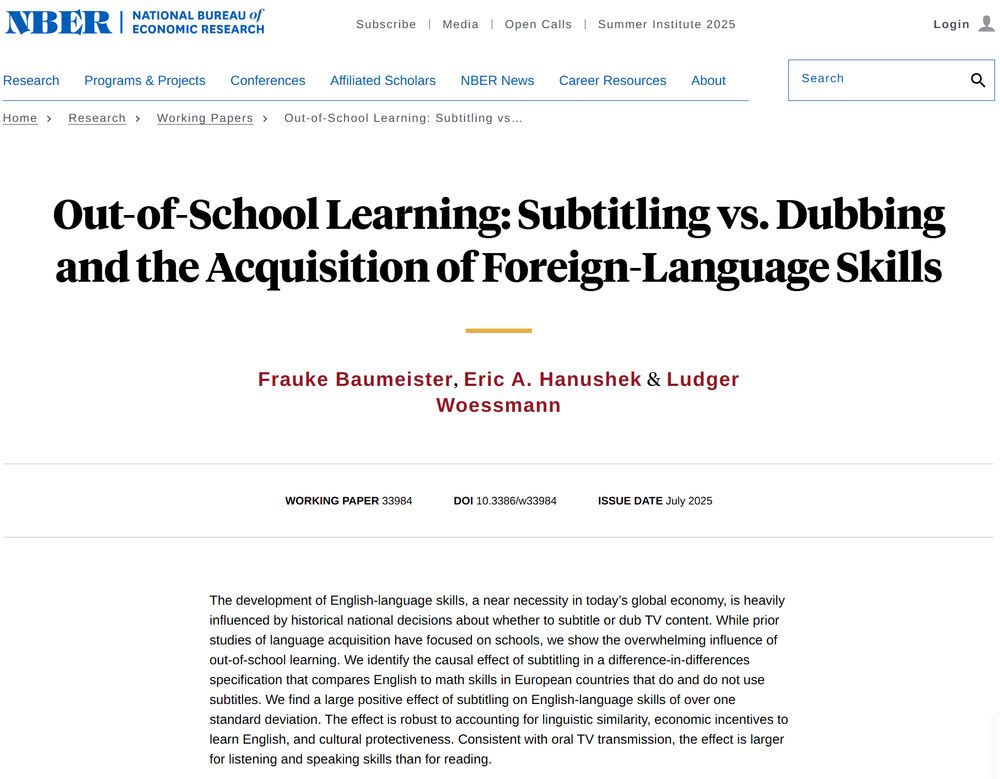

➡️ New Working Paper:

Out-of-School Learning: Subtitling vs. Dubbing and the Acquisition of Foreign-Language Skills

w/ F. Baumeister & E. Hanushek

www.nber.org/papers/w33984

A 🧵 1/12

➡️ New Working Paper:

Out-of-School Learning: Subtitling vs. Dubbing and the Acquisition of Foreign-Language Skills

w/ F. Baumeister & E. Hanushek

www.nber.org/papers/w33984

A 🧵 1/12

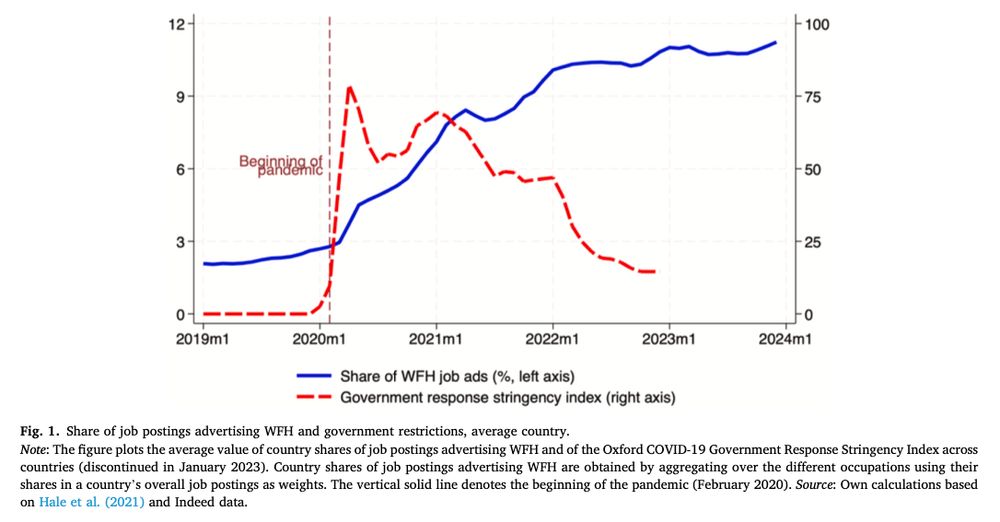

We analysed 1 billion job postings in 20 OECD countries.

The share of jobs advertising remote/hybrid work quadrupled from 2.5% to 11% (2019–2023) and has been stable since

🧵

We analysed 1 billion job postings in 20 OECD countries.

The share of jobs advertising remote/hybrid work quadrupled from 2.5% to 11% (2019–2023) and has been stable since

🧵

🇪🇸 Spain up 4% in the past month, now 65% above pre-pandemic levels

🇮🇹 Italy high & holding steady

🇩🇪 Germany & 🇬🇧 UK sliding

No crash anywhere (yet) but a continued divergence

🇪🇸 Spain up 4% in the past month, now 65% above pre-pandemic levels

🇮🇹 Italy high & holding steady

🇩🇪 Germany & 🇬🇧 UK sliding

No crash anywhere (yet) but a continued divergence

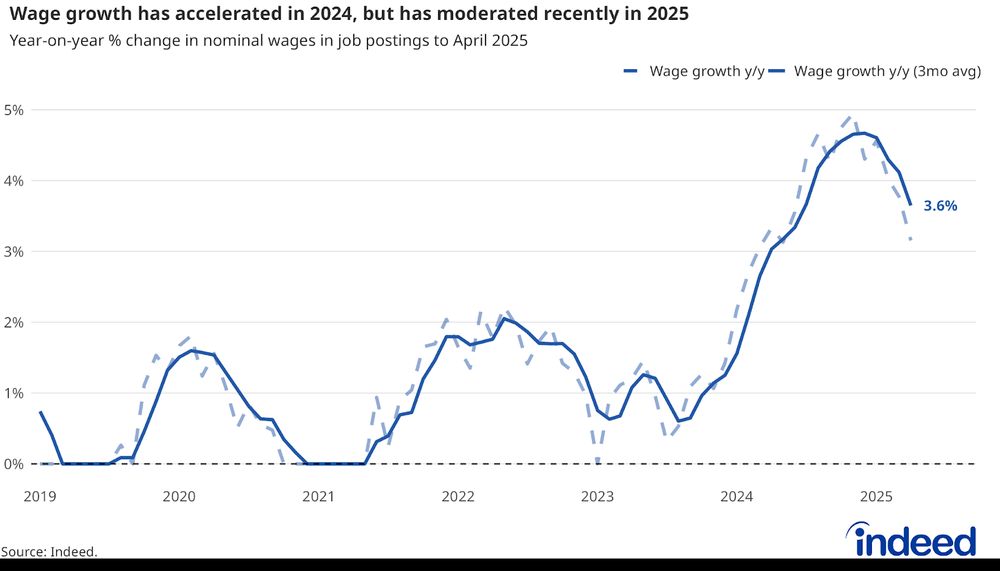

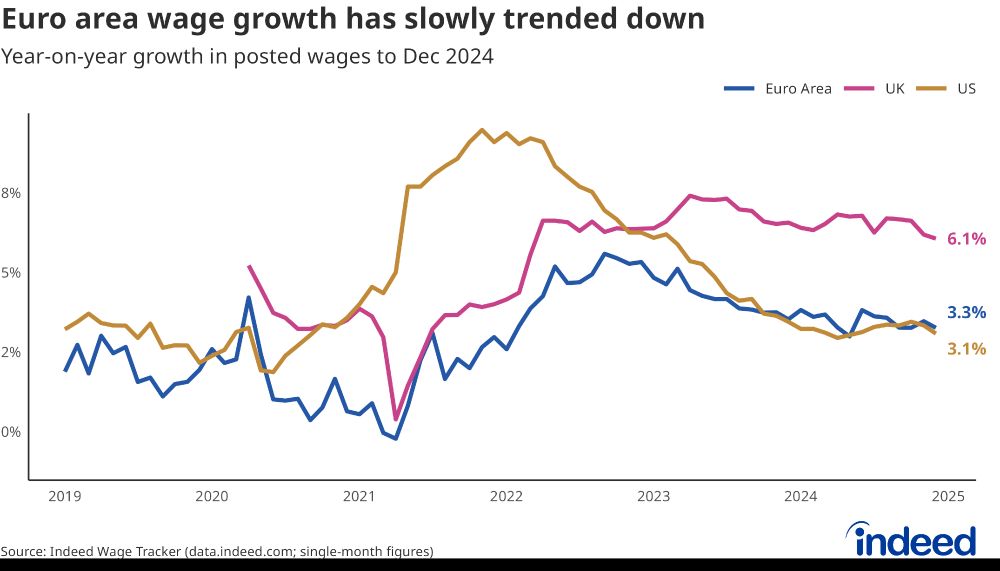

In a new blog post, @rlydon.bsky.social, Vahagn Galstyan and I dive into euro area wage trends and their implications for monetary policy. 🇪🇺🧵 1/

In a new blog post, @rlydon.bsky.social, Vahagn Galstyan and I dive into euro area wage trends and their implications for monetary policy. 🇪🇺🧵 1/

Research in Labor Economics (RLE) is planning a volume highlighting research on New Developments in Labor Economics. The editors Solomon Polachek and @ben_elsner are soliciting up to ten new papers showcasing new developments in #laborEconomics. … 1/2

Research in Labor Economics (RLE) is planning a volume highlighting research on New Developments in Labor Economics. The editors Solomon Polachek and @ben_elsner are soliciting up to ten new papers showcasing new developments in #laborEconomics. … 1/2

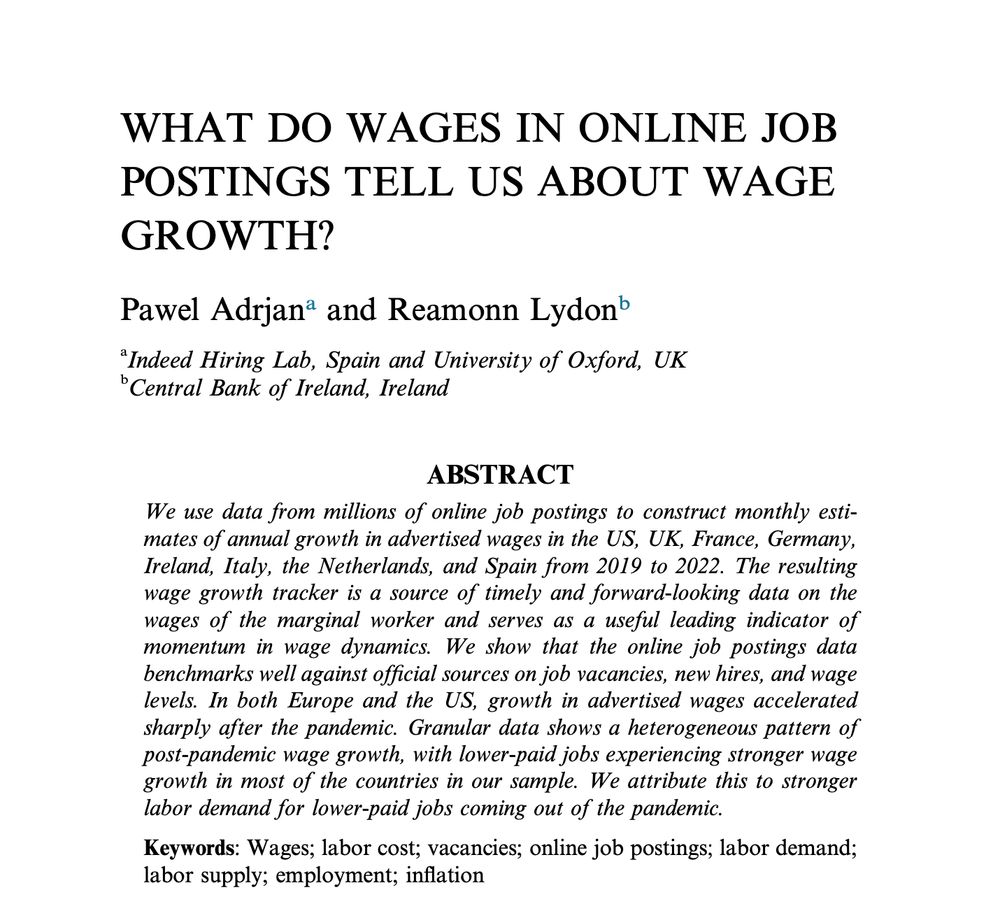

Main insights:

✅ Online job postings offer timely insights into wage trends

✅ Post-pandemic wage growth surged, especially for lower-paid jobs — signalling strong labour demand

Main insights:

✅ Online job postings offer timely insights into wage trends

✅ Post-pandemic wage growth surged, especially for lower-paid jobs — signalling strong labour demand

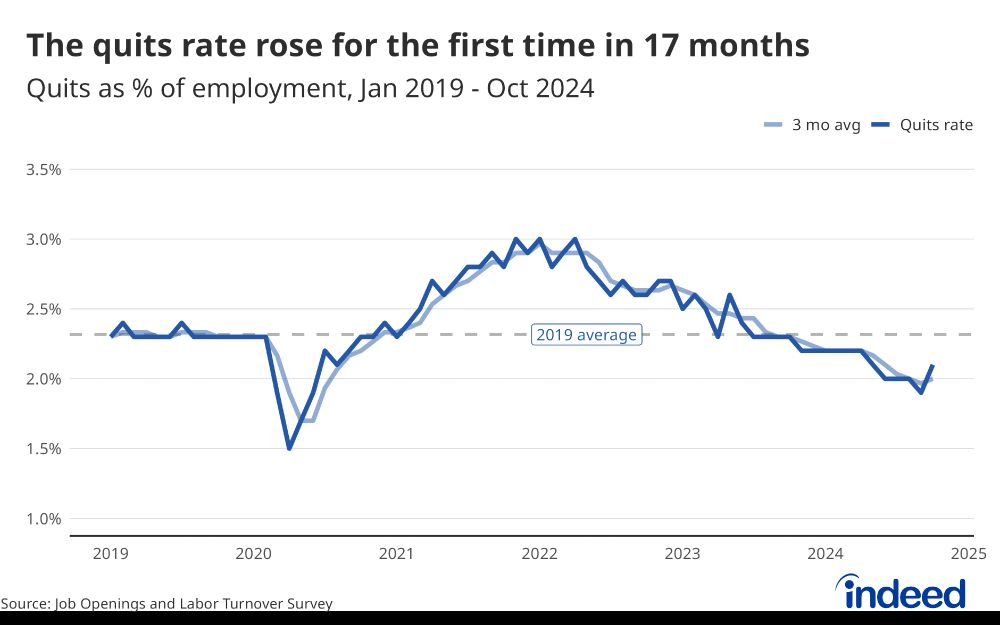

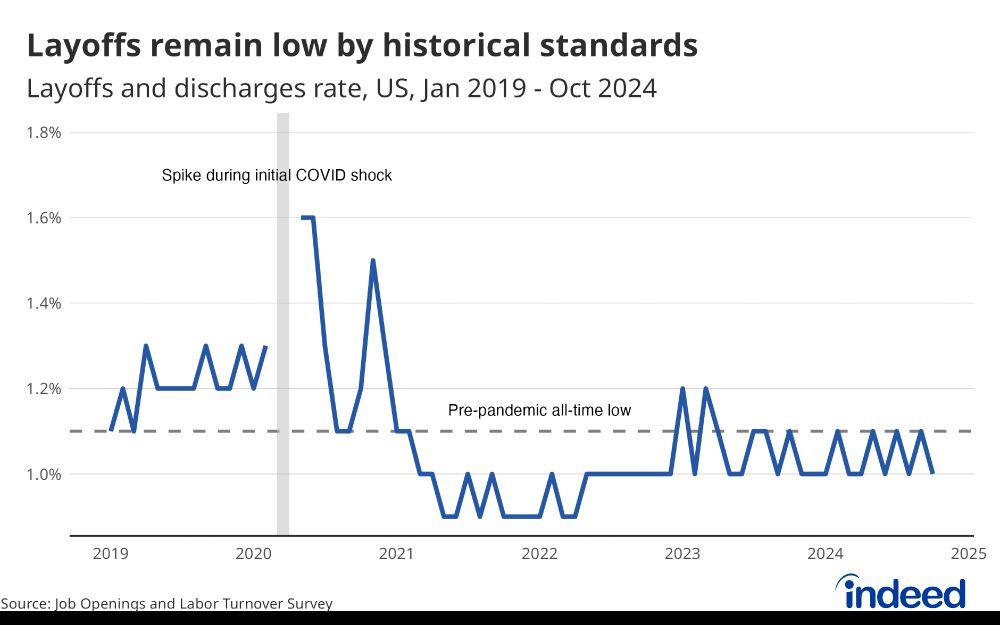

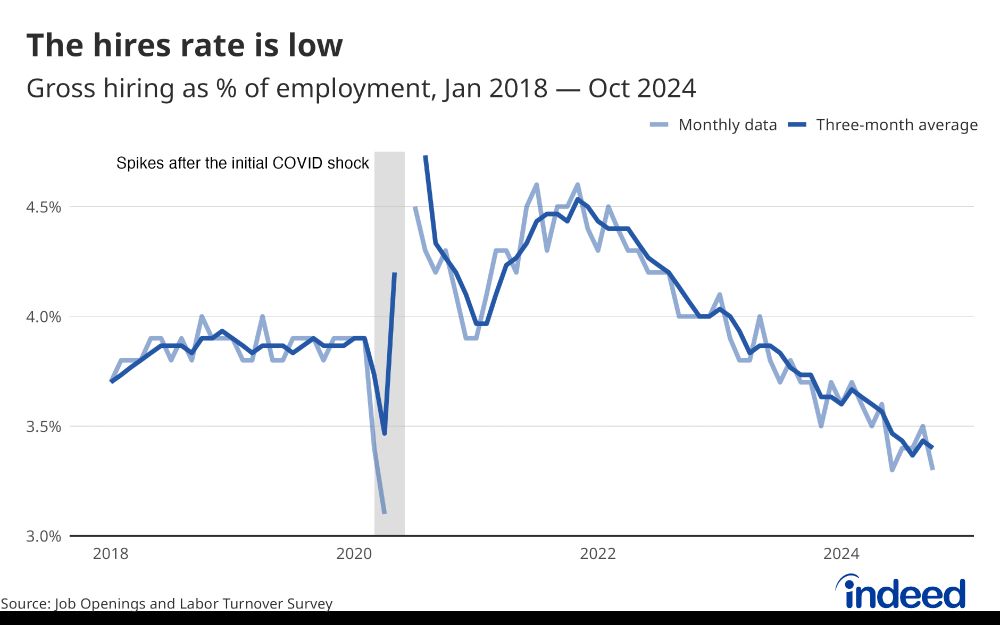

- Job openings ticked up to 7.7 million (from 7.4).

- The quits rate rose for the first time in 17 months.

- Layoff rate = 1.0 -> Below pre-pandemic all-time lows.

Hires rate weak at 3.3%, but could be a blip given slight pickup in recent months.

- Job openings ticked up to 7.7 million (from 7.4).

- The quits rate rose for the first time in 17 months.

- Layoff rate = 1.0 -> Below pre-pandemic all-time lows.

Hires rate weak at 3.3%, but could be a blip given slight pickup in recent months.

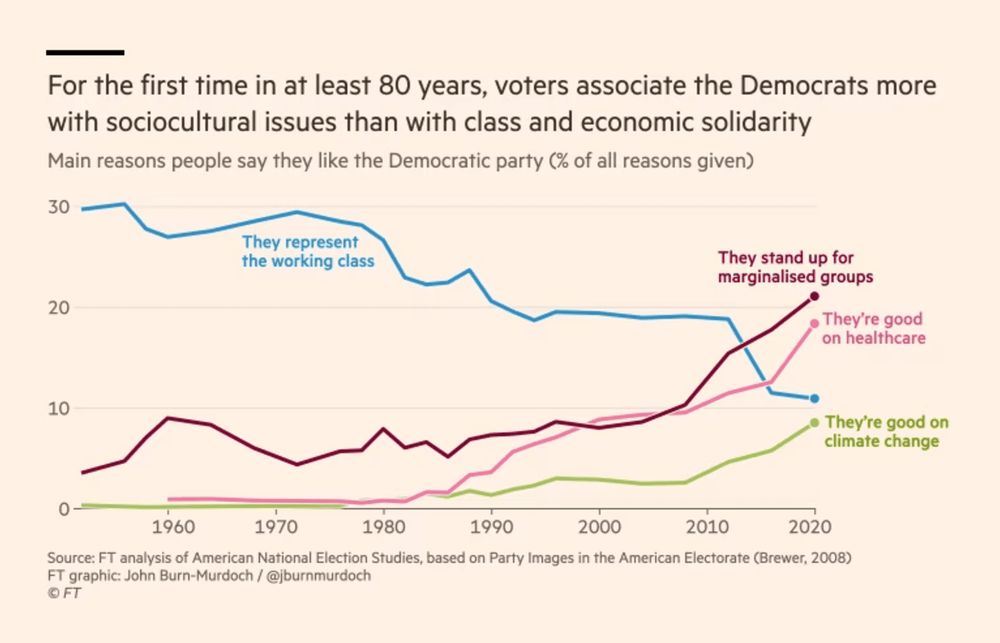

A 🧵 on a topic I find many students struggle with: "why do their 📊 look more professional than my 📊?"

It's *lots* of tiny decisions that aren't the defaults in many libraries, so let's break down 1 simple graph by @jburnmurdoch.bsky.social

🔗 www.ft.com/content/73a1...

A 🧵 on a topic I find many students struggle with: "why do their 📊 look more professional than my 📊?"

It's *lots* of tiny decisions that aren't the defaults in many libraries, so let's break down 1 simple graph by @jburnmurdoch.bsky.social

🔗 www.ft.com/content/73a1...

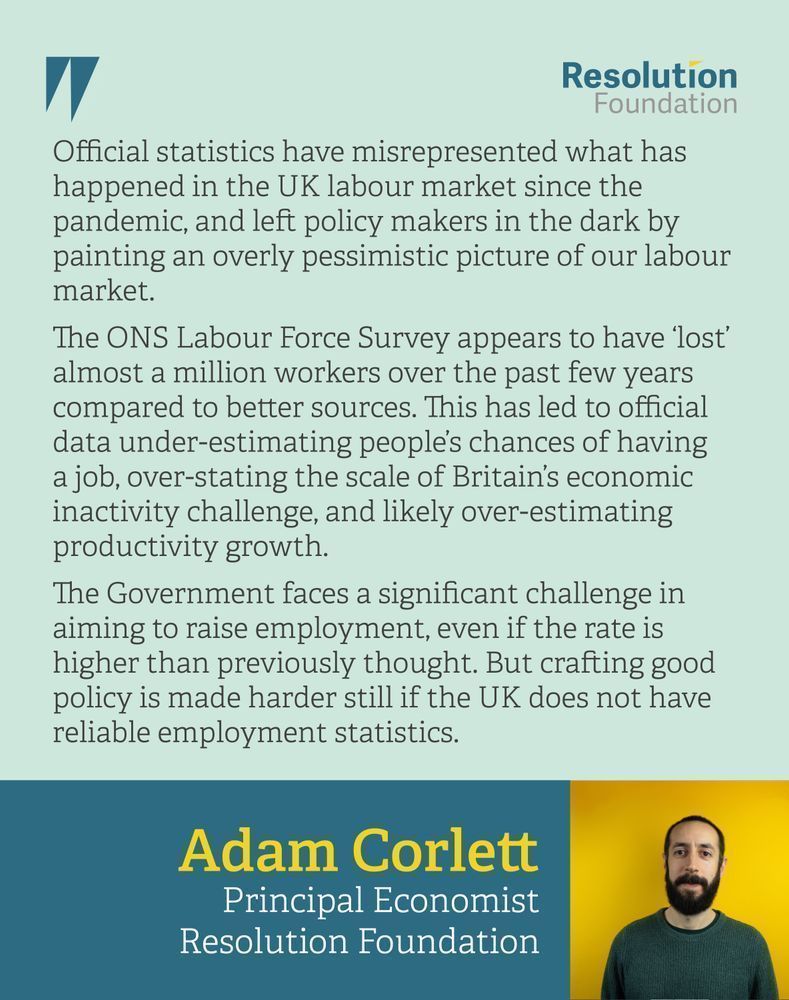

Official labour market data has ‘lost’ almost a million workers and is over-stating the scale of Britain’s economic inactivity challenge.

More➡️https://buff.ly/4fz1ifQ

Official labour market data has ‘lost’ almost a million workers and is over-stating the scale of Britain’s economic inactivity challenge.

More➡️https://buff.ly/4fz1ifQ

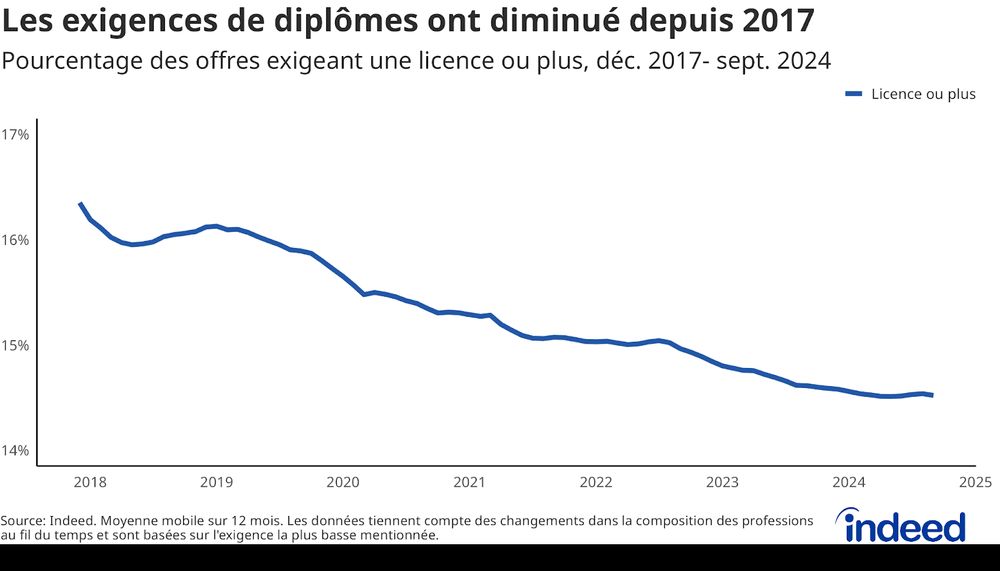

New research by #HiringLab's Lisa Feist 👇

New research by #HiringLab's Lisa Feist 👇

La conciliación, los horarios laborales y la educación deben ser los territorios a trabajar.

t.co/EXYrddCy4M

La conciliación, los horarios laborales y la educación deben ser los territorios a trabajar.

t.co/EXYrddCy4M

This is early work in progress with @jangromadzki.bsky.social and I look forward to the feedback.

Details: www.upo.es/area-analisi...

This is early work in progress with @jangromadzki.bsky.social and I look forward to the feedback.

Details: www.upo.es/area-analisi...

📄"Exclusionary Government Rhetoric and Migration Intentions"

🗣️Pawel Adrjan (Indeed)

📅Monday 18, Nov.

🕛12 noon

📍Boardroom. Building 3. #pablodeolavide

📄"Exclusionary Government Rhetoric and Migration Intentions"

🗣️Pawel Adrjan (Indeed)

📅Monday 18, Nov.

🕛12 noon

📍Boardroom. Building 3. #pablodeolavide

Job ad: econjobmarket.org/positions/11218

#EconSky #EconJM

Job ad: econjobmarket.org/positions/11218

#EconSky #EconJM

Feel free to nominate yourself or others to add to the list!

Feel free to nominate yourself or others to add to the list!

🇪🇺 Wage growth across the euro area continued its steady decline through October, broadly in line with ECB expectations.

📉 Latest charts, including individual country trends 👇

🇪🇺 Wage growth across the euro area continued its steady decline through October, broadly in line with ECB expectations.

📉 Latest charts, including individual country trends 👇