Rob Wood

@robwoodecon.bsky.social

Chief UK Economist at Pantheon Macroeconomics.

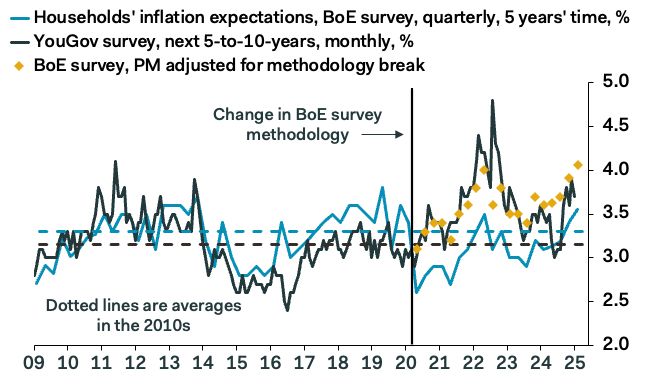

UK inflation expectations are modestly deanchored.

5-year ahead expectations higher than when inflation was in double digits and the survey is biased vs. history down by a method change in 2020. Paging MPC.

5-year ahead expectations higher than when inflation was in double digits and the survey is biased vs. history down by a method change in 2020. Paging MPC.

September 12, 2025 at 11:40 AM

UK inflation expectations are modestly deanchored.

5-year ahead expectations higher than when inflation was in double digits and the survey is biased vs. history down by a method change in 2020. Paging MPC.

5-year ahead expectations higher than when inflation was in double digits and the survey is biased vs. history down by a method change in 2020. Paging MPC.

You've got to the love the UK CBI retailing survey. Volatile much? But for what it's worth, sales for the time of the year reach the strongest in 14 months in July.

July 28, 2025 at 12:47 PM

You've got to the love the UK CBI retailing survey. Volatile much? But for what it's worth, sales for the time of the year reach the strongest in 14 months in July.

UK payrolls driven by NICS rather than weak demand. Sectors with high share of part-time workers—whose employment costs rise most after NICS hike—and self-employment—opportunity to cut tax liability by switching from employee status—see payrolls most. Latter means payrolls exaggerates job falls.

July 28, 2025 at 7:41 AM

UK payrolls driven by NICS rather than weak demand. Sectors with high share of part-time workers—whose employment costs rise most after NICS hike—and self-employment—opportunity to cut tax liability by switching from employee status—see payrolls most. Latter means payrolls exaggerates job falls.

UK political views increasingly seem to be driving responses to consumer sentiment—a phenomenon seen for some surveys in the US too—making them a less reliable leading indicator.

July 25, 2025 at 9:15 AM

UK political views increasingly seem to be driving responses to consumer sentiment—a phenomenon seen for some surveys in the US too—making them a less reliable leading indicator.

Which do you believe? Payrolls that just got massively revised, or the other two series which are also revision prone and in the case of the LFS not firing on all cylinders yet.

Jobs falling or rising solidly?....What the MPC would give for accurate data.

Jobs falling or rising solidly?....What the MPC would give for accurate data.

July 17, 2025 at 9:13 AM

Which do you believe? Payrolls that just got massively revised, or the other two series which are also revision prone and in the case of the LFS not firing on all cylinders yet.

Jobs falling or rising solidly?....What the MPC would give for accurate data.

Jobs falling or rising solidly?....What the MPC would give for accurate data.

Surprise, surprise, UK payrolls were revised up bang in line with their typical pattern. The question is, why would anyone believe the dodgy first estimates from this series showing tanking jobs? With a typical revision to June data, job falls are easing now.

July 17, 2025 at 8:34 AM

Surprise, surprise, UK payrolls were revised up bang in line with their typical pattern. The question is, why would anyone believe the dodgy first estimates from this series showing tanking jobs? With a typical revision to June data, job falls are easing now.

Shall we call it the estate agents' PMI?

July 7, 2025 at 8:06 AM

Shall we call it the estate agents' PMI?

Here's the thing about the UK PMI. The higher uncertainty goes the worse an indicator of growth the PMI becomes. Policy uncertainty was nearly 5 standard deviations above normal in April/May, so the PMI is giving a far too pessimistic steer.

June 4, 2025 at 10:42 AM

Here's the thing about the UK PMI. The higher uncertainty goes the worse an indicator of growth the PMI becomes. Policy uncertainty was nearly 5 standard deviations above normal in April/May, so the PMI is giving a far too pessimistic steer.

Cautious consumers you say? Retail sales growing the fastest in 3 years and now liquid asset accumulation dropping sharply. For my money the ONS saving rate data are wrong—they often revise it down sharply. Consumers will keep GDP growth ticking along.

June 2, 2025 at 9:47 AM

Cautious consumers you say? Retail sales growing the fastest in 3 years and now liquid asset accumulation dropping sharply. For my money the ONS saving rate data are wrong—they often revise it down sharply. Consumers will keep GDP growth ticking along.

The MPC will struggle to cut twice more this year after inflation surged to 3.5%, well above consensus of 3.3% but close to our call of 3.6%. Administered prices drove the surge, and there was a small Easter boost, but underlying pressures are stubborn. 'Skips' are likely now.

May 21, 2025 at 7:35 AM

The MPC will struggle to cut twice more this year after inflation surged to 3.5%, well above consensus of 3.3% but close to our call of 3.6%. Administered prices drove the surge, and there was a small Easter boost, but underlying pressures are stubborn. 'Skips' are likely now.

Reposted by Rob Wood

It's difficult to reconcile the data around the cautious consumer - not least another pick up in the savings ratio - with the strength in the retail sales. There are probably good reasons to put more weight on either set of data, but the discrepancy does muddy the true picture of consumer activity

March 28, 2025 at 11:51 AM

It's difficult to reconcile the data around the cautious consumer - not least another pick up in the savings ratio - with the strength in the retail sales. There are probably good reasons to put more weight on either set of data, but the discrepancy does muddy the true picture of consumer activity

Are more bad data leading us to misdiagnose the UK economy. Put another way can we really trust that the UK cash saving rate rose to an all-time high in Q4 2024 as the ONS reported this morning? The chart is startling, with households saving 12.0% of their income in Q4 (1/n)

March 28, 2025 at 9:50 AM

Are more bad data leading us to misdiagnose the UK economy. Put another way can we really trust that the UK cash saving rate rose to an all-time high in Q4 2024 as the ONS reported this morning? The chart is startling, with households saving 12.0% of their income in Q4 (1/n)

Retail sales continue their rebound after the Budget knocked confidence for a couple of months. Retail sales volumes have been trending up pretty solidly since late 2023 and 3m year-over-year growth reached the highest since March 2022. GDP growth will rebound in Q1.

March 28, 2025 at 7:55 AM

Retail sales continue their rebound after the Budget knocked confidence for a couple of months. Retail sales volumes have been trending up pretty solidly since late 2023 and 3m year-over-year growth reached the highest since March 2022. GDP growth will rebound in Q1.

Meanwhile, in other news that may have gone under the radar today. Uh-oh. Household 5-10 year ahead inflation expectations rise to the highest since October 2022, when actual inflation was 11.1%. Anchored these are not. Paging Andrew Bailey.....

March 26, 2025 at 6:11 PM

Meanwhile, in other news that may have gone under the radar today. Uh-oh. Household 5-10 year ahead inflation expectations rise to the highest since October 2022, when actual inflation was 11.1%. Anchored these are not. Paging Andrew Bailey.....

Fiscal statements are quite something to watch. The Chancellor talked a good game, but ultimately Ms. Reeves plans to borrow more in every year of the OBR's forecasts and raised spending in the near-term. Make me virtuous, but not yet (1/n)

March 26, 2025 at 5:58 PM

Fiscal statements are quite something to watch. The Chancellor talked a good game, but ultimately Ms. Reeves plans to borrow more in every year of the OBR's forecasts and raised spending in the near-term. Make me virtuous, but not yet (1/n)

Ah, PMI day. Always fun. Job cuts apparently moved from as bad as the month after Lehman's bankruptcy, to merely as bad as last October—when payrolls rose. We all know the problems: qualitative survey; responses can reflect sentiment. Treat with plenty of salt.

March 24, 2025 at 12:46 PM

Ah, PMI day. Always fun. Job cuts apparently moved from as bad as the month after Lehman's bankruptcy, to merely as bad as last October—when payrolls rose. We all know the problems: qualitative survey; responses can reflect sentiment. Treat with plenty of salt.

Reposted by Rob Wood

Have been part of one of the longitudinal HH surveys. Every time I fill in the same pages and pages of info for everyone in the household. The survey has no ‘memory’ in terms of showing me previous answers to check. All from scratch in each wave. If I didn’t care I’d have given up.

March 21, 2025 at 12:02 PM

Have been part of one of the longitudinal HH surveys. Every time I fill in the same pages and pages of info for everyone in the household. The survey has no ‘memory’ in terms of showing me previous answers to check. All from scratch in each wave. If I didn’t care I’d have given up.

Reposted by Rob Wood

Guardian December 2024 talks about internal problems: unrealistic targets and management/exec unwilling to listen to expert advice; low pay, constantly being told to find more savings, and poor morale; difficulty getting people to engage with survey staff.

March 21, 2025 at 10:12 AM

Guardian December 2024 talks about internal problems: unrealistic targets and management/exec unwilling to listen to expert advice; low pay, constantly being told to find more savings, and poor morale; difficulty getting people to engage with survey staff.

The latest disaster at the ONS. I wonder if they'll cease all data publication before too long.

In all seriousness, if labour market, trade and PPI data can't be trusted, there must be questions about what other errors and problems are lurking that we haven't found out yet.

In all seriousness, if labour market, trade and PPI data can't be trusted, there must be questions about what other errors and problems are lurking that we haven't found out yet.

March 21, 2025 at 8:43 AM

The latest disaster at the ONS. I wonder if they'll cease all data publication before too long.

In all seriousness, if labour market, trade and PPI data can't be trusted, there must be questions about what other errors and problems are lurking that we haven't found out yet.

In all seriousness, if labour market, trade and PPI data can't be trusted, there must be questions about what other errors and problems are lurking that we haven't found out yet.

Contrast BoE MPC minutes.

Dec. 2024 "Monetary policy **was acting** to ensure that longer-term inflation expectations were anchored at the 2% target."

Mar. 2025 "Monetary policy **would act** to ensure that longer-term inflation expectations were anchored at the 2% target."

Dec. 2024 "Monetary policy **was acting** to ensure that longer-term inflation expectations were anchored at the 2% target."

Mar. 2025 "Monetary policy **would act** to ensure that longer-term inflation expectations were anchored at the 2% target."

March 20, 2025 at 6:13 PM

Contrast BoE MPC minutes.

Dec. 2024 "Monetary policy **was acting** to ensure that longer-term inflation expectations were anchored at the 2% target."

Mar. 2025 "Monetary policy **would act** to ensure that longer-term inflation expectations were anchored at the 2% target."

Dec. 2024 "Monetary policy **was acting** to ensure that longer-term inflation expectations were anchored at the 2% target."

Mar. 2025 "Monetary policy **would act** to ensure that longer-term inflation expectations were anchored at the 2% target."

Job growth is far from great, but it does seem to be improving from a soft patch in the second half of last year. Payroll tax hikes are a risk to employment, but the blood-curdling business warnings are failing to show up in the hard data. We expect that to continue; jobs will hold up.

March 20, 2025 at 3:43 PM

Job growth is far from great, but it does seem to be improving from a soft patch in the second half of last year. Payroll tax hikes are a risk to employment, but the blood-curdling business warnings are failing to show up in the hard data. We expect that to continue; jobs will hold up.

Reposted by Rob Wood

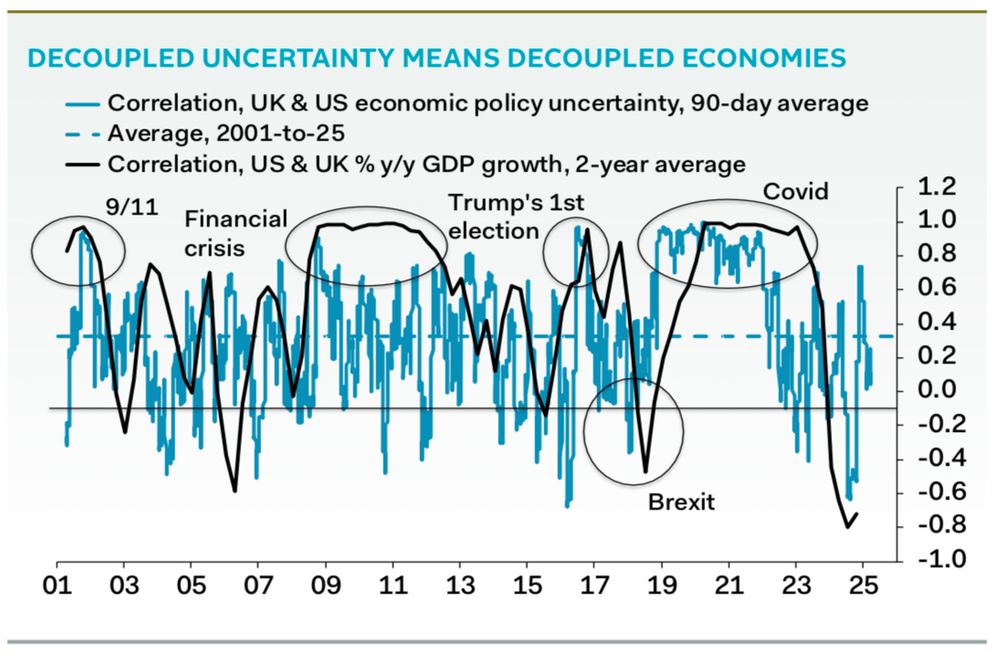

Fun chart from @robwoodecon.bsky.social on how decoupled the British and American economies now look.

March 17, 2025 at 12:29 PM

Fun chart from @robwoodecon.bsky.social on how decoupled the British and American economies now look.

The BoE turned more cautious. They added flexibility to skip a quarterly cut and raised concern about inflation persistence, adding that policy would anchor expectations. They have been far too sanguine about expectations, but they are well above normal levels. The MPC needs to be careful.

March 20, 2025 at 2:43 PM

The BoE turned more cautious. They added flexibility to skip a quarterly cut and raised concern about inflation persistence, adding that policy would anchor expectations. They have been far too sanguine about expectations, but they are well above normal levels. The MPC needs to be careful.

The latest Bank of England inflation attitudes survey shows long-term expectations high and rising, especially once we adjust for the structural break in the BoE data in 2020. The MPC is wrong to assume this year's inflation rise will have no second-round effects.

March 14, 2025 at 10:33 AM

The latest Bank of England inflation attitudes survey shows long-term expectations high and rising, especially once we adjust for the structural break in the BoE data in 2020. The MPC is wrong to assume this year's inflation rise will have no second-round effects.

A clear picture is emerging about the UK economy late last year. A temporary slowdown, rather than collapse. Growth dipped in October as consumers worried about tax hikes, but spending has rebounded. Retail sales rose 1.0% November-to-January, matching GDP improvement (1/2)

February 21, 2025 at 7:39 AM

A clear picture is emerging about the UK economy late last year. A temporary slowdown, rather than collapse. Growth dipped in October as consumers worried about tax hikes, but spending has rebounded. Retail sales rose 1.0% November-to-January, matching GDP improvement (1/2)