That's what happens when the market thinks high Core PCE will keep the Fed from cutting short-term, but the economy will be weaker long-term.

IOW, soft spending number >> hot inflation number

That's what happens when the market thinks high Core PCE will keep the Fed from cutting short-term, but the economy will be weaker long-term.

IOW, soft spending number >> hot inflation number

But Bessent always claimed Yellen was moving the 10yr materially (calling it stealth mon pol). So it makes sense that he believes this stuff will work.

But Bessent always claimed Yellen was moving the 10yr materially (calling it stealth mon pol). So it makes sense that he believes this stuff will work.

W/o TBA, mortgages become harder to trade and hedge for originators. That would drive mortgage rates up.

W/o TBA, mortgages become harder to trade and hedge for originators. That would drive mortgage rates up.

I'm skeptical Trump ever pulls the trigger on it.

www.wsj.com/finance/regu...

I'm skeptical Trump ever pulls the trigger on it.

www.wsj.com/finance/regu...

www.youtube.com/watch?v=DaYy...

www.youtube.com/watch?v=DaYy...

facetwealth.zoom.us/webinar/regi...

facetwealth.zoom.us/webinar/regi...

Unfortunately right now, neither site is has the diversity of opinions that I'd prefer.

Wow, you mean your strategy of following 18 people here and showing up once every three weeks to complain about how quiet it is hasn't paid off? Surprising!

Unfortunately right now, neither site is has the diversity of opinions that I'd prefer.

I think in reality, it isn't that simple. 1/

www.youtube.com/watch?v=HeZS...

I think in reality, it isn't that simple. 1/

www.youtube.com/watch?v=HeZS...

Rn we're fine, but it can't go much lower.

Rn we're fine, but it can't go much lower.

We just saw one of the most consequential weeks in the history of modern Europe.

A must-listen with DB's George Saravelos on Germany's spending package, and why it's the biggest story since German reunification podcasts.apple.com/us/podcast/w...

First, consider who in the supply chain has market power. Here, $WMT is saying they think they can squeeze suppliers, but don't want to raise $ on consumers. (1/2)

First, consider who in the supply chain has market power. Here, $WMT is saying they think they can squeeze suppliers, but don't want to raise $ on consumers. (1/2)

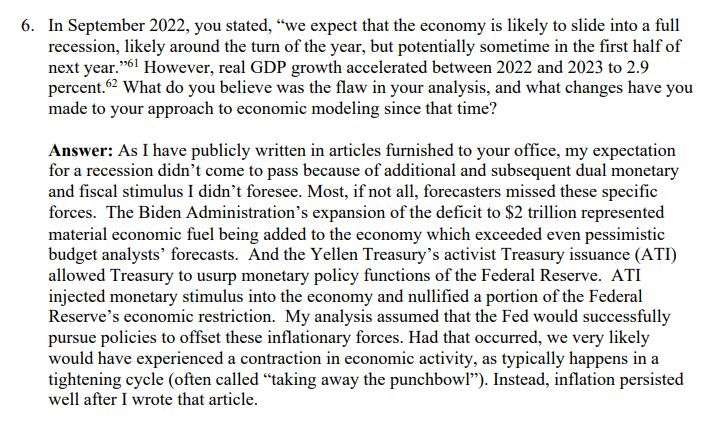

Regardless, at no time did he offer *evidence* that this "activist Treasury" bit had a meaningful impact. He just waived his hands in that direction.

Regardless, at no time did he offer *evidence* that this "activist Treasury" bit had a meaningful impact. He just waived his hands in that direction.