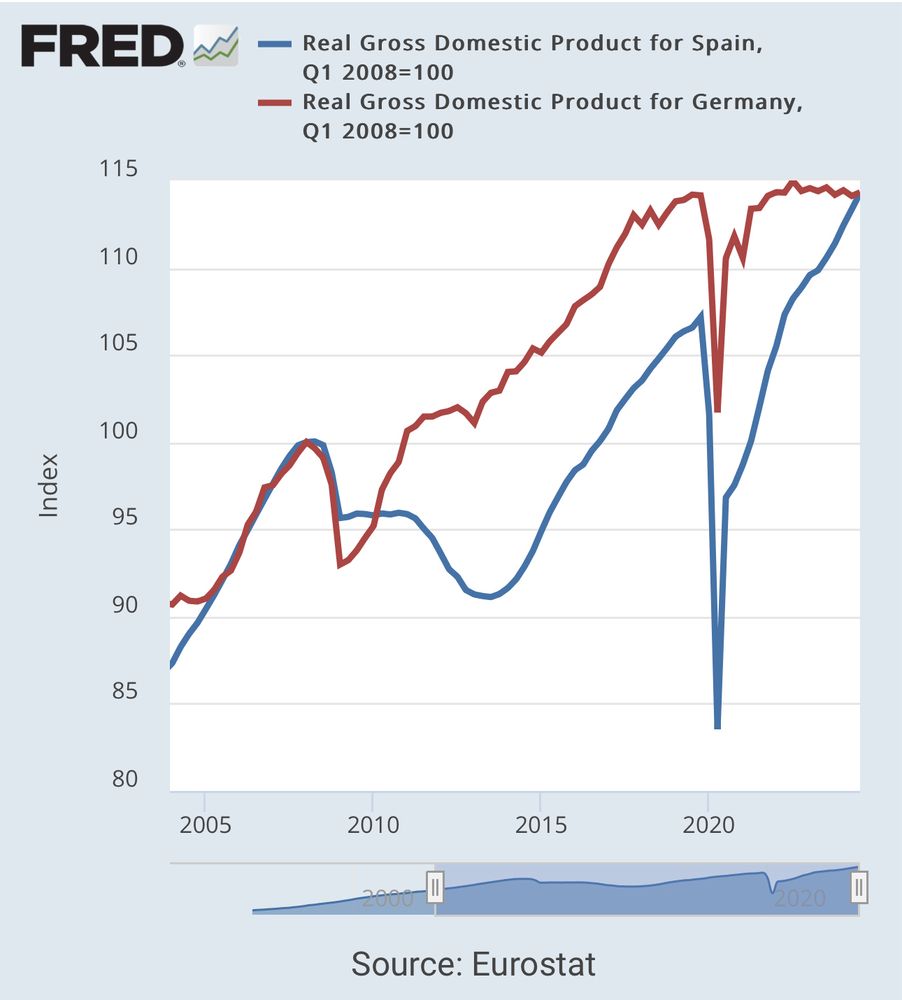

That's a huge accumulated difference in terms of the value of output achieved in one economy vs. another.

While there are indeed a number of things China can do to retaliate against the prospect of a worsening trade conflict with the US, and these are things the US and the world should worry about, this article makes the common mistake of...

www.bloomberg.com/news/article...

While there are indeed a number of things China can do to retaliate against the prospect of a worsening trade conflict with the US, and these are things the US and the world should worry about, this article makes the common mistake of...

www.bloomberg.com/news/article...

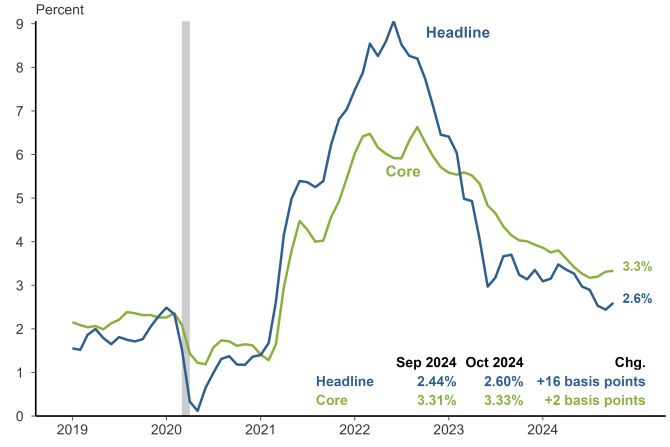

The Reeves budget outlays weren't mostly unfunded like the Kwarteng budget.

Gilts now have a large premium vs 2022. Real yields are 300bp higher, as inflation has halved.

To borrow from @darioperkins.bsky.social , no moron risk premium needed!

The Reeves budget outlays weren't mostly unfunded like the Kwarteng budget.

Gilts now have a large premium vs 2022. Real yields are 300bp higher, as inflation has halved.

To borrow from @darioperkins.bsky.social , no moron risk premium needed!

Shakespeare neither advocated nor militated.

He just observed and portrayed in a way that stuck.

Shakespeare neither advocated nor militated.

He just observed and portrayed in a way that stuck.

‘Toyota is going from one electric model to five to compete with Tesla., fuel stations are ripping out pumps for chargers…nursing homes in the rural interior have switched to battery-powered cars despite months of arctic cold.’

www.bloomberg.com/features/202...

‘Toyota is going from one electric model to five to compete with Tesla., fuel stations are ripping out pumps for chargers…nursing homes in the rural interior have switched to battery-powered cars despite months of arctic cold.’

www.bloomberg.com/features/202...

It is hard to pick up a newspaper in China without seeing exhortations to increase consumption and assurances that consumption is inexorably rising, but while there is the occasional reference to the difficulty of...

www.chinadaily.com.cn

It is hard to pick up a newspaper in China without seeing exhortations to increase consumption and assurances that consumption is inexorably rising, but while there is the occasional reference to the difficulty of...

www.chinadaily.com.cn

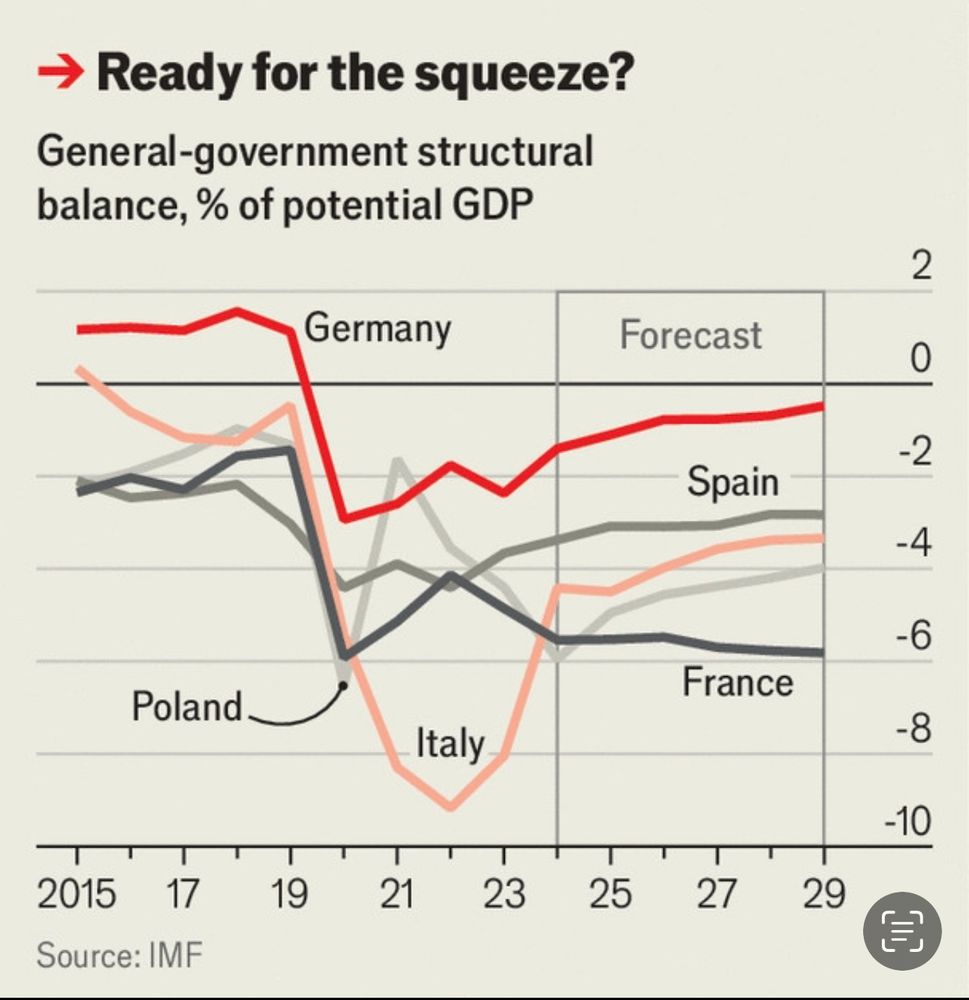

IMF’s forecasts suggest the trend continues.

Spain is swapping places with France in the Eurozone’s economic core.

Even Italy is projected to fare better.

Qu’est ce qu’il se passe???!!

IMF’s forecasts suggest the trend continues.

Spain is swapping places with France in the Eurozone’s economic core.

Even Italy is projected to fare better.

Qu’est ce qu’il se passe???!!

'Handouts after prices have increased to compensate consumers for lost income leave the shock of paying higher prices in place, and for less engaged voters it may be this that really counts.'

mainlymacro.blogspot.com/2024/11/shou...

Many governments cushioned the impact of energy price rises on consumers. Did this make sense in economic or political terms?

'Handouts after prices have increased to compensate consumers for lost income leave the shock of paying higher prices in place, and for less engaged voters it may be this that really counts.'

Not so good for retailers’ margins.

https://www.ft.com/content/2dc40ef5-c053-4d14-a693-a00b0982c887

Not so good for retailers’ margins.

Go little buddies, go!

www.frbsf.org/research-and...

www.frbsf.org/research-and...

Well I guess I'm on here now too.

Fintwit member since 2013, poster of charts, writer of research at Topdown Charts, and stormer of charts at The Weekly ChartStorm.

Looking forward to seeing how this platform goes.....

Well I guess I'm on here now too.

Fintwit member since 2013, poster of charts, writer of research at Topdown Charts, and stormer of charts at The Weekly ChartStorm.

Looking forward to seeing how this platform goes.....

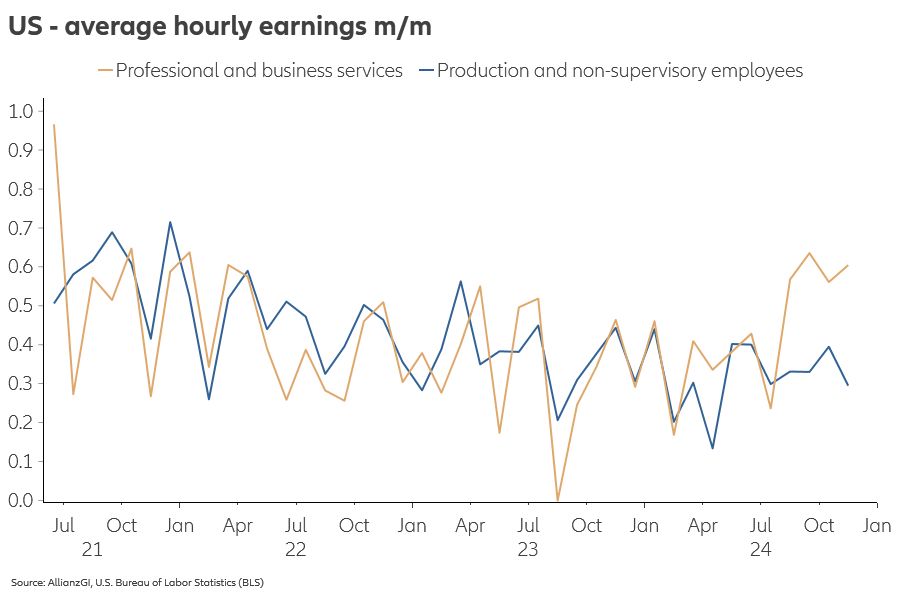

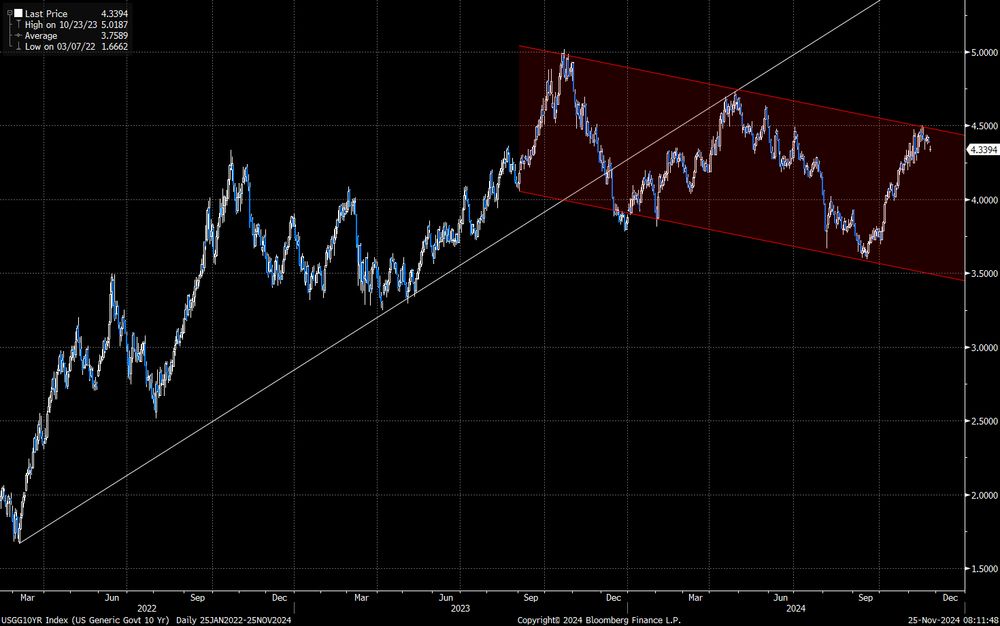

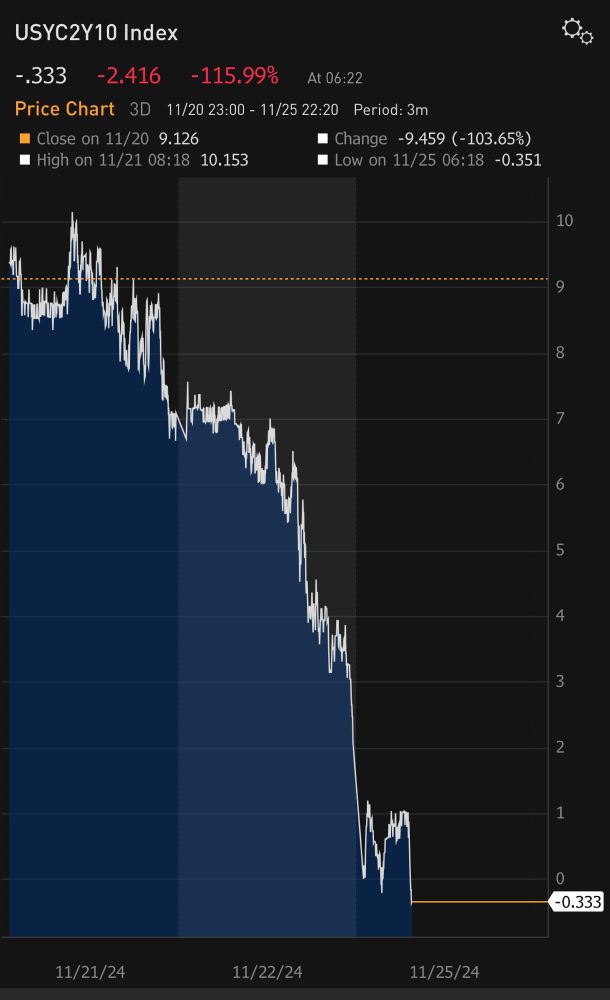

Doves have to join in for the 'higher neutral rate' narrative to go mainstream. Doesn't seem like they're joining the Logan/Bowman train yet.

Doves have to join in for the 'higher neutral rate' narrative to go mainstream. Doesn't seem like they're joining the Logan/Bowman train yet.

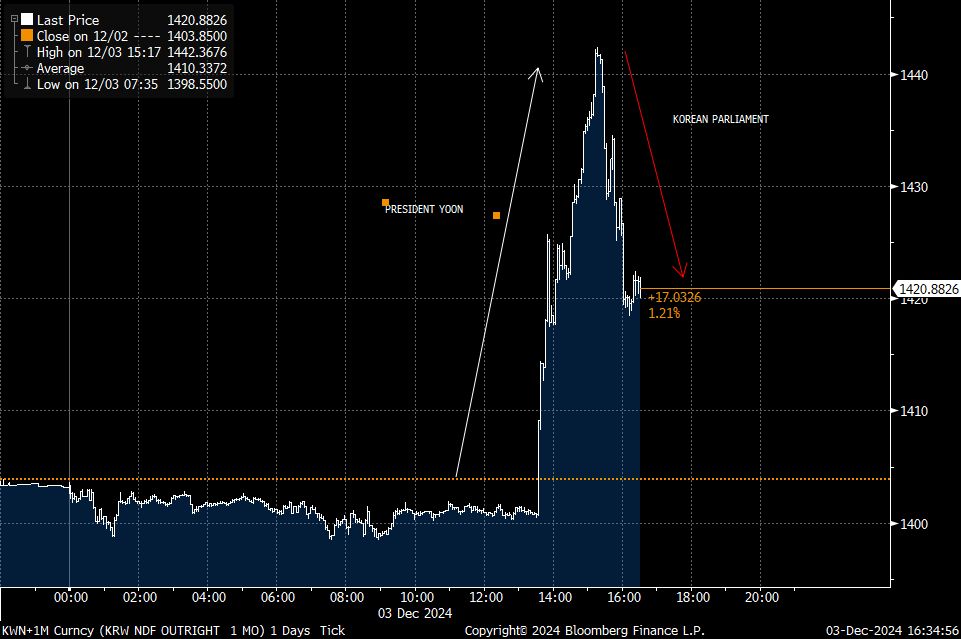

The threat from Trump is more an investment-chilling environment of high interest rates.

on.ft.com/4eOpSsg

The threat from Trump is more an investment-chilling environment of high interest rates.

on.ft.com/4eOpSsg

1/ Initial claims are where I thought they'd be around this time of year: the 210s.

The "improvement" relative to the spring/summer is illusory - just a reflection of funky seasonal adjustment. (The improvement from the hurricanes/strike is real, though.)

1/ Initial claims are where I thought they'd be around this time of year: the 210s.

The "improvement" relative to the spring/summer is illusory - just a reflection of funky seasonal adjustment. (The improvement from the hurricanes/strike is real, though.)