Research interests: corporate sustainability ,carbon performance, carbon management accounting, corporate responsibility

www.reuters.com/technology/g...

www.reuters.com/technology/g...

But because involution is a consequence of the surge in manufacturing that was itself a response to the post-2021-22 decline in property investment, if this is true, it simply shifts the problem forward, as I explain in a recent CRI piece.

carnegieendowment.org/posts/2025/0...

But because involution is a consequence of the surge in manufacturing that was itself a response to the post-2021-22 decline in property investment, if this is true, it simply shifts the problem forward, as I explain in a recent CRI piece.

carnegieendowment.org/posts/2025/0...

imbalances in countries that choose not to. To put it another way, this is an example of how one country's industrial policies can also become the industrial policies (in reverse) of another country, whether that benefits or harms the latter.

carnegieendowment.org/china-financ...

imbalances in countries that choose not to. To put it another way, this is an example of how one country's industrial policies can also become the industrial policies (in reverse) of another country, whether that benefits or harms the latter.

carnegieendowment.org/china-financ...

In the end, you cannot solve a structural problem through accounting or administrative measures. What we are instead likely to see is greater trade surpluses and rising inventories, with the former being the main way to limit the latter.

In the end, you cannot solve a structural problem through accounting or administrative measures. What we are instead likely to see is greater trade surpluses and rising inventories, with the former being the main way to limit the latter.

Manufacturing represents 27-28% of the Chinese economy, even more than the property sector. This means that anything that hurts manufacturing will be very hard for the rest of the economy to absorb.

Manufacturing represents 27-28% of the Chinese economy, even more than the property sector. This means that anything that hurts manufacturing will be very hard for the rest of the economy to absorb.

My friends in manufacturing tell me that they are under huge pressure to reduce wages and fire workers, but they're also under a lot of pressure by local governments to show higher growth numbers, and this partly explains why exports continue to rise much faster than imports.

My friends in manufacturing tell me that they are under huge pressure to reduce wages and fire workers, but they're also under a lot of pressure by local governments to show higher growth numbers, and this partly explains why exports continue to rise much faster than imports.

What is more, the growth in median household income was only 5.0%, which suggests that the poor, who are most likely than the rich to convert income into consumption, received a disproportionately low share of that increase.

www.stats.gov.cn/english/Pres...

What is more, the growth in median household income was only 5.0%, which suggests that the poor, who are most likely than the rich to convert income into consumption, received a disproportionately low share of that increase.

www.stats.gov.cn/english/Pres...

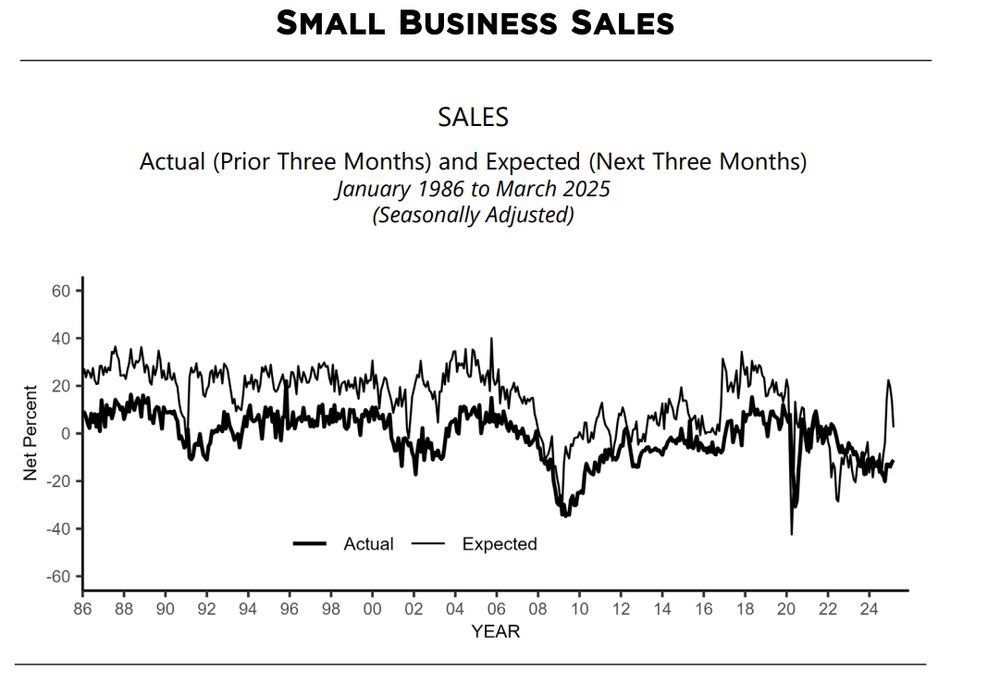

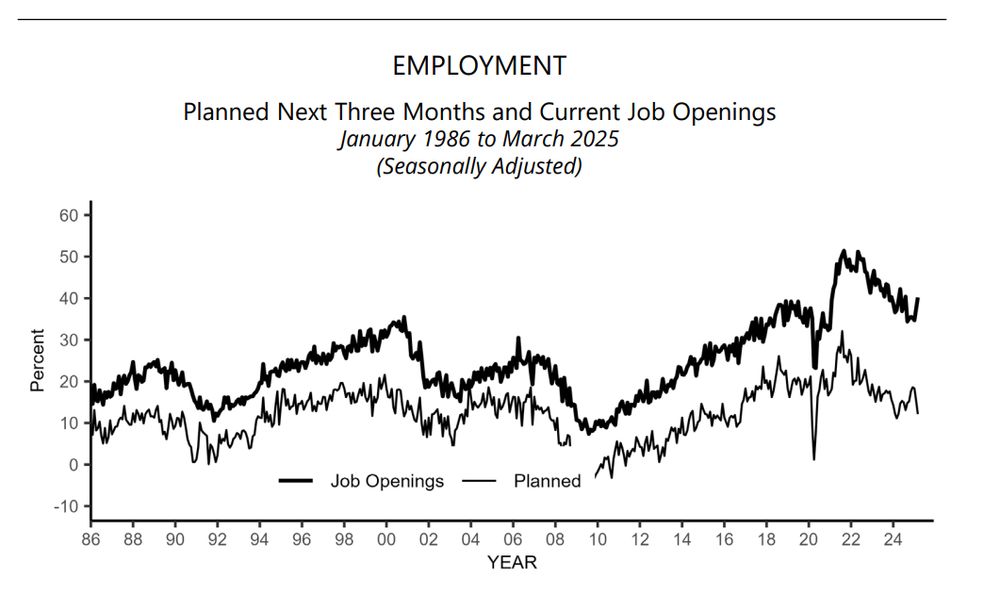

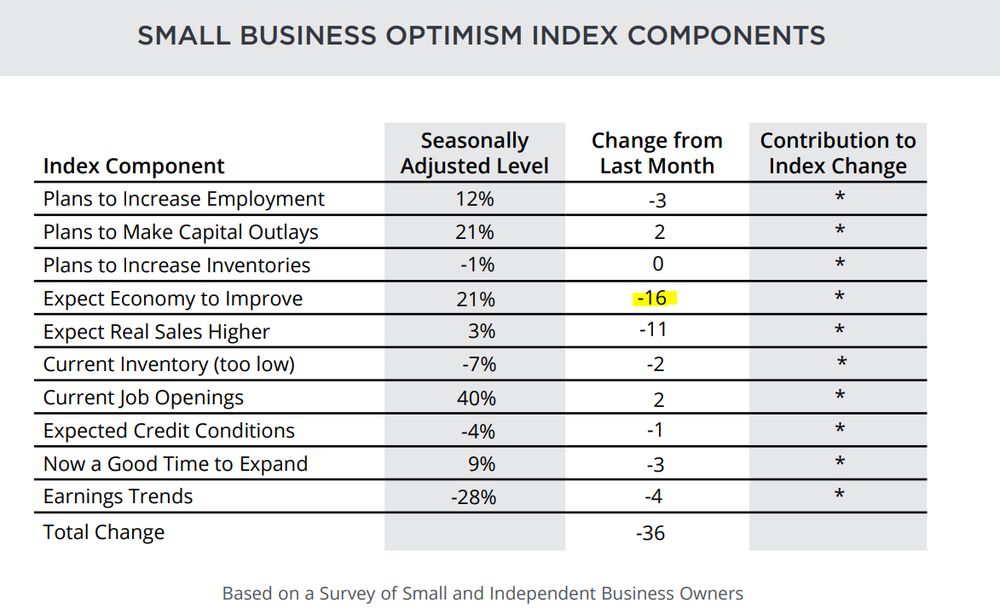

Today they say they're seeing declining optimism, expecting lower sales and hiring, and a significantly worsening picture for the overall economy.

www.nfib.com/wp-content/u...

Today they say they're seeing declining optimism, expecting lower sales and hiring, and a significantly worsening picture for the overall economy.

www.nfib.com/wp-content/u...

The point is that what had seemed like a stable global trading regime was in fact based on an unsustainable dependence of the rest of the world on the willingness of the US (along with the UK and Canada) to exchange ownership of domestic assets for large trade deficits.

The point is that what had seemed like a stable global trading regime was in fact based on an unsustainable dependence of the rest of the world on the willingness of the US (along with the UK and Canada) to exchange ownership of domestic assets for large trade deficits.

theovershoot.co/p/how-to-thi...

theovershoot.co/p/how-to-thi...

To make matters worse, the new tariffs don't really address the real US problem. One obvious reason is that the tariffs are largely bilateral, and while bilateral imbalances may impress those who don't understand trade and capital flows, they are in fact pretty useless.

To make matters worse, the new tariffs don't really address the real US problem. One obvious reason is that the tariffs are largely bilateral, and while bilateral imbalances may impress those who don't understand trade and capital flows, they are in fact pretty useless.

The global trading system is changing, in ways that may be as dramatic as in the 1930s and the 1970s. The temptation to go back to what used to work in the past may be a strong one, but it's not a sustainable one.

The global trading system is changing, in ways that may be as dramatic as in the 1930s and the 1970s. The temptation to go back to what used to work in the past may be a strong one, but it's not a sustainable one.

the US economy and worsen US trade imbalances, the tax subsidy to foreigners should be removed. I not only agree that the subsidies should be removed, but I'd further argue that foreign inflows should also be taxed.

carnegieendowment.org/china-financ...

the US economy and worsen US trade imbalances, the tax subsidy to foreigners should be removed. I not only agree that the subsidies should be removed, but I'd further argue that foreign inflows should also be taxed.

carnegieendowment.org/china-financ...