https://valuations.substack.com/

Seems like Trump in office should command a premium for vol.

Seems like Trump in office should command a premium for vol.

Who’s old enough to remember “Potatovation”?

Who’s old enough to remember “Potatovation”?

I’m always looking for pushback.

open.substack.com/pub/valuatio...

I’m always looking for pushback.

open.substack.com/pub/valuatio...

Oof.

Oof.

In honor of tax loss season, I wrote up my $JACK Post-Mortem. A lesson in thesis creep and bad models. An all-around terrible call.

Enjoy,

open.substack.com/pub/valuatio...

In honor of tax loss season, I wrote up my $JACK Post-Mortem. A lesson in thesis creep and bad models. An all-around terrible call.

Enjoy,

open.substack.com/pub/valuatio...

A year ago $BTI was trading at $28 per share 6x EV/EBITDA and offering an 11% dividend yield.

A year ago $BTI was trading at $28 per share 6x EV/EBITDA and offering an 11% dividend yield.

Time horizons getting shorter these days. Sets up great dislocations for anyone with flexibility and duration.

Time horizons getting shorter these days. Sets up great dislocations for anyone with flexibility and duration.

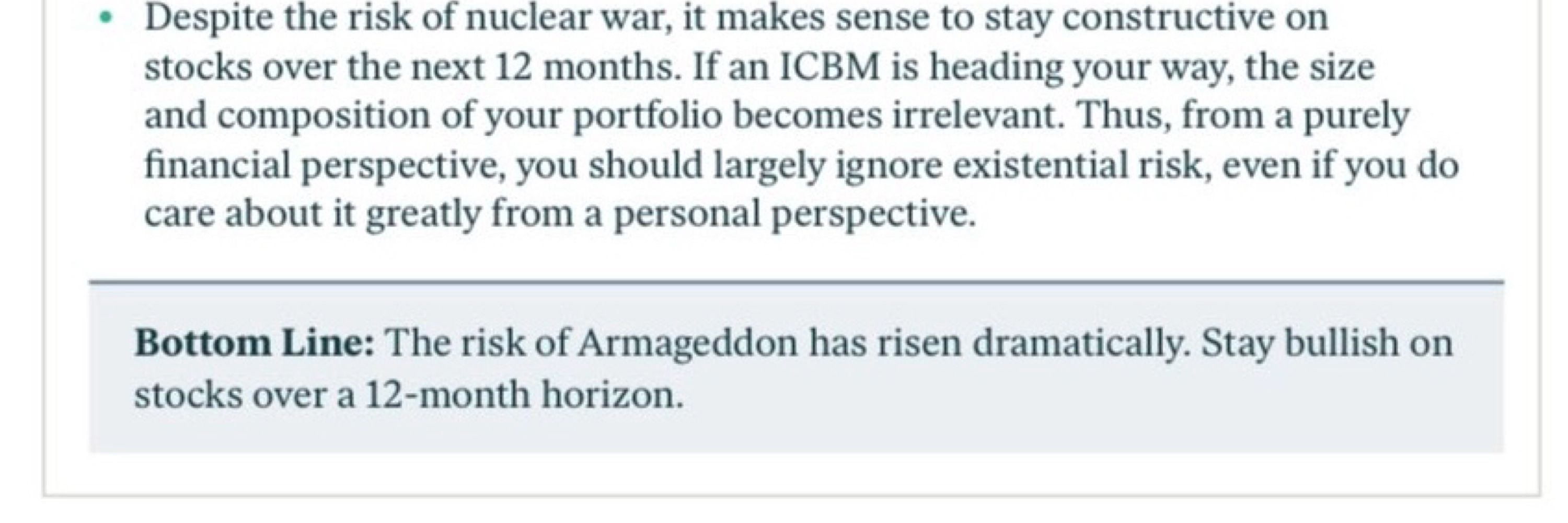

Question: what the fuck??

Question: what the fuck??

(The market usually goes up).

rare, have historically led to further upside. The soft-landing environment of 1995 began

a period of four consecutive years when the SPX gained over 20% each year.”

(The market usually goes up).

newsroom.ucla.edu/stories/comp...