Political economist @ LSE | Finance, central banking & more | benjaminbraun.org

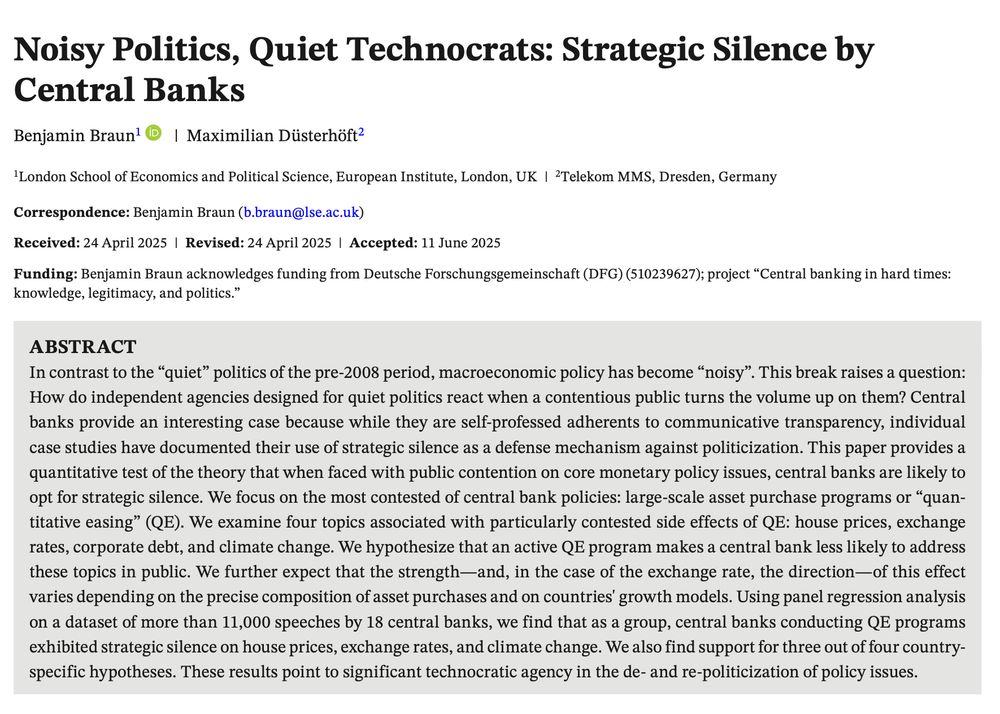

Our theory: At first, CBs seek to ward off politicization by talking 𝘭𝘦𝘴𝘴 about controversial topics.

We tested this 𝐬𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜 𝐬𝐢𝐥𝐞𝐧𝐜𝐞 𝐡𝐲𝐩𝐨𝐭𝐡𝐞𝐬𝐢𝐬.🧵

onlinelibrary.wiley.com/doi/10.1111/...

Reposted by Benjamin Braun

Reposted by Benjamin Braun

Reposted by Benjamin Braun

www.phenomenalworld.org/analysis/enf...

Reposted by Scott L. Greer, Benjamin Braun

@alanbeattie.bsky.social on the money:

www.ft.com/content/8073...

"In one version of the course, this is the only slide. You would have still learned a lot, but it would be a bit of a rip-off. Fortunately, I teach a slightly different version."

Reposted by Benjamin Braun

Reposted by Daniela Gabor

Reposted by Diane Coyle, Benjamin Braun, Antonio Fatás

www.bis.org/publ/bisbull...

Link: www.sciencedirect.com/science/arti...

Reposted by Benjamin Braun

www.ft.com/content/781c...

Reposted by Benjamin Braun

“One Sentence at a Time: A Quantitative History of Rationality in Economic Thought”

▶️ osf.io/preprints/so...

We study how rationality changes in economics over the long 20th century using ~290000 journal articles (1900–2009)

#rstats #EconSky

Reposted by Benjamin Braun

Reposted by Benjamin Braun

Reposted by David Peetz, Iñaki Aldasoro

2025, year when brutal home invasions to steal laptops and crypto wallet passwords surged.

Reposted by Benjamin Braun

Reposted by Fabián Muniesa, Benjamin Braun

Please try it out, and reach out if you encounter any problems, or have any suggestions to improve it for your use case (and of course, our underlying CBS database is still open access)

Reposted by Benjamin Braun

Reposted by Shannon Vallor, Jason Mittell, Colin F. Camerer , and 11 more Shannon Vallor, Jason Mittell, Colin F. Camerer, Christopher Wright, Benjamin Braun, Patrick Svensson, Stephen D. Murphy, Michael Jones‐Correa, Jennifer A. Johnson, Catherine J. Frieman, Stephen A. Meserve, Charles T. Mathewes, Annette Yoshiko Reed, Olúfẹ́mi Táíwò

THIS is why faculty resist technological strategies for teaching. There is no engaging with Edtech without this context

Cover design pending: happy to share this beautiful poster from the Harvard Law and Political Economy Project (2023).

Reposted by Benjamin Braun

Cover design pending: happy to share this beautiful poster from the Harvard Law and Political Economy Project (2023).