That is changing. In the post below, I outline some ways I use Cursor and Claude Code to get feedback on my own work directly

That is changing. In the post below, I outline some ways I use Cursor and Claude Code to get feedback on my own work directly

I wrote a Substack post about the benefits of longer maturities, potential concerns of households making mistakes, and what longer maturity mortgages might do for young households and first-time buyers (not much?)

I wrote a Substack post about the benefits of longer maturities, potential concerns of households making mistakes, and what longer maturity mortgages might do for young households and first-time buyers (not much?)

👉Find it via papers.ssrn.com/sol3/papers.... #EconSky #Homeownership #YoHo

👉Find it via papers.ssrn.com/sol3/papers.... #EconSky #Homeownership #YoHo

Read: papers.ssrn.com/sol3/papers....

Read: papers.ssrn.com/sol3/papers....

https://maxkasy.github.io/inequalityresearch/

(The textbook has not been updated recently, but hopefully is still useful.)

https://maxkasy.github.io/inequalityresearch/

(The textbook has not been updated recently, but hopefully is still useful.)

One catch: AI wrote the hypotheses after seeing the results.

Should this matter?

New paper w/ Robert Novy-Marx on AI-Powered (Finance) Scholarship🧵

papers.ssrn.com/sol3/papers....

From 2003 to 2006, Danish house prices increased by 60 percent, in a robust regulatory design that limits housing speculation. This was a larger increase than in the US, Spain, or Ireland!

From 2003 to 2006, Danish house prices increased by 60 percent, in a robust regulatory design that limits housing speculation. This was a larger increase than in the US, Spain, or Ireland!

stata2r.github.io

stata2r.github.io

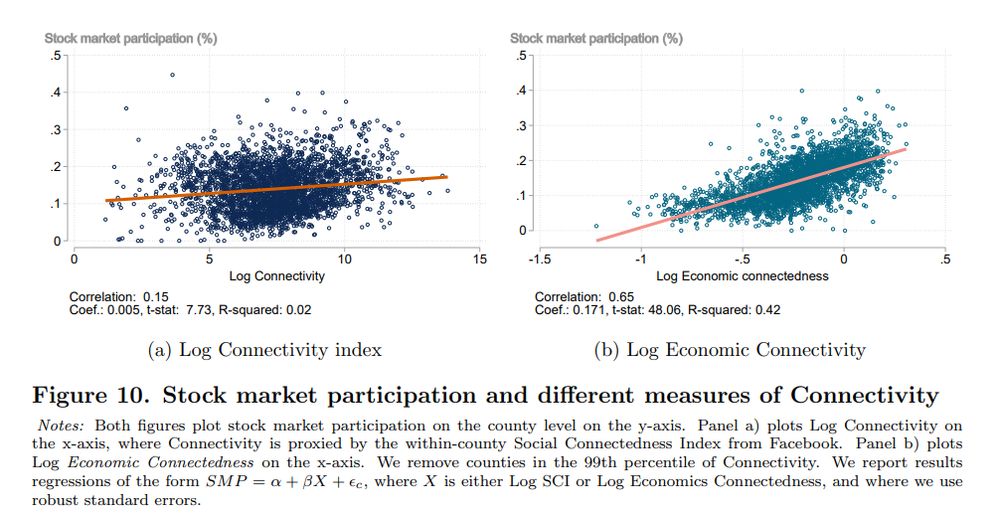

1) why does the return to housing differ by wealth?

2) why is the stock market participation rate not increasing over time?

1) (How) Does paternity leave shape gender norms?

2) Why are so few men nurses?

1) why does the return to housing differ by wealth?

2) why is the stock market participation rate not increasing over time?

On a mac: use cmd+shift+4 to take a picture. In Windows, use Windows logo key + Shift + S.

On a mac: use cmd+shift+4 to take a picture. In Windows, use Windows logo key + Shift + S.

It's cool! It has:

- *Insane* microdata

- Simple approach

- Relevant policy result

It was likely also my last academic work. Here we go

•Odd Lots

•Acquired

•Fall of Civilizations

•Tides of History

•Ezra Klein

•Revolutions

•Conversations with Tyler

•Trepp Wire

•Invest Like the Best

•Speaking Densely

•99% Invisible

•Dwarkesh

•Good on Paper

•Derek Thompson

•Macro Musings

•Sharp Tech

•War on the Rocks

Thanks to @tarduno.bsky.social for reminding me!

go.bsky.app/DpxtxXn

Thanks to @tarduno.bsky.social for reminding me!

go.bsky.app/DpxtxXn

I especially liked the point that mechanisms are useful if the channels affect the interpretation of the results but not if all mechanisms point in the same direction.

I especially liked the point that mechanisms are useful if the channels affect the interpretation of the results but not if all mechanisms point in the same direction.