Reader in Political Economy, King’s College London

www.kcl.ac.uk/people/dr-scott-james

IPE of finance and tech, monetary politics, City of London

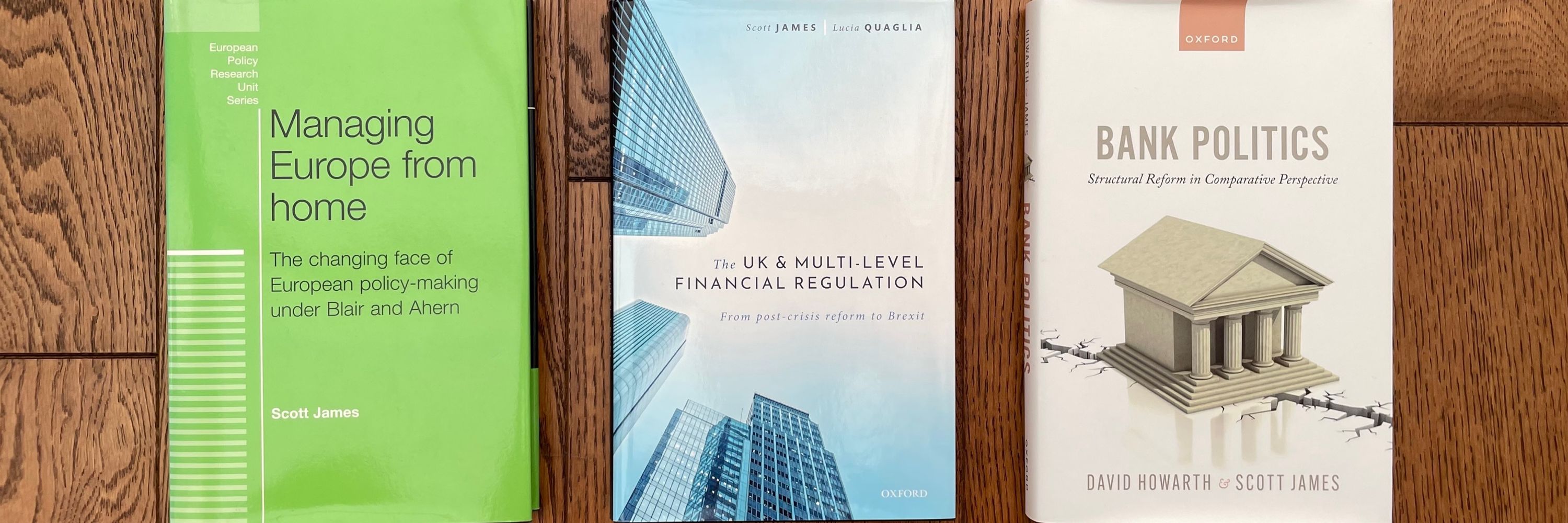

BANK POLITICS (OUP, 2023)

https://global.oup.com/academic/product/bank-politics-9780192898609?cc=gb&lang=en& ..

more

Reader in Political Economy, King’s College London

www.kcl.ac.uk/people/dr-scott-james

IPE of finance and tech, monetary politics, City of London

BANK POLITICS (OUP, 2023)

https://global.oup.com/academic/product/bank-politics-9780192898609?cc=gb&lang=en&

doi.org/10.1177/1024...

Reposted by James Scott

Agency meets structure, a love story

Reposted by James Scott

Reposted by James Scott

Whereas CBDCs make more sense for Europe and China with much less private / offshore issuance.

But then doesn’t this constrain the further internationalisation of the euro / renminbi? 🧐

Ends.

Am I missing something? 3/n

Retail and wholesale CBDCs work for pure public (cash) and public-private money (commercial bank liabilities). 2/n

Thinking about why the US has not pursued a CBDC - aside from domestic political opposition - and the extent to which this reflects a structural logic of full spectrum global dollar dominance. 1/n

🧵

@dsquareddigest.bsky.social & @himself.bsky.social

www.thebritishacademy.ac.uk/documents/60...

If interest-bearing CBDCs spread from China to Europe, expect yield-bearing $ stablecoins to follow close behind

Over to you, Brussels?

www.forbes.com/sites/digita...

Reposted by Elizabeth Saunders, Steve Peers, James Scott

Dollar HOD on this and stocks ripping.

Reposted by James Scott

@buddyyakov.bsky.social

@benbraun.bsky.social

@erinkaylockwood.bsky.social

@drscottjames.bsky.social