*WALMART 3Q ADJ EPS 62C, EST. 60C

*WALMART 3Q TOTAL US COMP SALES EX-GAS +4.4%, EST. +4%

*WMT SEES FY SALES EX-FX +4.8% TO +5.1%, SAW +3.75% TO +4.75%

*WALMART SEES FY ADJ EPS $2.58 TO $2.63, SAW $2.52 TO $2.62

*WALMART 3Q ADJ EPS 62C, EST. 60C

*WALMART 3Q TOTAL US COMP SALES EX-GAS +4.4%, EST. +4%

*WMT SEES FY SALES EX-FX +4.8% TO +5.1%, SAW +3.75% TO +4.75%

*WALMART SEES FY ADJ EPS $2.58 TO $2.63, SAW $2.52 TO $2.62

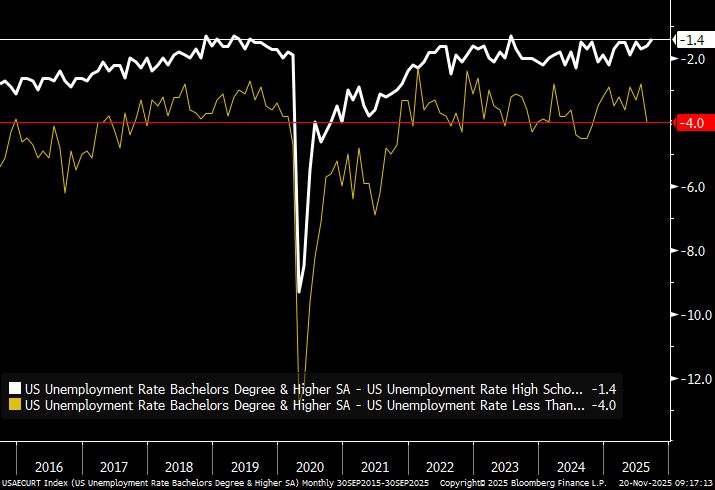

A great guest contrib from Neil Dutta in today's newsletter, where he calls out the Fed's reluctance to cut rates.

You can read the full thing here www.bloomberg.com/news/newslet...

A great guest contrib from Neil Dutta in today's newsletter, where he calls out the Fed's reluctance to cut rates.

You can read the full thing here www.bloomberg.com/news/newslet...

A great guest contrib from Neil Dutta in today's newsletter, where he calls out the Fed's reluctance to cut rates.

You can read the full thing here www.bloomberg.com/news/newslet...

Pick your indicator: is the labor market deteriorating measurably and weaker than 2018? Unemployment rate says yes. Or is the jobs market stronger than 2016-2019 and stable? Prime-age emp-pop says yes.

Pick your indicator: is the labor market deteriorating measurably and weaker than 2018? Unemployment rate says yes. Or is the jobs market stronger than 2016-2019 and stable? Prime-age emp-pop says yes.

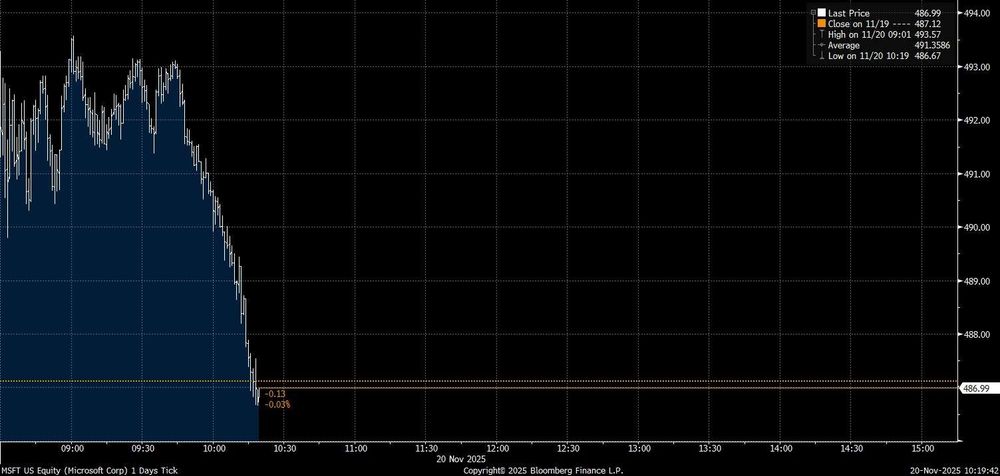

a) the Bitcoin bounce was meh ish

b) it led the rollover again

a) the Bitcoin bounce was meh ish

b) it led the rollover again

*technical term

*technical term

I appealed, but haven’t heard back yet.

Twitter keeps reminding me that if I remove the tweet, I can be fully reinstated immediately.

I appealed, but haven’t heard back yet.

Twitter keeps reminding me that if I remove the tweet, I can be fully reinstated immediately.

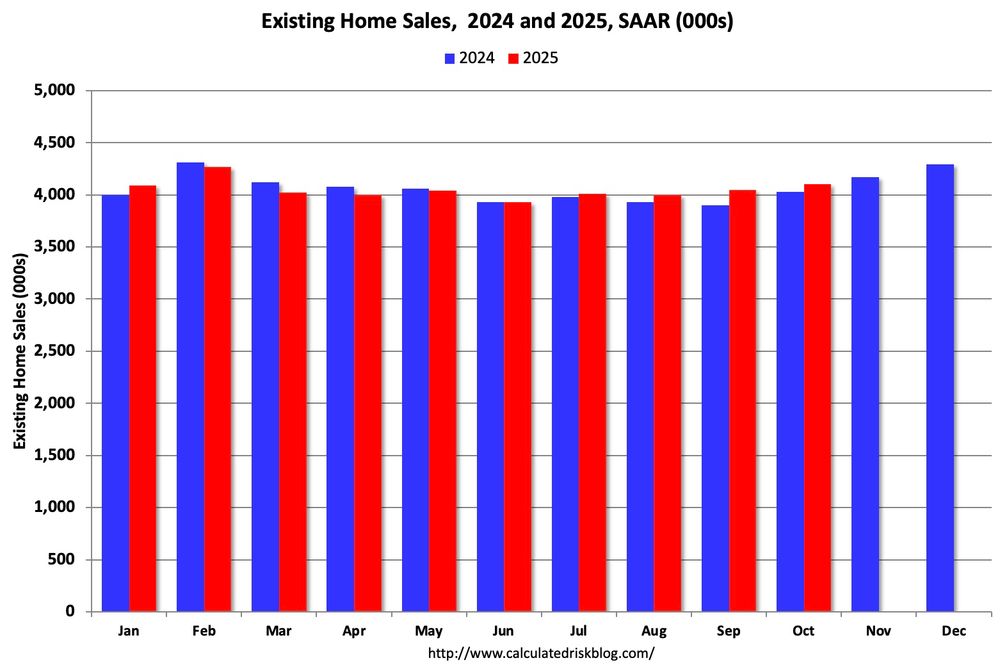

calculatedrisk.substack.com/p/nar-existi...

Sales are essentially unchanged year-to-date.

Will this be the lowest level of annual sales in 30 years?

calculatedrisk.substack.com/p/nar-existi...

Sales are essentially unchanged year-to-date.

Will this be the lowest level of annual sales in 30 years?

www.calculatedriskblog.com/2025/11/nar-...

www.calculatedriskblog.com/2025/11/nar-...