Reader in Political Economy, King’s College London

www.kcl.ac.uk/people/dr-scott-james

IPE of finance and tech, monetary politics, City of London

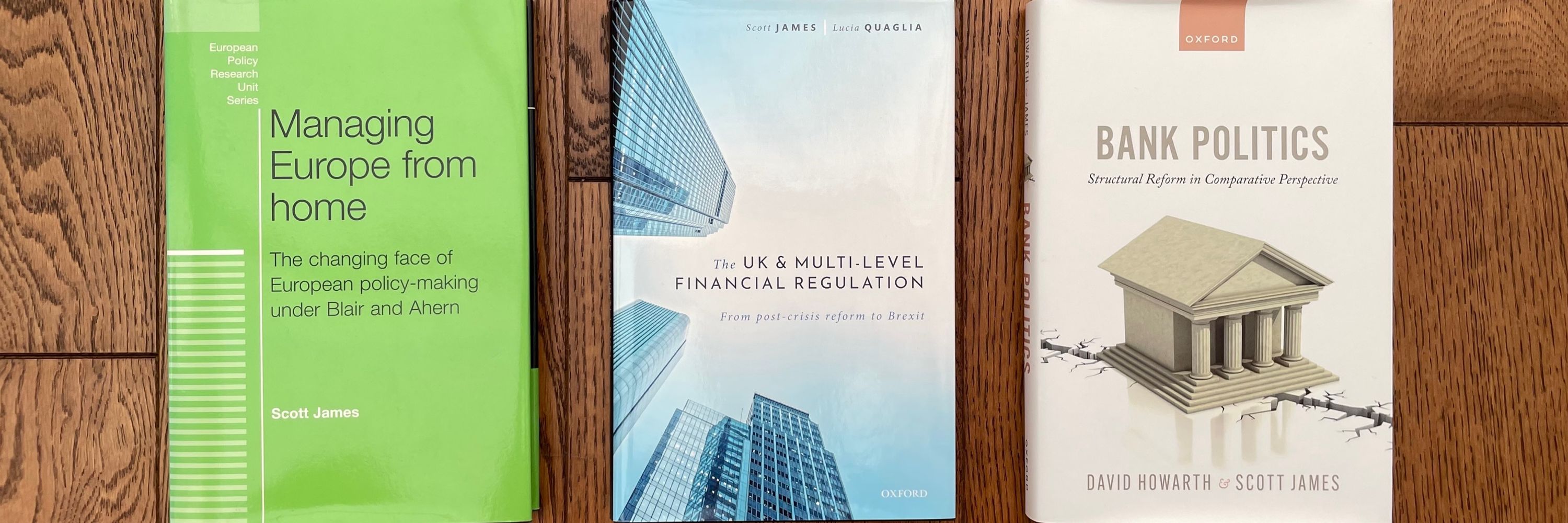

BANK POLITICS (OUP, 2023)

https://global.oup.com/academic/product/bank-politics-9780192898609?cc=gb&lang=en& ..

more

Reader in Political Economy, King’s College London

www.kcl.ac.uk/people/dr-scott-james

IPE of finance and tech, monetary politics, City of London

BANK POLITICS (OUP, 2023)

https://global.oup.com/academic/product/bank-politics-9780192898609?cc=gb&lang=en&

doi.org/10.1177/1024...

25-year cycles of de/redollarisation?

Reposted by Jonathan Portes, James Scott

Can’t see any of the likely successors making *major* changes to borrowing. You might get more taxes & more spending.

And don’t rule out a more pro-growth attitude to immigration.

www.ft.com/content/c855... Starmer camp warns leadership challenge risks economic chaos

www.youtube.com/live/M6vebFZ...

Reposted by James Scott, Pepper D. Culpepper

Reposted by James Scott

Reposted by James Scott

Agency meets structure, a love story

Reposted by James Scott

Reposted by James Scott

Whereas CBDCs make more sense for Europe and China with much less private / offshore issuance.

But then doesn’t this constrain the further internationalisation of the euro / renminbi? 🧐

Ends.

Am I missing something? 3/n

Retail and wholesale CBDCs work for pure public (cash) and public-private money (commercial bank liabilities). 2/n