Very excited to share this gentle introduction to another way of making sense of statistical models (w @vincentab.bsky.social)

Preprint: doi.org/10.31234/osf...

Website: j-rohrer.github.io/marginal-psy...

Very excited to share this gentle introduction to another way of making sense of statistical models (w @vincentab.bsky.social)

Preprint: doi.org/10.31234/osf...

Website: j-rohrer.github.io/marginal-psy...

At @wired.com we kept hearing conflicting accounts, so we surveyed 730 coders and developers at every career stage about how (and how often) they use AI chatbots on the job:

www.wired.com/story/how-so...

At @wired.com we kept hearing conflicting accounts, so we surveyed 730 coders and developers at every career stage about how (and how often) they use AI chatbots on the job:

www.wired.com/story/how-so...

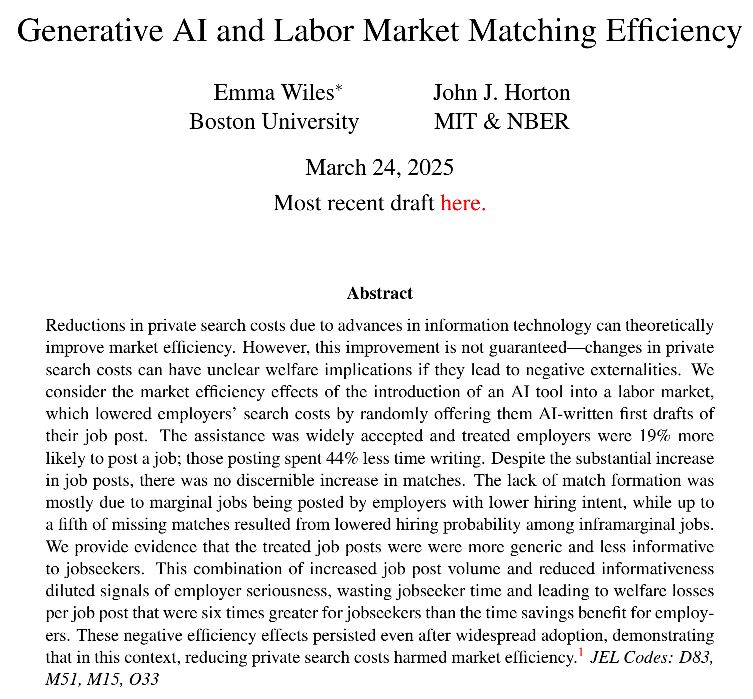

emmawiles.github.io/storage/jobo...

emmawiles.github.io/storage/jobo...

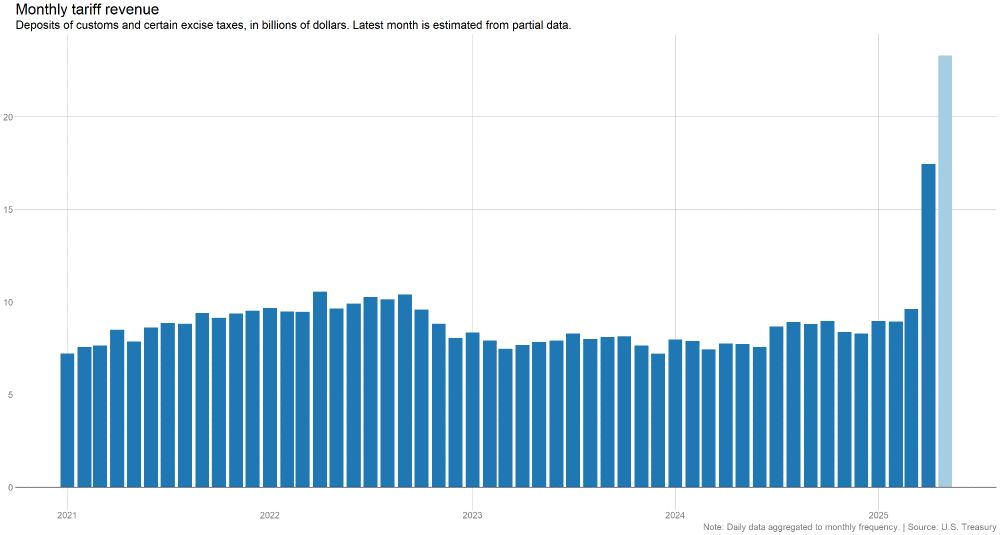

For some context, the tax bill passed by Congress last week would reduce federal revenue by ~$468 billion in 2026 (per CBO).

For some context, the tax bill passed by Congress last week would reduce federal revenue by ~$468 billion in 2026 (per CBO).

https://www.ft.com/content/1bf97b4f-786a-4277-8901-df84a6971488

https://www.ft.com/content/1bf97b4f-786a-4277-8901-df84a6971488

Fastest: Austin (19.4%), Raleigh (15.1%), Orlando (12.6%), Dallas (12.1%), Nashville (11.9%)

Slowest: SF (-3%), Cleveland (-1.9%), Milwaukee (-1.4%), Boston (-1.1%), Pittsburgh (-0.8%)

Fastest: Austin (19.4%), Raleigh (15.1%), Orlando (12.6%), Dallas (12.1%), Nashville (11.9%)

Slowest: SF (-3%), Cleveland (-1.9%), Milwaukee (-1.4%), Boston (-1.1%), Pittsburgh (-0.8%)