Reposted by: Jonathan Heathcote, Tore Ellingsen

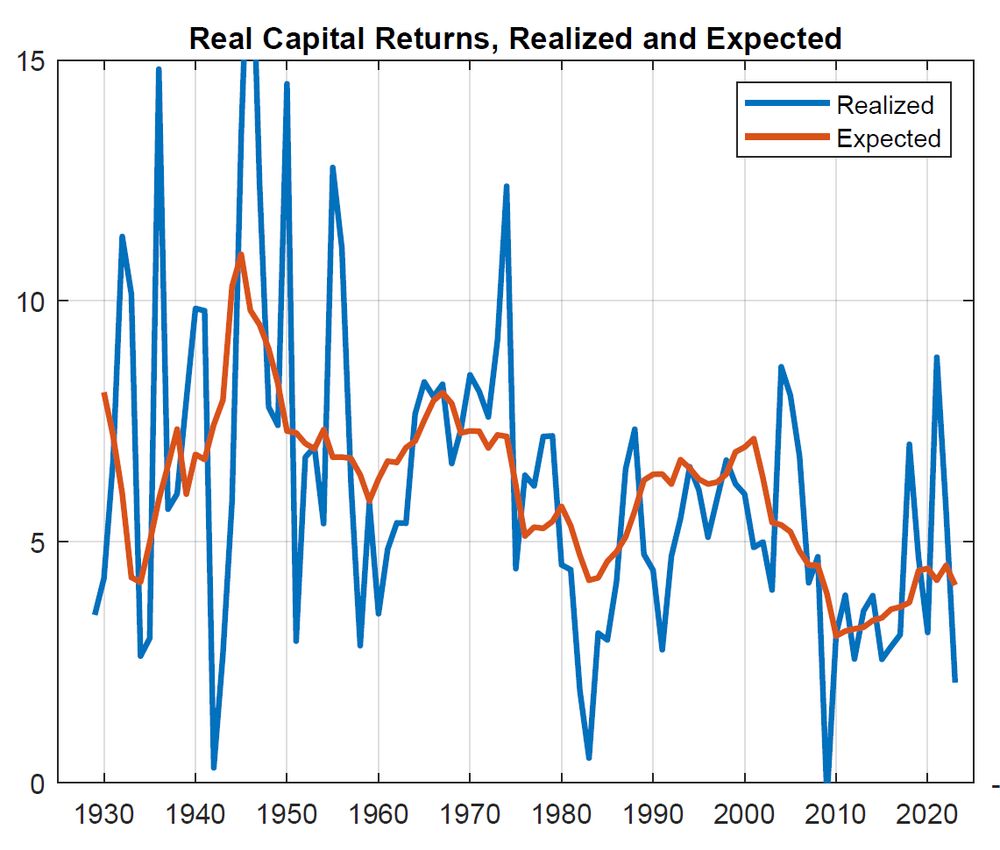

by Jonathan Heathcote — Reposted by: Jonathan Heathcote

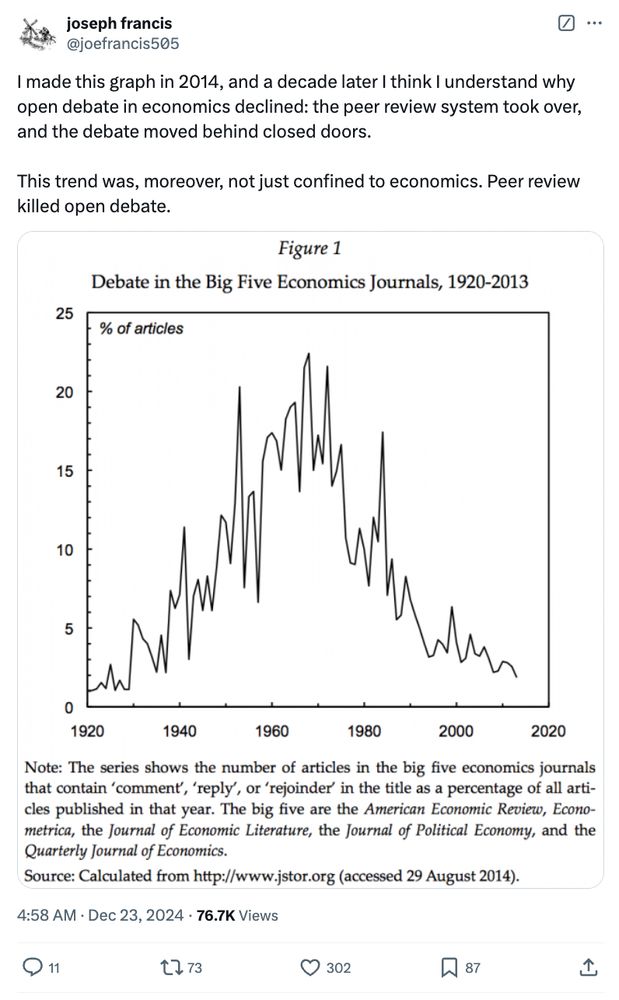

by Ben H. Ansell — Reposted by: Jonathan Heathcote, Catherine C. Eckel, Matthias Doepke , and 10 more Jonathan Heathcote, Catherine C. Eckel, Matthias Doepke, Alberto Bisin, Jon H. Fiva, Dominic Nyhuis, Tayfun Sönmez, Michael A. Goldstein, Ioana Marinescu, Micaël Castanheira, Winston T. Lin, Mike Kestemont, Michael E. Rose

As a result, valuable debate happens in secret, and the resulting paper is an opaque compromise with anonymous co-authors called referees.

1/

Reposted by: Jonathan Heathcote

Deadline is Dec 22.

irs.princeton.edu/news/2024/nl...

Reposted by: Jonathan Heathcote, Randi Hjalmarsson

Reposted by: Jonathan Heathcote, Micaël Castanheira, Pierre Boyer

cepr.org/events/cepr-...

by Jonathan Heathcote — Reposted by: Mariacristina De Nardi

Reposted by: Jonathan Heathcote

Reposted by: Jonathan Heathcote

📍 Monash Prato Centre, Prato, Italy🇮🇹

📅 June 25-26, 2025

Submit your research thred.devecon.org/conferences/...

#EconSky #DevelopmentEconomics