I think data could be more accessible to a wider audience so sometimes I’ll quote post with a comment about why I find it surprising.

How the economy navigates the additional growth on tap will be a function of the cost of debt and, critically, sustaining high growth.

#economy #debt #markets @wsj.com

My guide to data visualization, which includes a very long table of contents, tons of charts, and more.

--> Why data visualization matters and how to make charts more effective, clear, transparent, and sometimes, beautiful.

www.scientificdiscovery.dev/p/salonis-gu...

My guide to data visualization, which includes a very long table of contents, tons of charts, and more.

--> Why data visualization matters and how to make charts more effective, clear, transparent, and sometimes, beautiful.

www.scientificdiscovery.dev/p/salonis-gu...

1. Home prices need to drop -40%

2. Incomes need to increase +60%

3. Interest rates need to drop to 2%

1. Home prices need to drop -40%

2. Incomes need to increase +60%

3. Interest rates need to drop to 2%

Home Sellers outnumber Buyers by more than 500,000, the largest gap ever recorded 👀

Home Sellers outnumber Buyers by more than 500,000, the largest gap ever recorded 👀

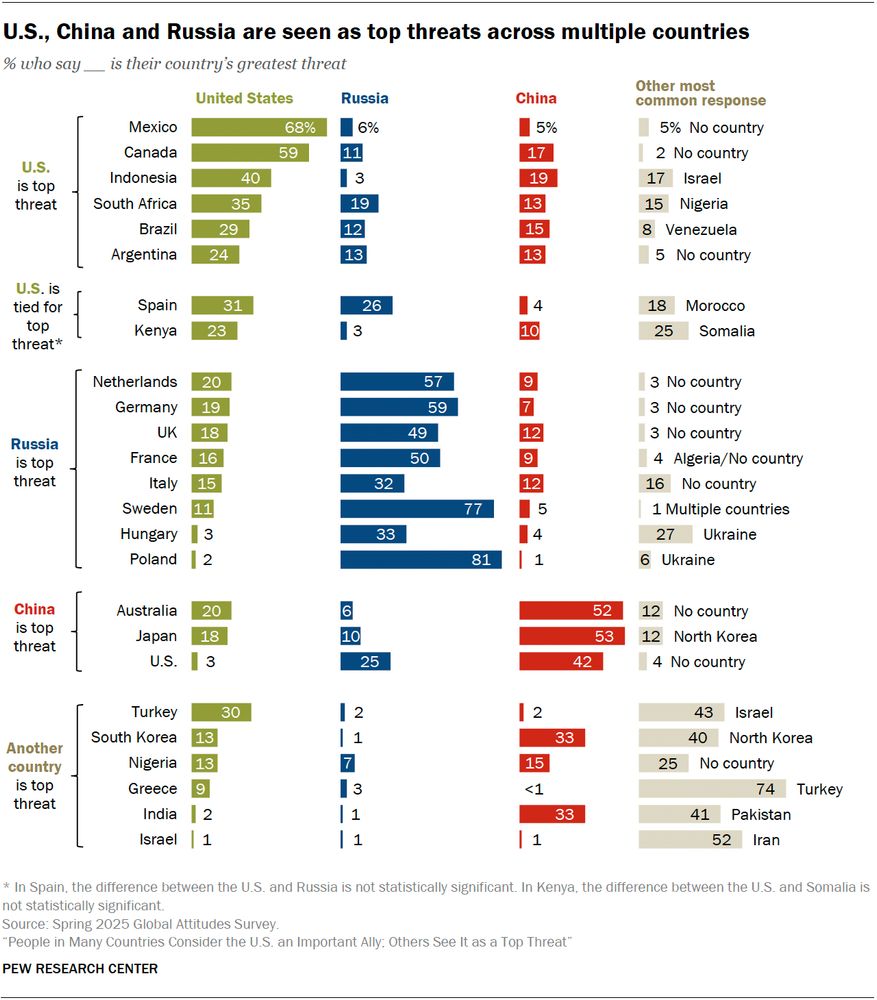

www.pewresearch.org/global/2025/...

www.pewresearch.org/global/2025/...

www.bls.gov/news.release...

While outer ring suburbs are accommodating the most new housing, downtowns are growing a lot faster than inner ring suburbs.

While outer ring suburbs are accommodating the most new housing, downtowns are growing a lot faster than inner ring suburbs.

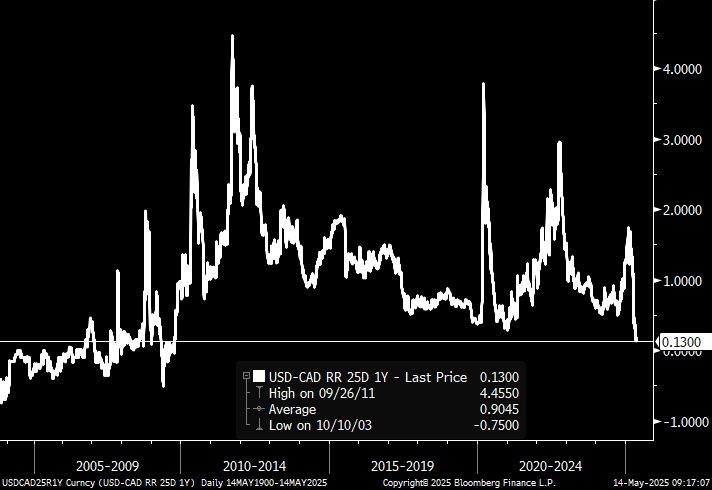

If you have any questions about this READ THE ALT TEXT FIRST PLEASE then feel free to fire away.

*we're going to ignore the 3/9/20 print IMO

If you have any questions about this READ THE ALT TEXT FIRST PLEASE then feel free to fire away.

*we're going to ignore the 3/9/20 print IMO

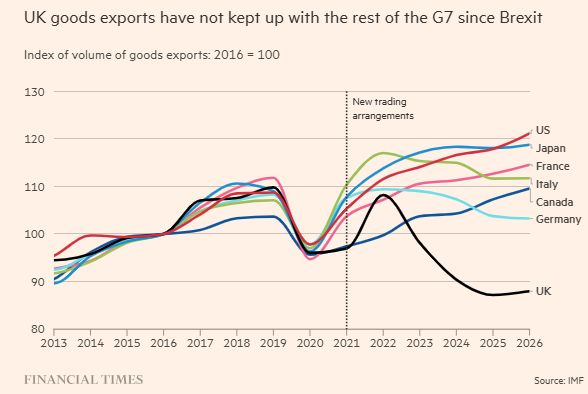

Spoiler, it does not end happily

www.ft.com/content/342d...

Spoiler, it does not end happily

www.ft.com/content/342d...

Usually US economic pain is cushioned by falling bond yields and a strengthening dollar, which mean lower interest rates and more spending power for consumers.

This time we’re seeing the opposite, meaning the pain will be amplified.

Usually US economic pain is cushioned by falling bond yields and a strengthening dollar, which mean lower interest rates and more spending power for consumers.

This time we’re seeing the opposite, meaning the pain will be amplified.

My @morningjoe-msnbc.bsky.social Chart

My @morningjoe-msnbc.bsky.social Chart