https://twinwolvesai.com/

research: AI, risk, complexity, finance history

newsletter: https://complex-machinery.com

(some posts in 🇫🇷 🇩🇪 🇷🇺)

This is a tight, executive-level read on how to approach AI (both ML/AI and genAI) in your company.

twinwolvesai.com

#dataBS

So when they've decided a given risk is uninsurable, that is a sign.

So when they've decided a given risk is uninsurable, that is a sign.

"OpenAI is a money pit with a website on top. That much we know already, but [...] there's a lot of guesswork required when estimating the depth of the pit."

"OpenAI is a money pit with a website on top. That much we know already, but [...] there's a lot of guesswork required when estimating the depth of the pit."

Gift link: www.bloomberg.com/news/article...

Gift link: www.bloomberg.com/news/article...

Remember: AI-the-technology is fine. AI-the-far-off-dream-sold-as-reality is the problem.

Remember: AI-the-technology is fine. AI-the-far-off-dream-sold-as-reality is the problem.

Since they don't engage in invasive data collection, they're doing the honest thing of simply _asking_ people for information.

So why not give their survey a whirl?

Since they don't engage in invasive data collection, they're doing the honest thing of simply _asking_ people for information.

So why not give their survey a whirl?

I see that, but I see even stronger parallels to 2008 (GFC).

In particular, it feels like the genAI space is aiming for "too big to fail" status.

Might be a good time to review some GFC-related reads ...

One week til new job at Hudson River! Can't wait!!

One week til new job at Hudson River! Can't wait!!

They made a "take a break" nudge that has no obvious "ok, I'll take a break" affordance. Its three affordances are:

1) Keep chatting (default, highlighted)

2) x out — keeps chatting

3) "This was helpful" — what is this?

🧵

They made a "take a break" nudge that has no obvious "ok, I'll take a break" affordance. Its three affordances are:

1) Keep chatting (default, highlighted)

2) x out — keeps chatting

3) "This was helpful" — what is this?

🧵

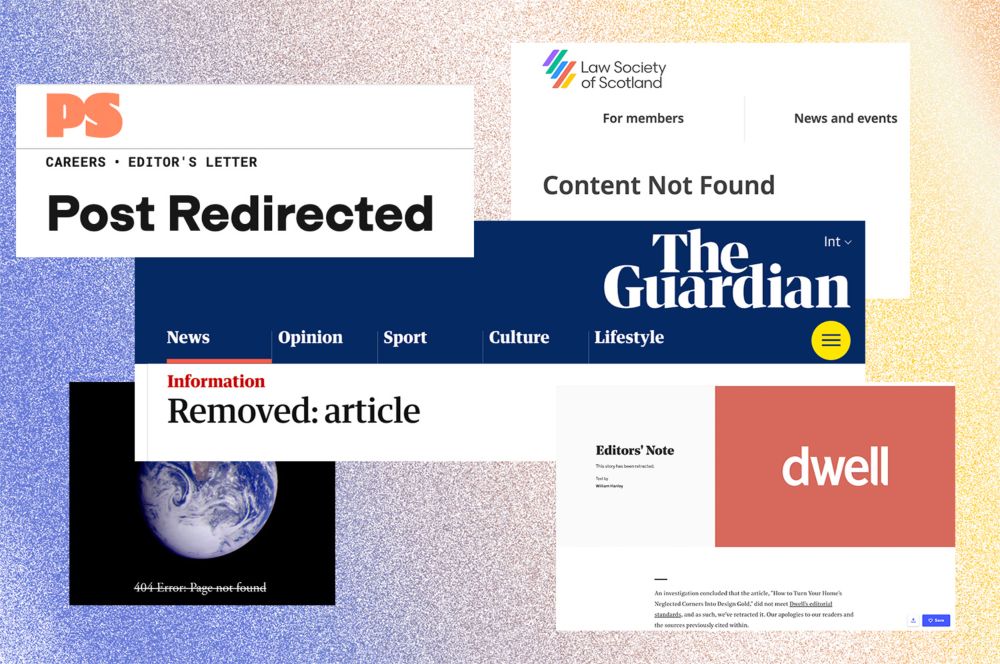

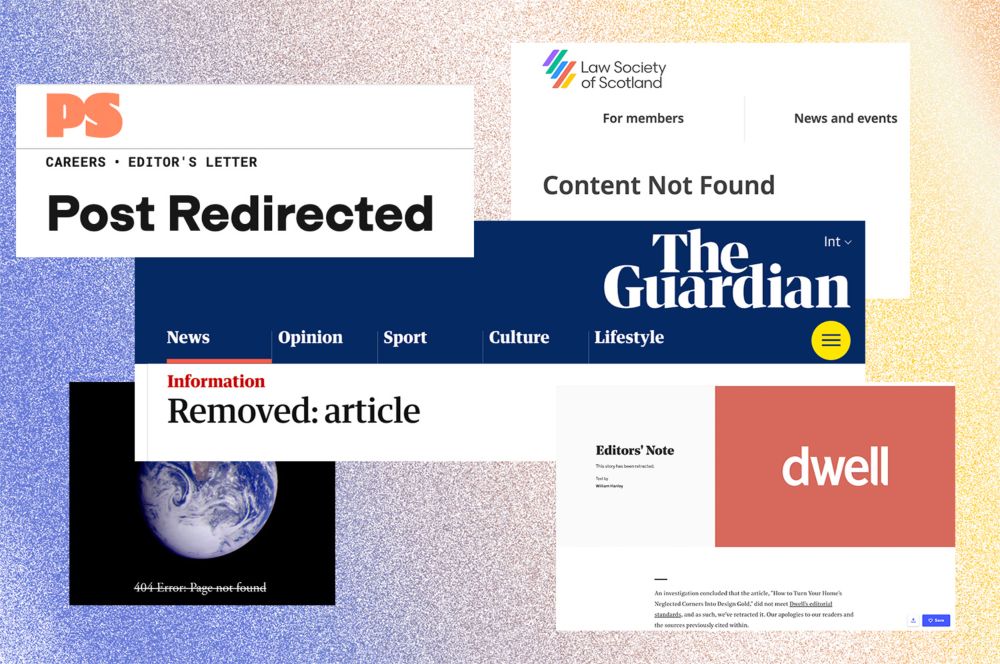

(The same holds for plenty of other writers, I'm sure.)

A thoughtful "have you considered [subtopic X or angle Y]" can send a piece in a new and interesting direction for writer and reader alike.

Nobody ever reads a great article and thinks, "Dang, that was some tight editing." But editing is a big part of how it got to be great.

So writers, if you've ever worked with a good editor, shout 'em out.

(The same holds for plenty of other writers, I'm sure.)

A thoughtful "have you considered [subtopic X or angle Y]" can send a piece in a new and interesting direction for writer and reader alike.

@barrons.com $NVDA

@firstadopter.bsky.social

www.barrons.com/articles/nvi...

@barrons.com $NVDA

@firstadopter.bsky.social

www.barrons.com/articles/nvi...

Do they test (and, importantly, correct) as thoroughly as this cruise line?

WSJ’s Jacob Passy boarded the Celebrity Xcel to watch the final preparations. 🔗 on.wsj.com/480LmC2

Do they test (and, importantly, correct) as thoroughly as this cruise line?

Ontario passed a law starting Jan 2026 that it is illegal for companies to ghost you.

If you have interviewed for a job they are legally required to inform you if they hire someone else or close the position.

The law also requires salary transparency on listings and disclosing use of AI

(newsletter.complex-machinery.com/archive/027-...)

November 2025: investors see genAI hype as a vastly-overpriced lottery ticket that echoes of a Ponzi scheme.

(newsletter.complex-machinery.com/archive/027-...)

November 2025: investors see genAI hype as a vastly-overpriced lottery ticket that echoes of a Ponzi scheme.

1/ Large incidents occur when several small, innocuous issues collide in an unfortunate manner.

2/ You don't need a large group of issues for this to happen. Just a few will do.

1/ Large incidents occur when several small, innocuous issues collide in an unfortunate manner.

2/ You don't need a large group of issues for this to happen. Just a few will do.

(newsletter.complex-machinery.com/archive/027-...)

November 2025: investors see genAI hype as a vastly-overpriced lottery ticket that echoes of a Ponzi scheme.

(newsletter.complex-machinery.com/archive/027-...)

November 2025: investors see genAI hype as a vastly-overpriced lottery ticket that echoes of a Ponzi scheme.

(LBOs are for daytime reading.)

(LBOs are for daytime reading.)

- trust

- how con artists tell us what we want to hear

- how even a little digging can shed light on the truth

- the extra scrutiny honest people will face because of scammers in the ranks

- trust

- how con artists tell us what we want to hear

- how even a little digging can shed light on the truth

- the extra scrutiny honest people will face because of scammers in the ranks

I very much disagree with this framing. People buying lots of Nvidia GPUs tells us nothing about the eventual ROI on those GPUs.

In fact, a bubble effectively <requires> “too many” of these to be bought.

- trust

- how con artists tell us what we want to hear

- how even a little digging can shed light on the truth

- the extra scrutiny honest people will face because of scammers in the ranks

- trust

- how con artists tell us what we want to hear

- how even a little digging can shed light on the truth

- the extra scrutiny honest people will face because of scammers in the ranks

The meltdown of auto conglomerate First Brands Group serves as a warning about genAI companies.

Also:

- my new book!

- Diet Bullshit, depicted

newsletter.complex-machinery.com/archive/049-...

#dataBS

The meltdown of auto conglomerate First Brands Group serves as a warning about genAI companies.

Also:

- my new book!

- Diet Bullshit, depicted

newsletter.complex-machinery.com/archive/049-...

#dataBS

On one side you have the underlying technology. On the other side you have the hype, vapor, and failed promises.

I'm bullish on AI-the-technology. We need a new term to separate that from the AI-as-vapor hype wave.

Thoughts?

#dataBS

On one side you have the underlying technology. On the other side you have the hype, vapor, and failed promises.

I'm bullish on AI-the-technology. We need a new term to separate that from the AI-as-vapor hype wave.

Thoughts?

#dataBS

(It keeps saying: "too big to fail"...)

(It keeps saying: "too big to fail"...)