Skanda Amarnath

@skandaamarnath.bsky.social

15K followers

1.7K following

750 posts

Executive Director of Employ America

Macro / Labor / Finance / Energy / Chart posting

Posts

Media

Videos

Starter Packs

Reposted by Skanda Amarnath

George Pearkes

@peark.es

· 11d

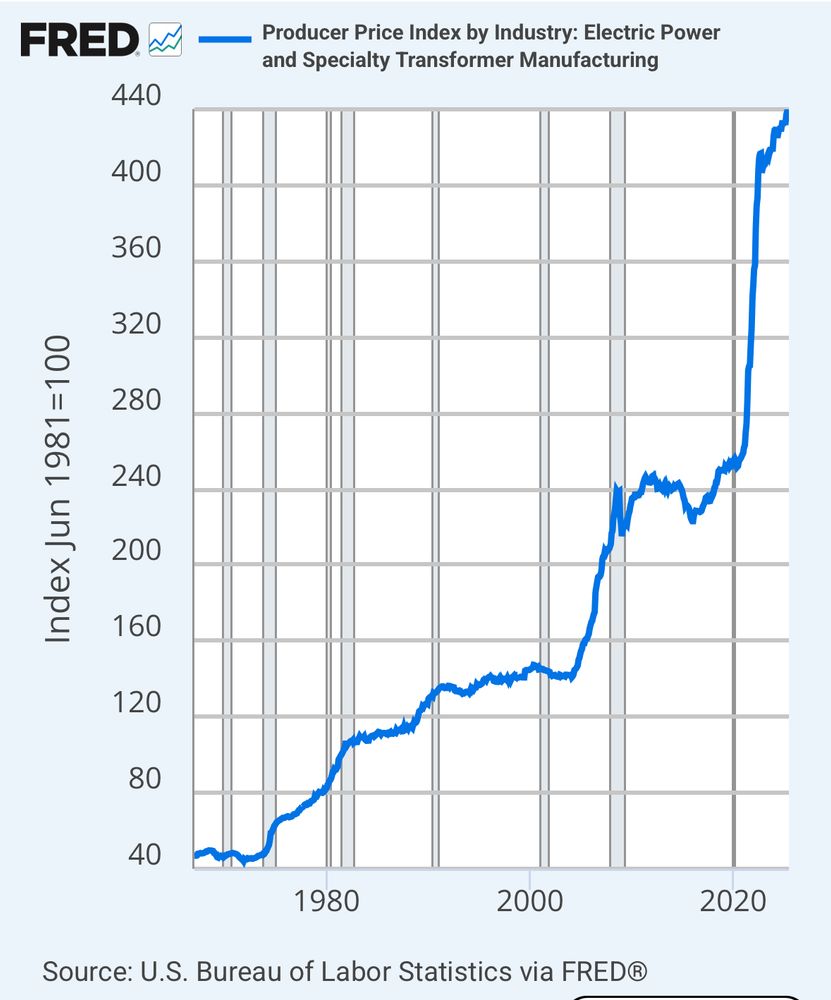

The Lesson Nuclear Companies Should Take From the Dot-Com Boom — Shift Key with Robinson Meyer and Jesse Jenkins

Electricity prices are the biggest economic issue in the New Jersey governor’s race, which is perhaps next month’s most closely watched election. Mikie Sherrill, the Democratic candidate and frontrunn...

overcast.fm

Reposted by Skanda Amarnath

Reposted by Skanda Amarnath

Reposted by Skanda Amarnath

Reposted by Skanda Amarnath

Reposted by Skanda Amarnath

Reposted by Skanda Amarnath

Preston Mui

@prestonmui.bsky.social

· Sep 9

Treasury Default, A Weak Dollar Policy, and Mass Fed Firings? What The Miran Hearing Missed

The confirmation hearing for Miran aired some key issues, but hardly all of them, and not the most important ones. It would be unwise to make an exception for seemingly “short-term” appointments; shor...

www.employamerica.org

Reposted by Skanda Amarnath

Tim Bartik

@timbartik.bsky.social

· Sep 2

Reposted by Skanda Amarnath

Reposted by Skanda Amarnath

Reposted by Skanda Amarnath

Reposted by Skanda Amarnath

Reposted by Skanda Amarnath

Reposted by Skanda Amarnath

Preston Mui

@prestonmui.bsky.social

· Aug 14

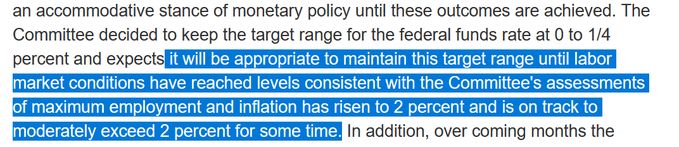

In Defense of the 2020 Fed Framework's Emphasis on Full Employment

The 2020 Fed Framework changes around full employment were appropriate and an important part of achieving the full employment recovery seen after the pandemic. Blaming it for historically unique deman...

www.employamerica.org

Reposted by Skanda Amarnath

Preston Mui

@prestonmui.bsky.social

· Aug 14

The Supply Problem In The Fed's Framework - Part 5: Revising The Consensus Statement For Supply-Aware Monetary Policy

This is the final post in our multi-part series on the Fed's 2025 framework review and strategy for dealing with supply shocks. Part 1 discusses how the Fed can deal with tariff inflation risks, Part ...

www.employamerica.org

He repealed much of the IRA. They tried to explicitly tax wind and solar build out. They’re taxing imported products that are vital for electricity connection. Just blame Trump.

Reposted by Skanda Amarnath

Reposted by Skanda Amarnath

Reposted by Skanda Amarnath

Reposted by Skanda Amarnath

Seaver Wang

@wang-seaver.bsky.social

· Jul 22

Reposted by Skanda Amarnath

Michael Baumann

@baumann.bsky.social

· Jul 18

Reposted by Skanda Amarnath

Michael Baumann

@baumann.bsky.social

· Jul 18