by Stuart Elden — Reposted by: Andrew Leyshon, Martin Paul Eve

Reposted by: Andrew Leyshon

Reposted by: Andrew Leyshon

#highered #EduSky

by Daniela Gabor — Reposted by: Andrew Leyshon, Benjamin Braun

New Rip-off Britain project by @cmmonwealth.bsky.social shows what institutional ownership has done for us: 200bn from our pockets to Big Finance!

🧵

by Andrew Leyshon — Reposted by: Andrew Leyshon

www.musicbusinessworldwide.com/nearly-a-thi...

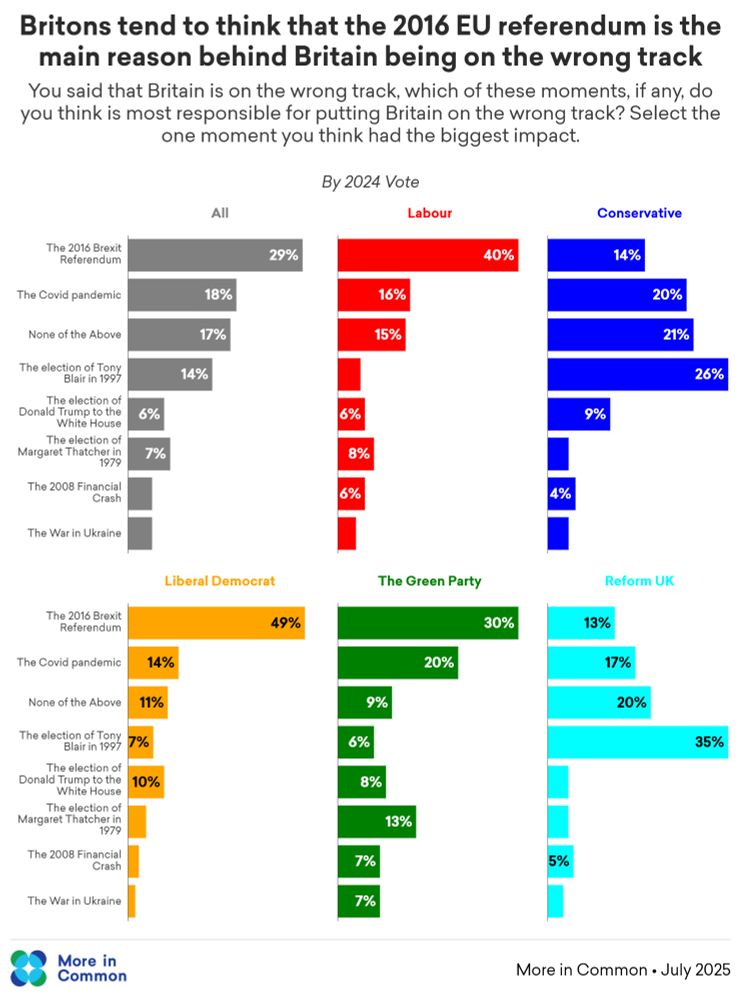

by Andrew Leyshon — Reposted by: Anand Menon

Reposted by: Andrew Leyshon, Meredith Broussard

by Benjamin Braun — Reposted by: Andrew Leyshon, John Hogan, Henry Farrell , and 1 more Andrew Leyshon, John Hogan, Henry Farrell, Benjamin Braun

Reposted by: Andrew Leyshon, Joanna Bryson, Marc Lynch , and 28 more Andrew Leyshon, Joanna Bryson, Marc Lynch, Ben H. Ansell, Adrian Barnett, Richard McElreath, Linda J. Skitka, Zhang, Ingrid Piller, Melissa Terras, Rafael H. M. Pereira, Martin Paul Eve, Justin H. Kirkland, Finland, Martin Tomko, Jason Jones, Ingo Rohlfing, Karen Benjamin Guzzo, Samuel Bentolila, Samuel Workman, Gordon B. Schmidt, Bruce Bradbury, Michiel van Meeteren, Zen Faulkes, Simon Usherwood, Emmanuel Mourlon‐Druol, Urška Demšar, Hayley Bennett, Eugene McCann, Annalee Newitz, Susan D. Blum

www.csi.minesparis.psl.eu/articles-ved...

by Andrew Leyshon — Reposted by: Paul Langley

by Paul Langley — Reposted by: Andrew Leyshon, Brett Christophers