*There was another ~5% cut in the Feb performance review cycle which may partially land in Q2: www.bloomberg.com/news/article...

*There was another ~5% cut in the Feb performance review cycle which may partially land in Q2: www.bloomberg.com/news/article...

But I found this bit on how much more

accurate the latest models have gotten to be interesting (though more work is needed) arxiv.org/pdf/2503.057...

But I found this bit on how much more

accurate the latest models have gotten to be interesting (though more work is needed) arxiv.org/pdf/2503.057...

The quietly-released Major Cities Chief Assn violent crime data showed homicides fell by ~17%, to levels below those in 2020; higher still than 2019 (w 2 fewer agencies reporting), but lower than 2016 and 2017.

This is BIG NEWS!

The quietly-released Major Cities Chief Assn violent crime data showed homicides fell by ~17%, to levels below those in 2020; higher still than 2019 (w 2 fewer agencies reporting), but lower than 2016 and 2017.

This is BIG NEWS!

www.nytimes.com/2025/03/02/w...

www.nytimes.com/2025/03/02/w...

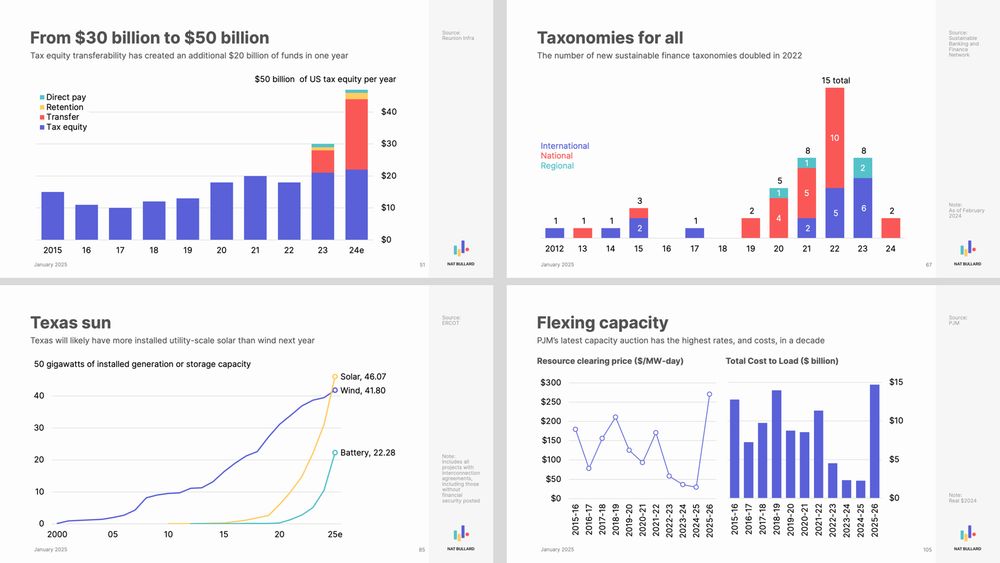

Not so great for American oil & gas E&Ps’ share prices

Not so great for American oil & gas E&Ps’ share prices

Sub to the newsletter here:

www.bloomberg.com/account/news...

Sub to the newsletter here:

www.bloomberg.com/account/news...

By undercutting manufacturing in these countries, these cheap imports can result in a net decline in total production, in which case consumers in these countries will actually consume less because their incomes will decline faster than the prices of consumer goods.

By undercutting manufacturing in these countries, these cheap imports can result in a net decline in total production, in which case consumers in these countries will actually consume less because their incomes will decline faster than the prices of consumer goods.

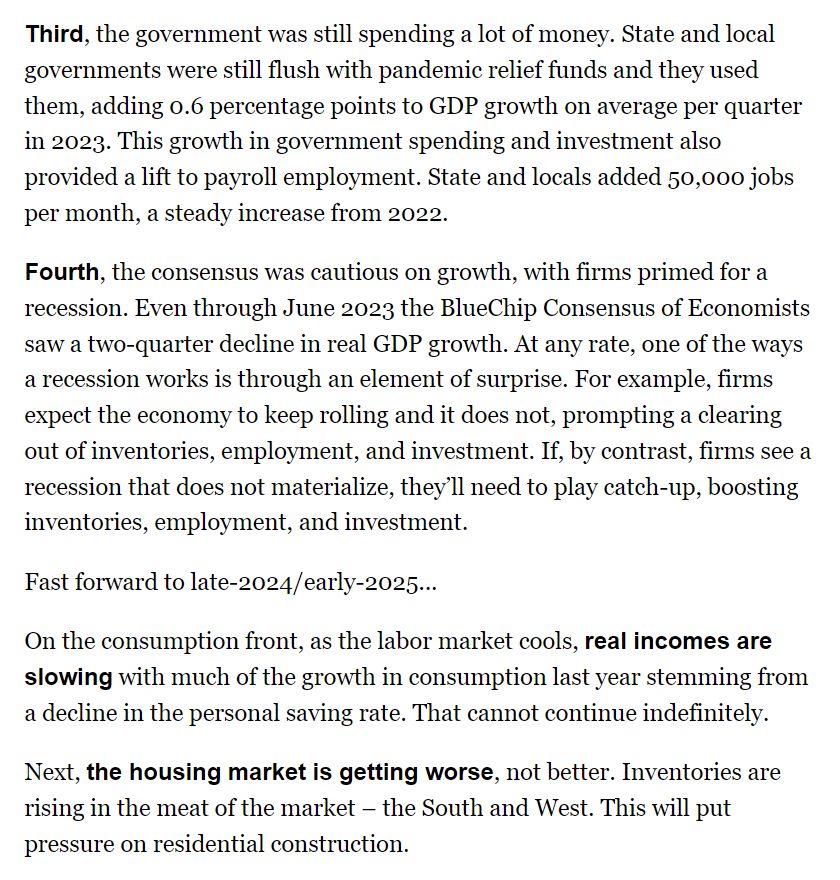

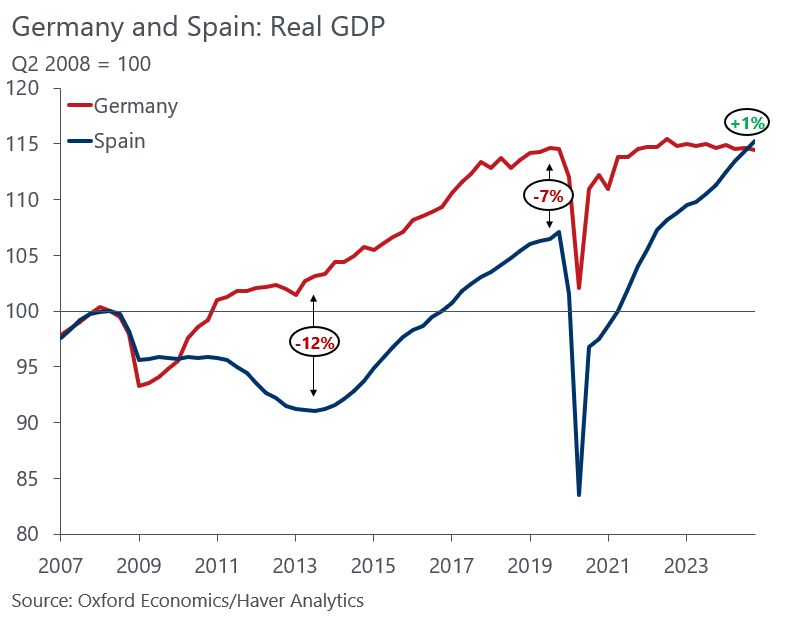

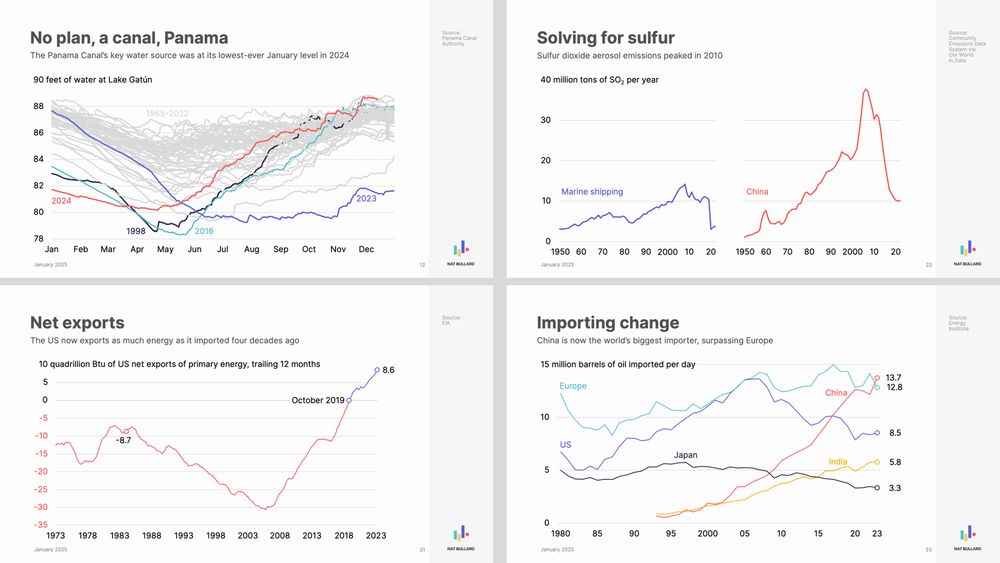

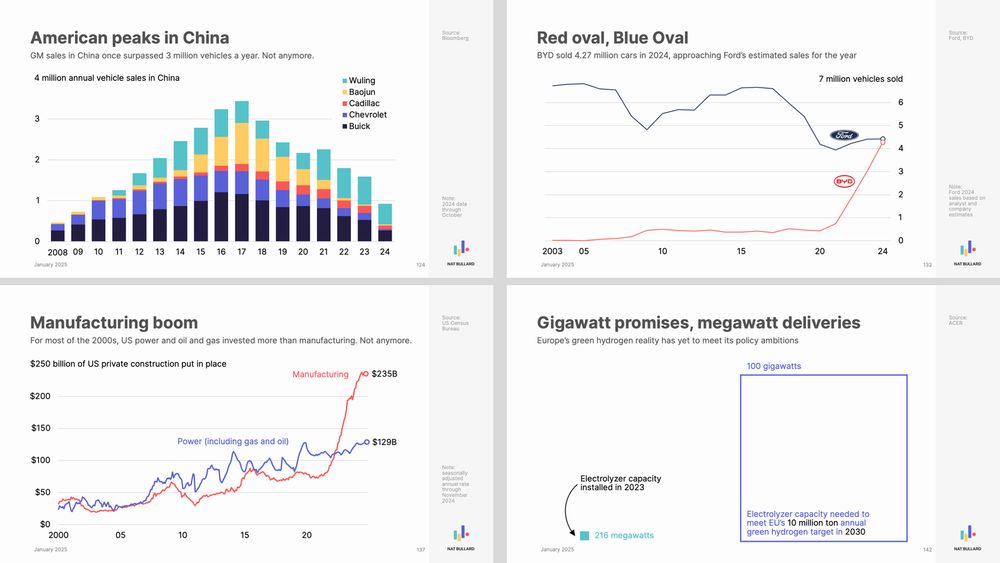

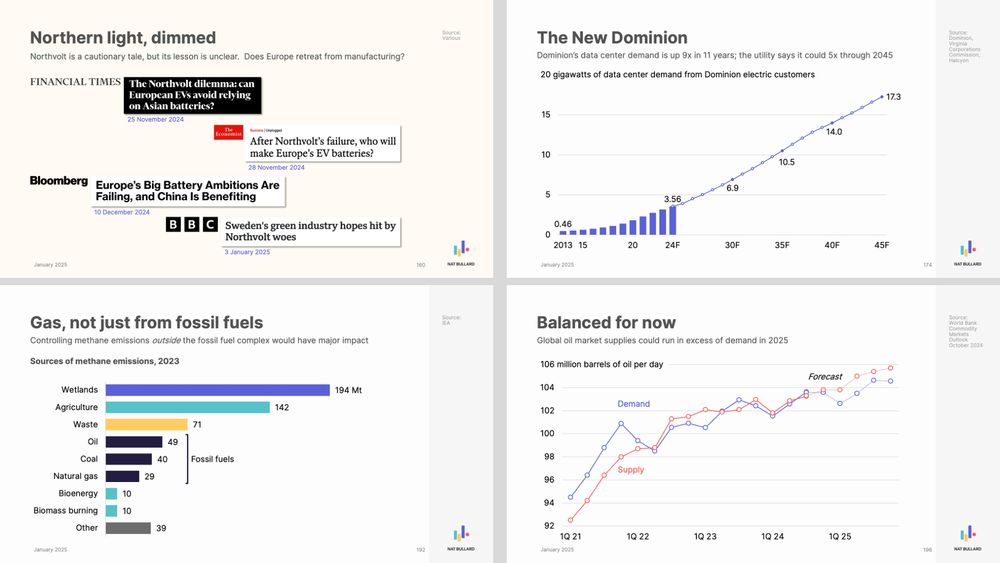

200 slides, covering everything from water levels in Lake Gatún to sulfur dioxide emissions to ESG fund flows to Chinese auto exports to artificial intelligence. www.nathanielbullard.com/presentations

200 slides, covering everything from water levels in Lake Gatún to sulfur dioxide emissions to ESG fund flows to Chinese auto exports to artificial intelligence. www.nathanielbullard.com/presentations

go.bsky.app/6L2nSyU

go.bsky.app/6L2nSyU

There are literally only three ways China can reduce its trade surplus. One way, obviously, is to produce less, but of course that would be extremely painful economically and would force up unemployment. Beijing would do all it could to avoid this "solution".

There are literally only three ways China can reduce its trade surplus. One way, obviously, is to produce less, but of course that would be extremely painful economically and would force up unemployment. Beijing would do all it could to avoid this "solution".

stephaniehmurray.substack.com/p/the-parado...

stephaniehmurray.substack.com/p/the-parado...

To the extent that average wages increase by enough to matter to the economy, these wage increases will cut at the core of what makes Chinese manufacturing so globally competitive, i.e. the low share Chinese households retain of what they produce.

To the extent that average wages increase by enough to matter to the economy, these wage increases will cut at the core of what makes Chinese manufacturing so globally competitive, i.e. the low share Chinese households retain of what they produce.

SCMP: "Five provincial-level regions – the provinces of Shanxi and Sichuan, the Inner Mongolia and Xinjiang Uygur autonomous regions, and the southwestern megacity of Chongqing – increased their minimum wages recently."

sc.mp/wa2vj?utm_so... via @scmpnews

SCMP: "Five provincial-level regions – the provinces of Shanxi and Sichuan, the Inner Mongolia and Xinjiang Uygur autonomous regions, and the southwestern megacity of Chongqing – increased their minimum wages recently."

sc.mp/wa2vj?utm_so... via @scmpnews