Layna Mosley

by Layna Mosley — Reposted by: Bessma Momani

Details here: www.princeton.edu/acad-positio...

by Layna Mosley

by Layna Mosley

by Layna Mosley

on.ft.com/3VCzxuE

by Layna Mosley

www.nytimes.com/2025/09/25/b...

Reposted by: Layna Mosley, Joanna Bryson, Lisa W. Fazio , and 34 more Layna Mosley, Joanna Bryson, Lisa W. Fazio, Jason Mittell, Scott L. Greer, John Horgan, Steve Peers, David Feldman, Rosemary A. Joyce, David Rothschild, Catherine Baker, Michael D. Green, Ryan Enos, Kevin Carey, Karen Benjamin Guzzo, Silvia Secchi, Aaron Sojourner, Andrew L. Whitehead, Nazita Lajevardi, Stacy D. VanDeveer, Beatriz Gallardo Paúls, Scott A. Imberman, John Hogan, Daniel Kane, Christine Kooi, Michael H. Whitworth, James Goodwin, Mark Rice, Lisa Diedrich, Nelson Flores, Seth Masket, Daxton R. Stewart, Nancy M. Wingfield, Nathan P. Kalmoe, Timothy D. McBride, Clark Gray, David Darmofal

Reposted by: Layna Mosley, Stephen M. Walt, Anna O. Law , and 33 more Layna Mosley, Stephen M. Walt, Anna O. Law, Lisa W. Fazio, Mark A. Lemley, Will Jennings, Brendan Nyhan, Jesse H. Kroll, Richard Price, Bryan D. Jones, Shawn Cole, Laia Balcells, Cathy N. Davidson, David S. Cohen, Berk Özler, Karen Benjamin Guzzo, Jonathan Hopkin, Janet Murray, Rebecca Tushnet, McKenzie Wark, Jacob T. Levy, Nazita Lajevardi, Scott A. Imberman, Robert B. Reich, Kevin Miller, Rebecca M. Bratspies, Jason Lyall, Alfie Kohn, David Bartram, Henry Jones, Matthew P. McAllister, Daxton R. Stewart, Nathan P. Kalmoe, Southern Africa, Stuart Shapiro, David Darmofal

ALSO SCOTUS: considering race as one factor in targeting whom to detain and deport is cool cool cool

by Layna Mosley

Can't really argue with that, IR scholars!

by Layna Mosley

by Layna Mosley

by Layna Mosley

on.ft.com/4p6YpIk

by Layna Mosley

by Layna Mosley

"Eighty-two per cent of the participants in the FT poll are convinced that financial markets have so far priced in the White House’s interventions on the Fed only partially or marginally..."

on.ft.com/464lZwU

Reposted by: Layna Mosley

We @democracydefendersfund.org immediately sued you & got an injunction on your 1st voting EO

We will do the same here if you try it again

The Constitution gives this authority to the states & Congress, not you!

www.nytimes.com/2025/08/31/u...

by Layna Mosley

(But fed governors not being accustomed to needing to take public stances, yes…)

by Layna Mosley — Reposted by: John Hogan, Gerardo Martí

www.ft.com/content/b7d4...

by Layna Mosley — Reposted by: John Hogan

Sure, governments care more about borrowing costs as debt increases, but...

on.ft.com/4fUW4fC

by Layna Mosley

www.nytimes.com/2025/08/07/u...

by Layna Mosley

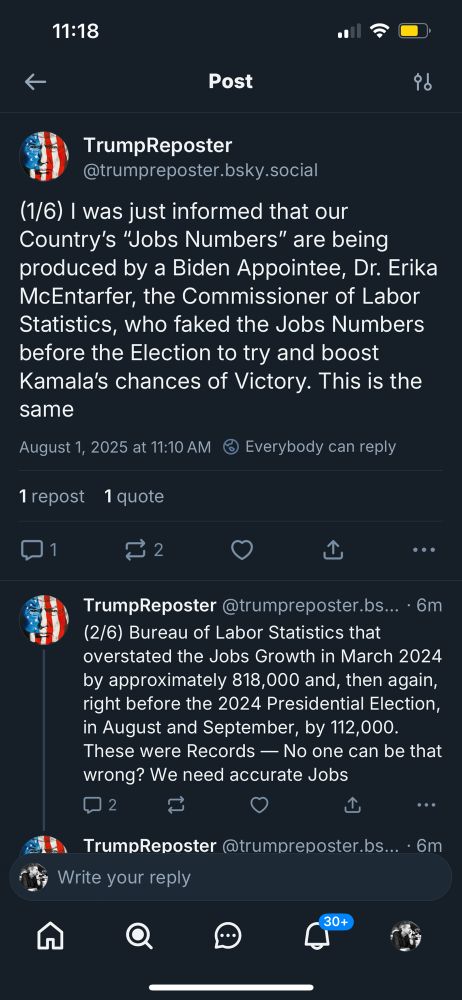

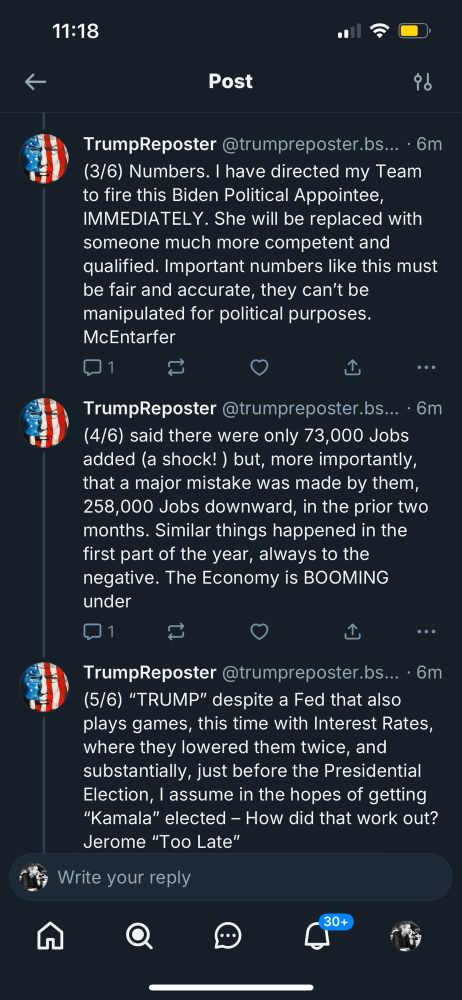

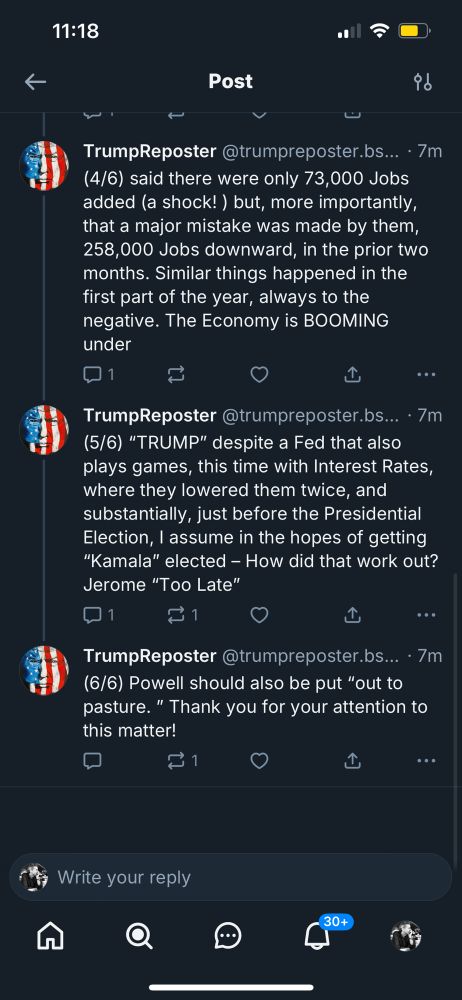

by Justin Wolfers — Reposted by: Layna Mosley, Elizabeth Saunders, Mark A. Lemley , and 15 more Layna Mosley, Elizabeth Saunders, Mark A. Lemley, Brady T. West, Patrick Dunleavy, Michael A. Clemens, Valerie P. Hans, Mark D. White, Andrew R. Morral, Shelly Lundberg, Aaron Sojourner, Amy W. Ando, Barrett, Henrik Skaug Sætra, Michael Westphal, Anthony Burke, Ted Temzelides, Sean P. Corcoran

It will also backfire: You can't bend economic reality, but you can break the trust of markets. And biased data yields worse policy.

by Layna Mosley

“She will be replaced with someone much more competent and qualified. Important numbers like this must be fair and accurate, they can’t be manipulated for political purposes,” Trump said.

on.ft.com/44XPXTT

by Layna Mosley

7. "Both of those sources of uncertainty are resolved," Miran said. "We expect things to get materially stronger from here, now that our policies are starting to sort into place."

[bad job numbers? wait until next month! abcnews.go.com/Business/hir...

by Layna Mosley

by Layna Mosley

It also makes more obvious the negative consequences of Trump's trade policies.

www.nytimes.com/2025/07/30/b...

by Layna Mosley

He must've known the audience wasn't buying it, but that didn't stop him. Hard to know if it was arrogance, blind faith or both-- but there seems to be no bottom for US trade policy.

[3/3]

by Layna Mosley

3. Most US trade has been non-reciprocal in nature.

4. The president is focused on making the US the best place in the world for doing business.

5. Tariffs are going to close fiscal gaps in US budget.

[2/n]

by Layna Mosley

To an audience of mostly economists, policymakers and investors, he said:

1.Trump is one of the best negotiators the world has seen; and the most transparent & accessible president in history.

[1/n]

Reposted by: Layna Mosley

by Layna Mosley

(1) US trade policy bad, but not as bad as it could be.

(2) Trade war and threats to Fed independence are bad for US borrowing costs and bad for the dollar's value...but good for governments and firms that need to service dollar-denominated debt.

www.ft.com/content/a92e...